19 Jul 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

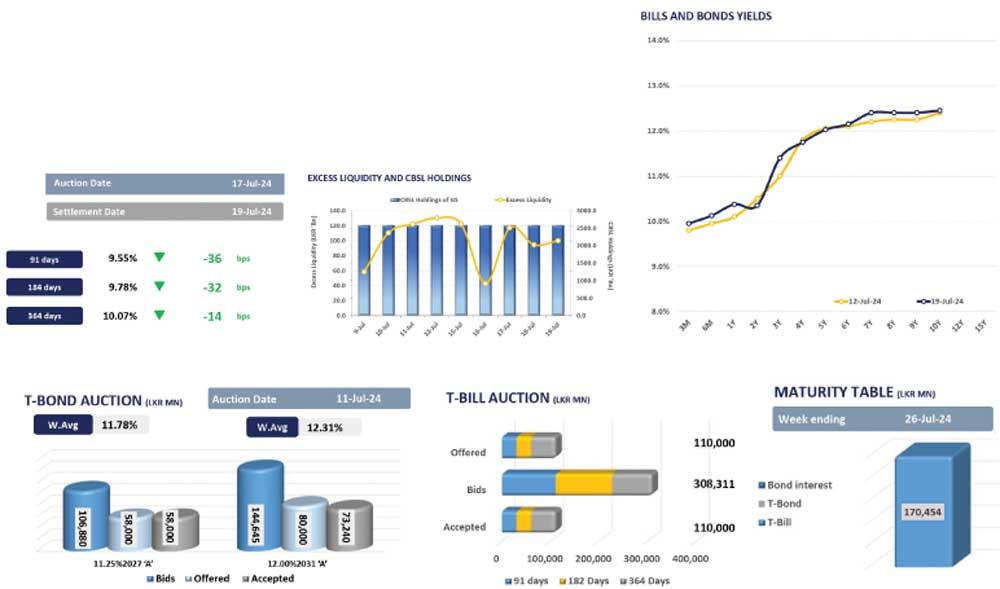

At the end of the week, the secondary market yield curve remained broadly stable amidst mixed activities witnessed across the board.

Following a period of consecutive bullish sentiment earlier in the week, the market experienced a subdued session with thin trading volumes during the day.

Among the traded maturities, the 01.02.26 and 15.12.26 maturities changed hands in the range of 10.20 percent-10.25 percent and 10.45 percent-10.50 percent, respectively. On the mid end, trades were observed at 11.75 percent for the 15.02.28 maturity and 11.80 percent for the 01.05.28 maturity.

Market sentiment extended to longer tenures as well, with the 15.09.29 and 01.12.31maturities trading at 12.00 percent and 12.40 percent, respectively.

Furthermore, the Central Bank of Sri Lanka has announced a Treasury bill issuance totalling Rs.160.0 billion through an auction scheduled for July 24, 2024, slightly below the Rs.170.5

billion T-bill maturing for the week ending July 26, 2024.

Meanwhile, out of the total auction, Rs.45.0 billion is to be raised from the 91-day maturity, Rs.45.0 billion is expected to be raised from the 182-day maturity while Rs.70.0 billion is to be raised from the 364-day maturity.

Moreover, in the forex market, the Sri Lankan rupee further depreciated against the US dollar for the third consecutive day, settling at Rs.303.99.

26 Nov 2024 3 hours ago

26 Nov 2024 4 hours ago

26 Nov 2024 5 hours ago

26 Nov 2024 6 hours ago

26 Nov 2024 7 hours ago