19 Nov 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

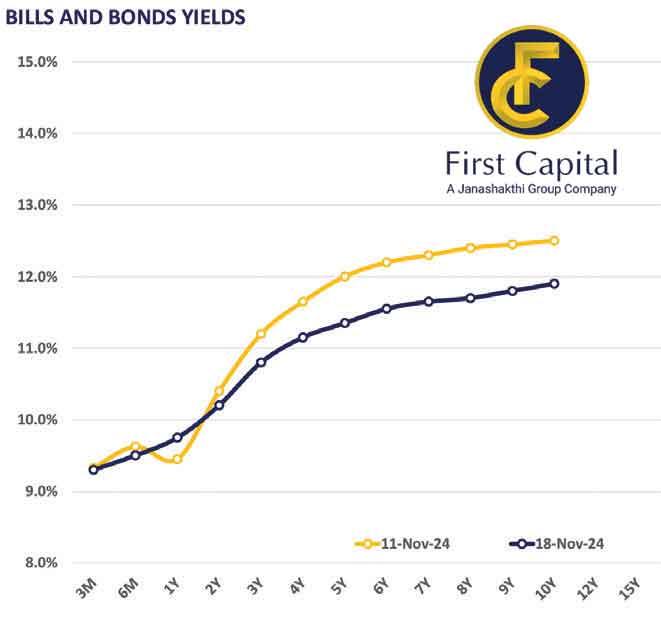

The secondary market commenced the week with a noticeable shift, moving away from the subdued sentiment of the previous week as the secondary market experienced relatively high trading volumes amidst the increased market activity. As a result, the secondary market yield curve edged down significantly across all the maturities.

Amongst the traded maturities, on the short end of the curve, 15.12.26 traded at 10.35 percent whilst the 2027 maturities namely, 01.05.27, 15.09.27 and 15.12.27 traded between 10.70 percent and 10.85 percent. Towards the belly end of the curve, notable trades were recorded in the 2028 maturities, namely, 15.01.28, 15.03.28, 01.05.28, 01.07.28 and 15.12.28 traded between 10.95 percent and 11.25 percent. Meanwhile, the 15.09.29 maturity traded between 11.25 percent and 11.45 percent. At the tail end of the curve, 01.10.32 traded between 11.60 percent and 11.85 percent. On the external front, the Sri Lankan rupee slightly appreciated against the greenback, closing at Rs.292.19/US dollar, compared to Rs.292.30/US dollar recorded on November 14, 2024. Furthermore, the Sri Lankan rupee also appreciated against the other major currencies such as the AUD, GBP and EUR compared to November 14, 2025. The Central Bank holdings of government securities remained unchanged, closing at Rs.2,515.62 billion yesterday.

25 Dec 2024 1 hours ago

24 Dec 2024 24 Dec 2024

24 Dec 2024 24 Dec 2024

24 Dec 2024 24 Dec 2024

24 Dec 2024 24 Dec 2024