28 Aug 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

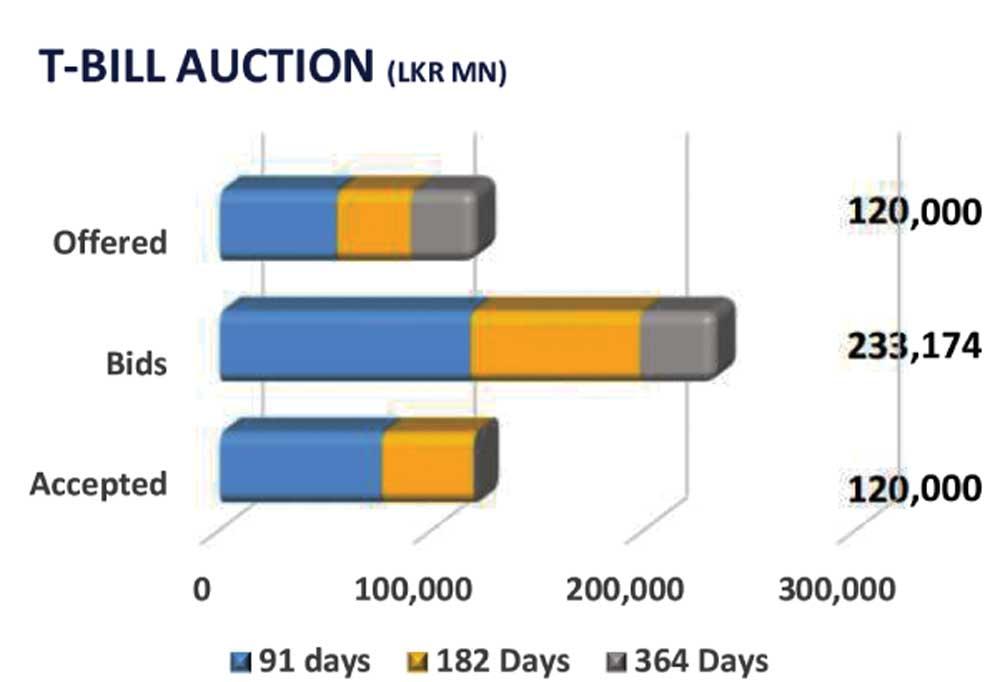

The secondary market experienced a quiet day yesterday with limited trading activity, as market participants positioned themselves ahead of the Rs. 100.0bn T-Bill auction scheduled for today.

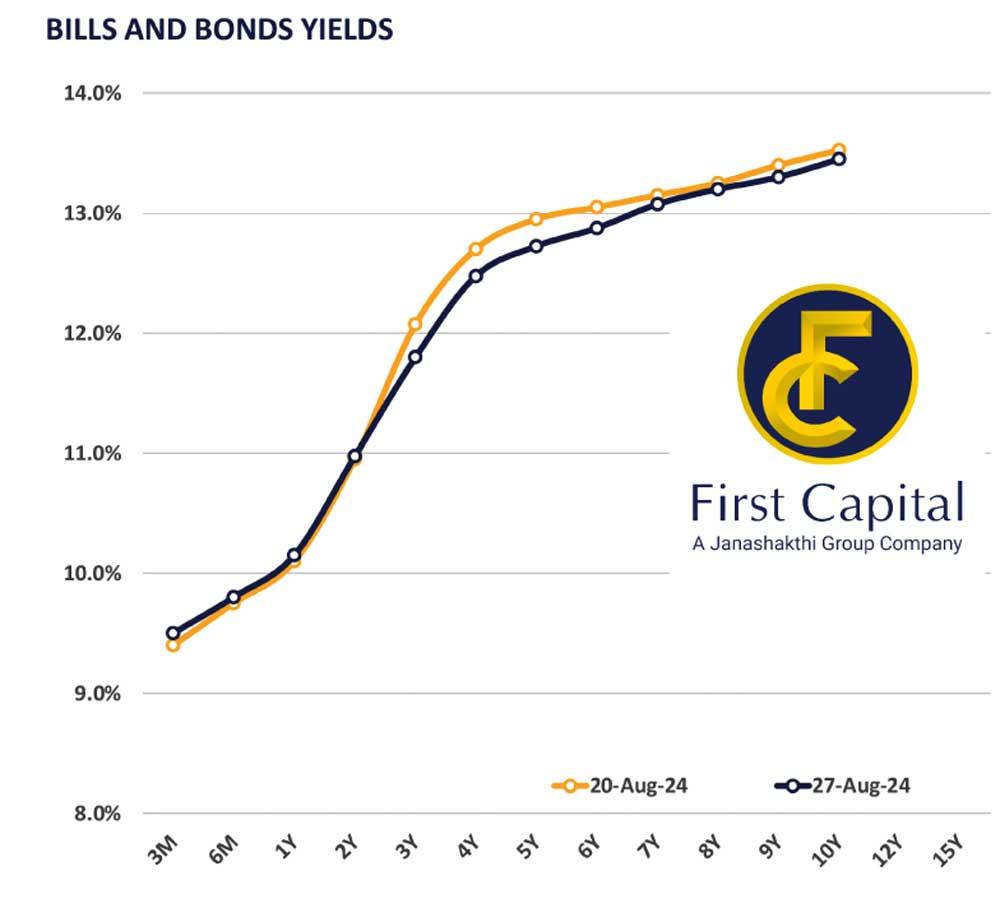

On the short end of the yield curve, bonds maturing on 01.06.26 and 15.12.27 traded at 10.95% and 11.80%, respectively. Meanwhile, mid-tenor bonds, including 01.05.28, 01.07.28, and 15.12.28, recorded trades at 12.35%, 12.55%, and 12.60%, respectively. Additionally, the 15.06.29 and 15.09.29 maturities traded at 12.75% during the day.

