23 Aug 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

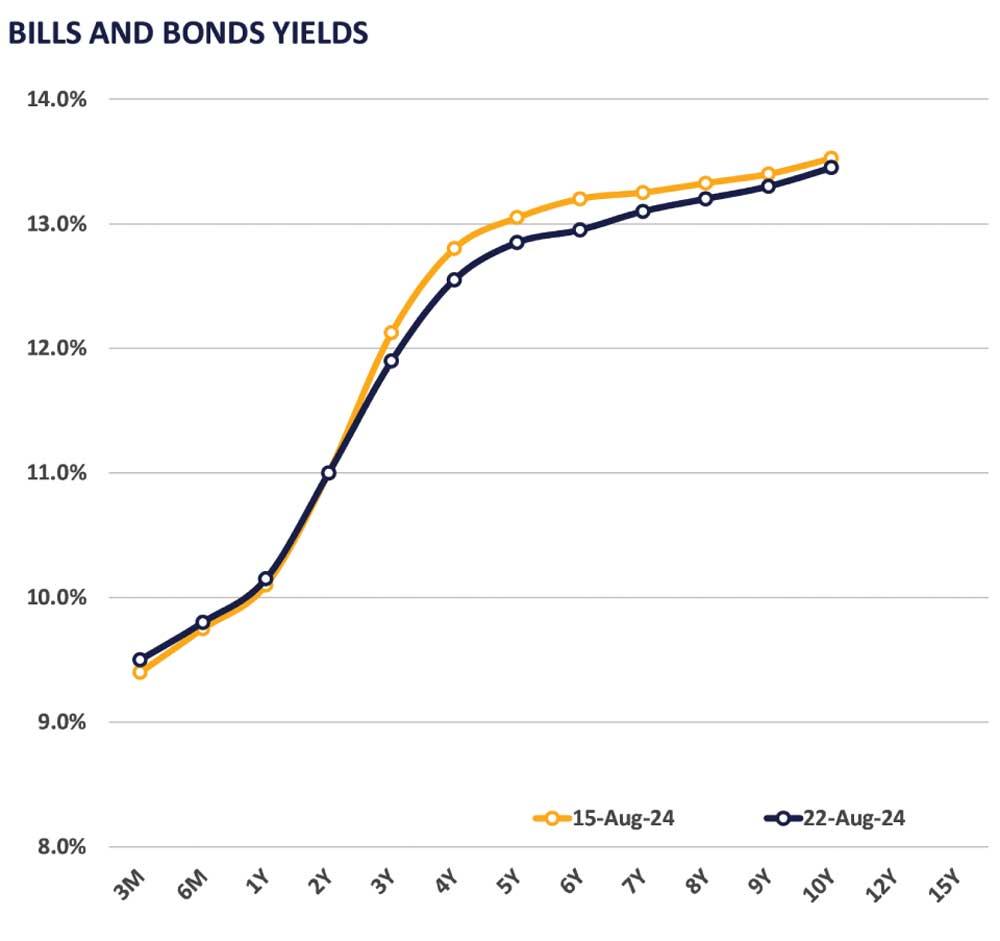

The secondary market witnessed very thin volumes backed by limited activity during the day which resulted in the yield curve to remain broadly unchanged.

Limited trades were enticed during the day, amongst them, 01.06.26 traded at 11.0%, 15.12.28 traded at 12.80%.

Moreover, towards the belly end of the curve 15.06.29 and 15.09.29 maturities traded at 12.85%. On the external side LKR slightly depreciated against the US$ recording at Rs. 300.0 compared to Rs. 299.3 recorded during the previous day.

Moreover, LKR depreciated against most of the currencies during the day namely, GBP, EUR, JPY and CNY.

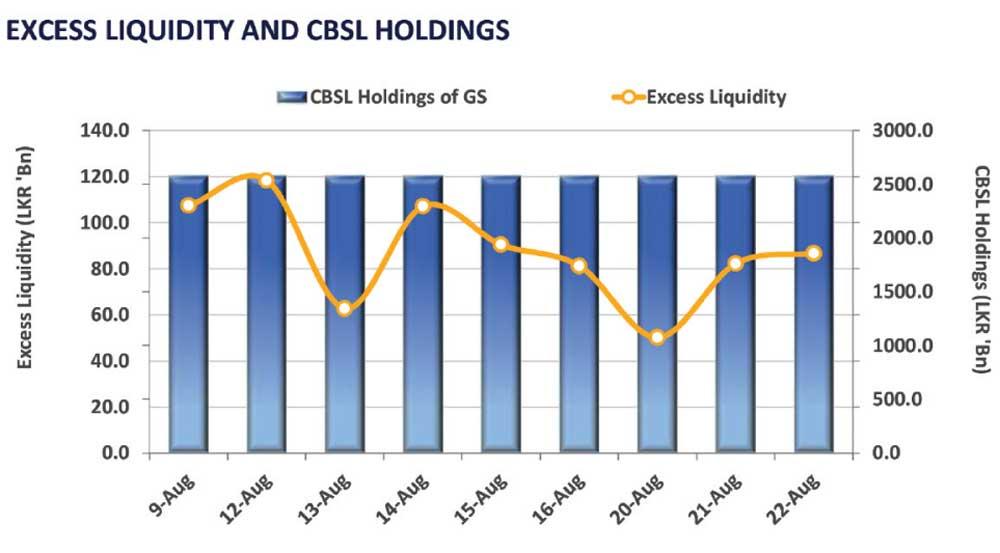

Overnight liquidity in the banking system increased during the day to Rs. 86.7bn from Rs. 82.2bn recorded during the previous day. CBSL holdings remained stagnant at Rs. 2,575.6bn.

PMI index for manufacturing recorded an index value of 59.5 in Jul-24. All sub-indices contributed positively to this improvement.

Moreover, PMI index for services recorded an index value of 71.1 registering the highest value recorded YTD. All sub-indices improved except employment.

25 Nov 2024 5 hours ago

25 Nov 2024 6 hours ago

25 Nov 2024 6 hours ago

25 Nov 2024 8 hours ago

25 Nov 2024 8 hours ago