15 Nov 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

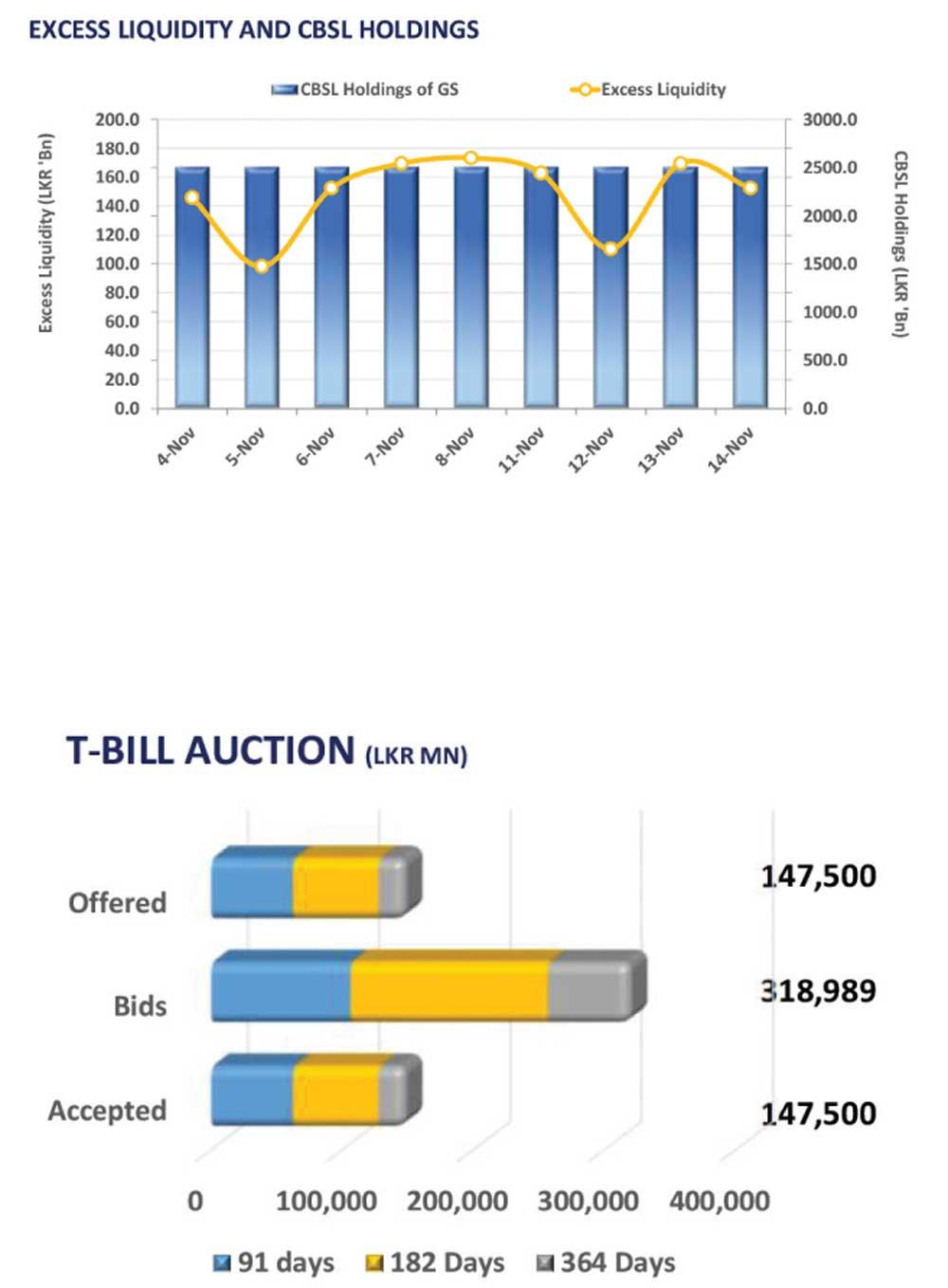

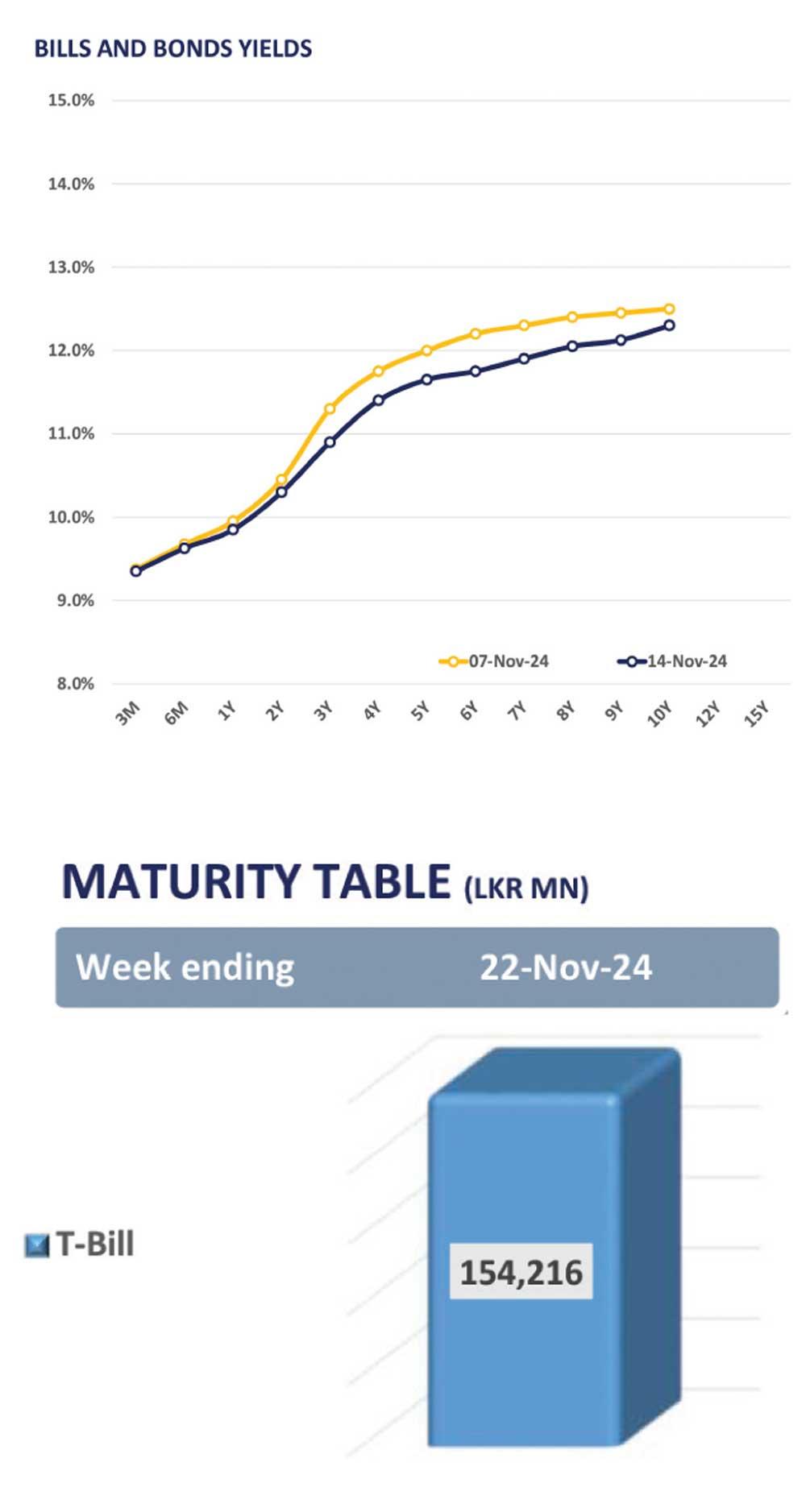

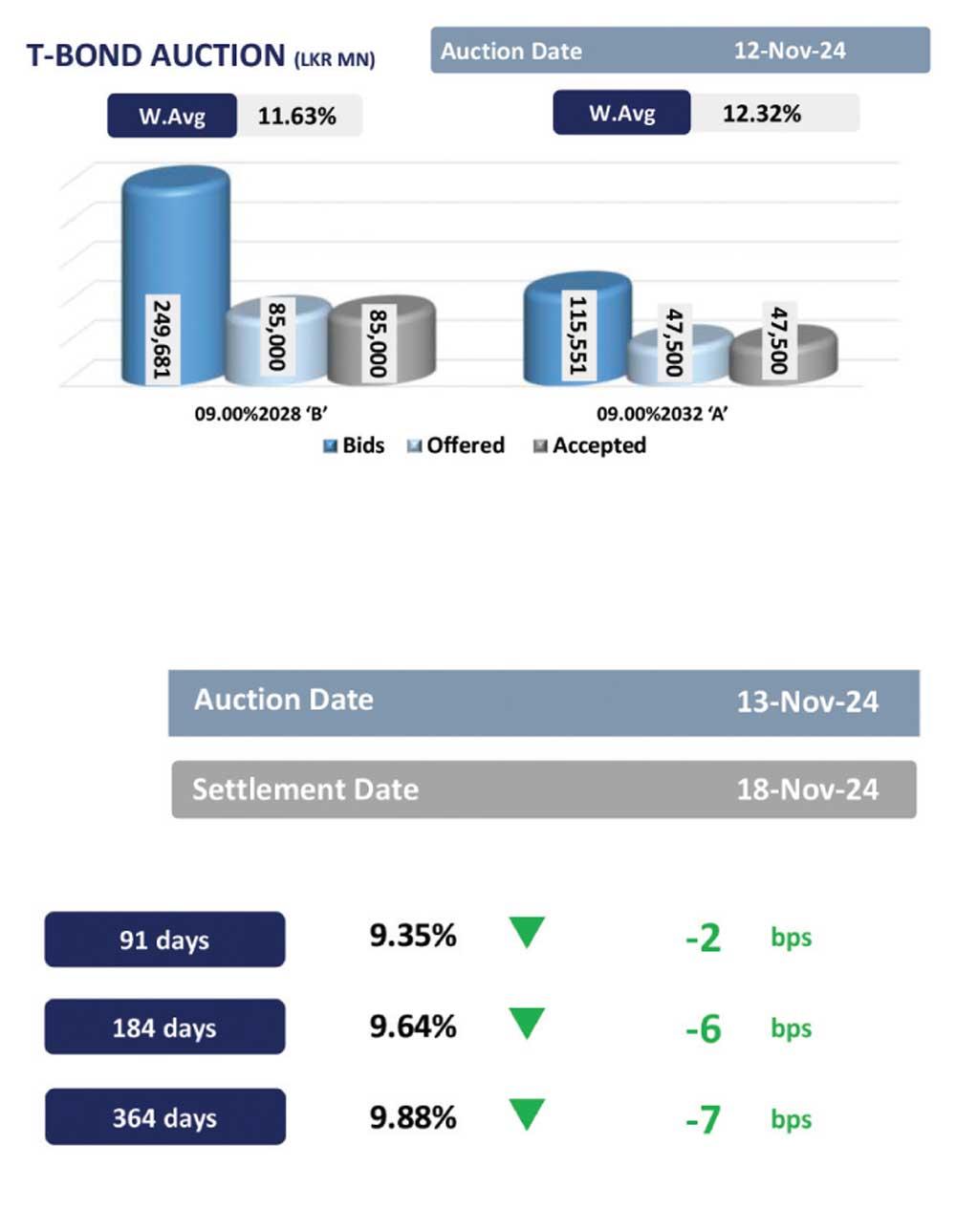

Following a sustained period of bullish sentiment, the secondary market yield curve remained broadly stable while generating ultra-thin volumes.

Investors largely refrained from taking significant positions, opting to await greater clarity on the upcoming parliamentary election results. Amidst the thin trading activity, limited transactions observed across mid-tenor maturities.

Notably, the 15.01.28 traded at 11.25% while 15.09.29 changed hands at 11.60%. Meanwhile, the CBSL has announced a Treasury Bill issuance totaling Rs. 145.0bn through an auction scheduled for 20th Nov 2024, out of the total auction, Rs. 50.0bn is to be raised from 91-day maturity, Rs. 65.0bn is expected to be raised from 182-day maturity while Rs. 30bn is to be raised from 364-day maturity.

On the external side, the LKR further appreciated against the greenback closing at Rs. 292.3. This movement mirrored broader trends as the LKR also appreciated against other major currencies such as the AUD, GBP, and EUR.

25 Dec 2024 5 minute ago

24 Dec 2024 9 hours ago

24 Dec 2024 24 Dec 2024

24 Dec 2024 24 Dec 2024

24 Dec 2024 24 Dec 2024