Furthermore, foreign holdings in government securities decreased by 3.53% WoW, registering at Rs. 43.5bn as of 22nd August 2024. Consequently, the foreign holding percentage remained stagnant at 0.26%.

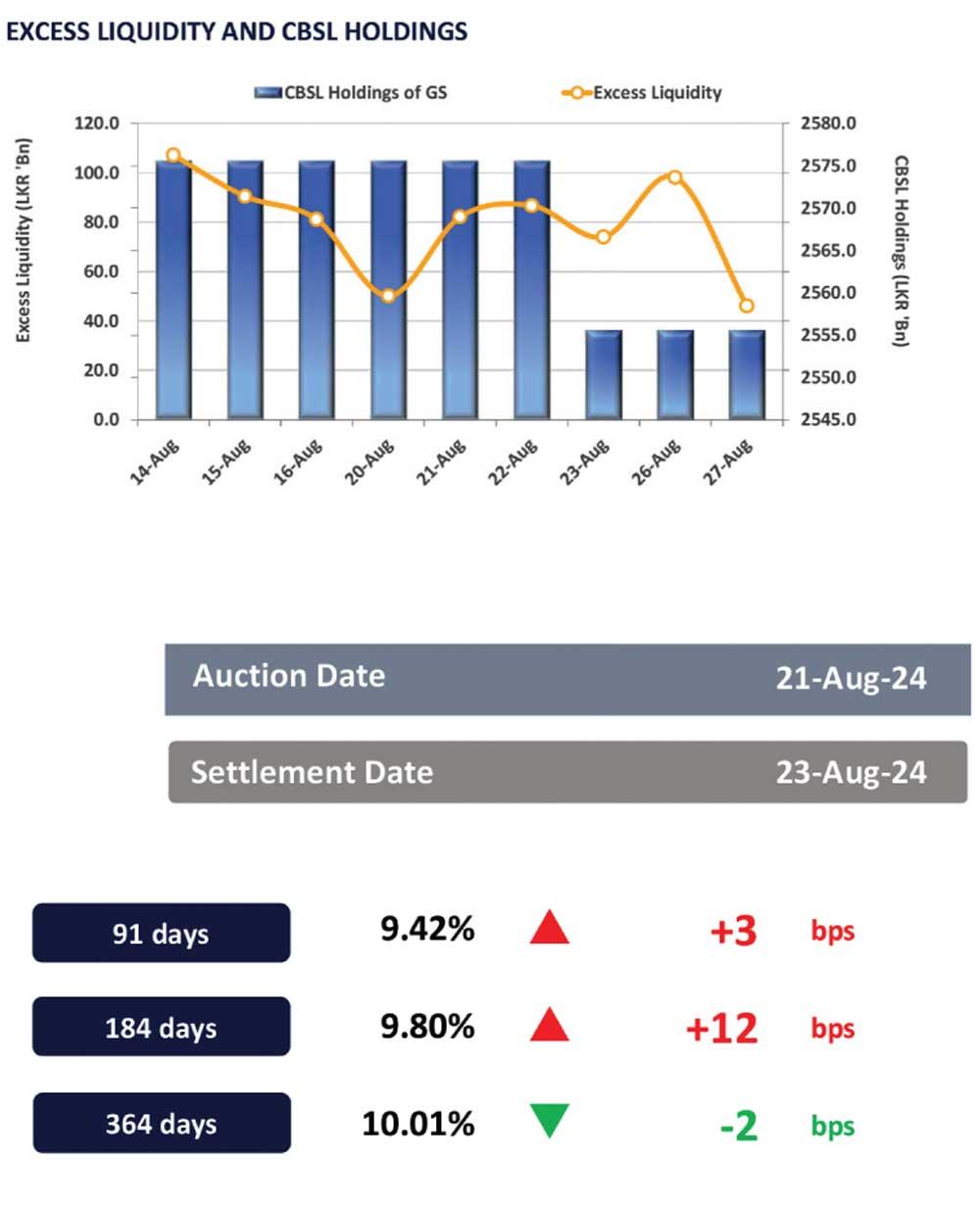

Notably, the overnight liquidity for the day declined to Rs. 46.2bn compared to Monday’s closing of Rs. 98.1bn, whilst CBSL holdings remained steady at Rs. 2,555.6bn for the 03rd consecutive session.

Furthermore, in the forex market, the LKR depreciated against the USD, closing at LKR 300.6 for the day. Moreover, for the year up to 23rd August 2024, the LKR has appreciated against the USD by 7.6%, reflecting a strong overall performance despite recent fluctuations.

25 Nov 2024 1 hours ago

25 Nov 2024 2 hours ago

25 Nov 2024 2 hours ago

25 Nov 2024 3 hours ago

25 Nov 2024 4 hours ago