02 Oct 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

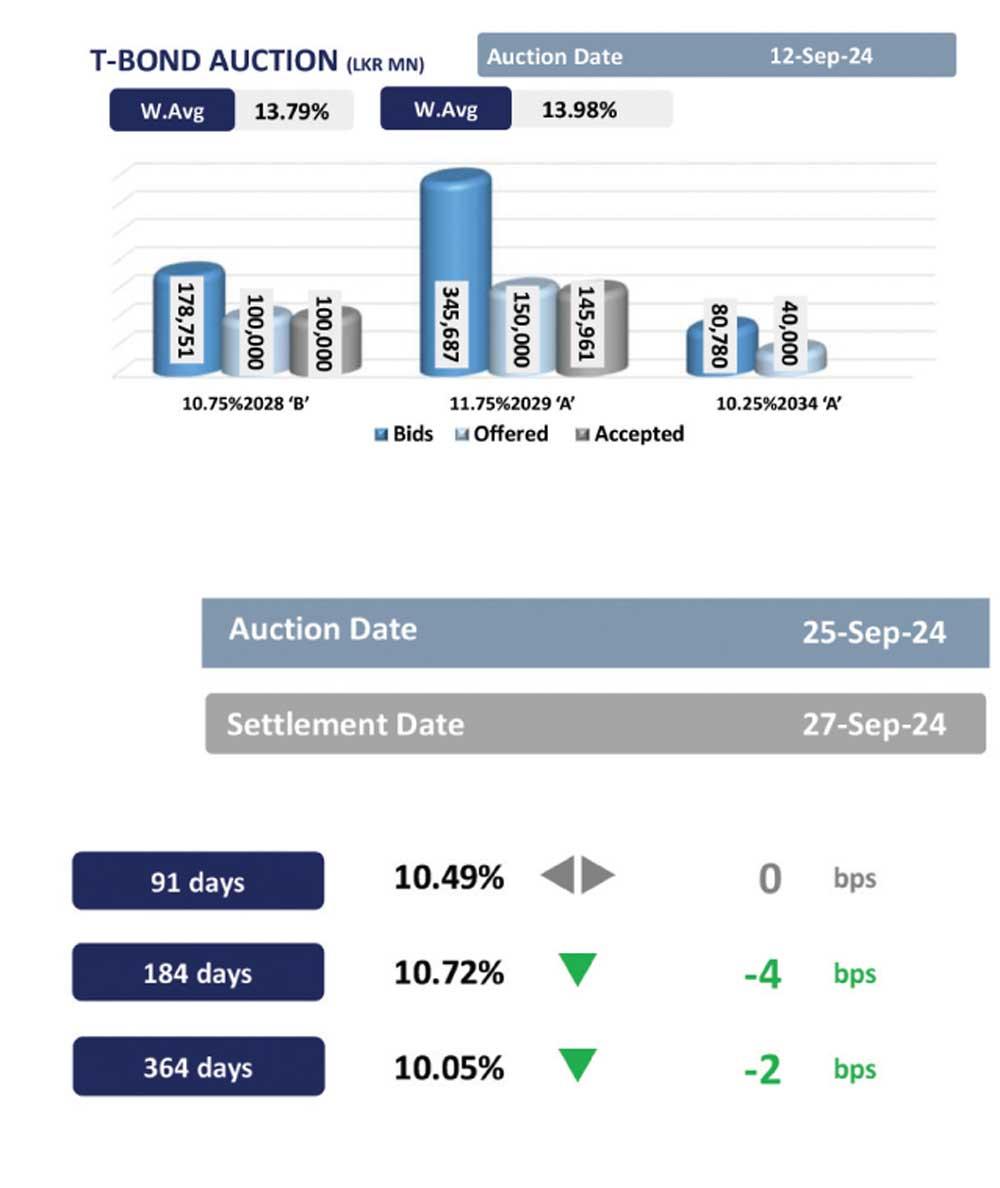

The secondary market exhibited mixed activities throughout yesterday, with subdued trading volumes ahead of today’s Rs. 142.5bn T-bill auction.

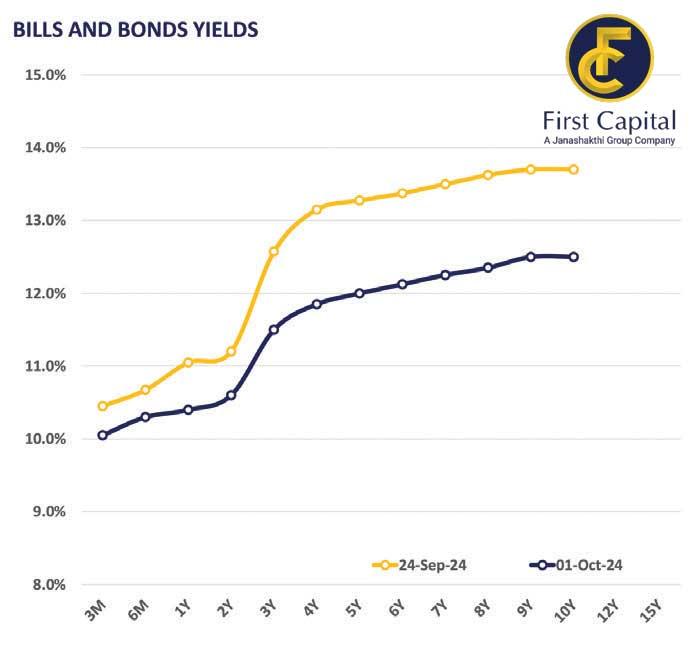

In the early hours yesterday, modest selling pressure was observed on mid-tenor bonds, specifically the 2028 and 2029 maturities. The 15.02.28 maturity traded at 11.90%, while the 15.09.29 maturity traded at 12.05%.

However, in the latter part of the session, renewed buying interest surfaced, with the 15.12.27 maturity trading within a narrower yield band of 11.60%-11.55%. The 2028 maturities, including 15.02.28 and 01.07.28, traded between 12.00%-11.82%, whilst the 2029 maturities, such as 15.06.29 and 15.09.29 ranged from 12.07%-11.95%.

Moreover, foreign holdings in government securities slightly increased by 0.01%WoW, registering at Rs. 39.4bn as of 26th September 2024. Consequently, the foreign holding percentage remained stagnant at 0.23% over the week.

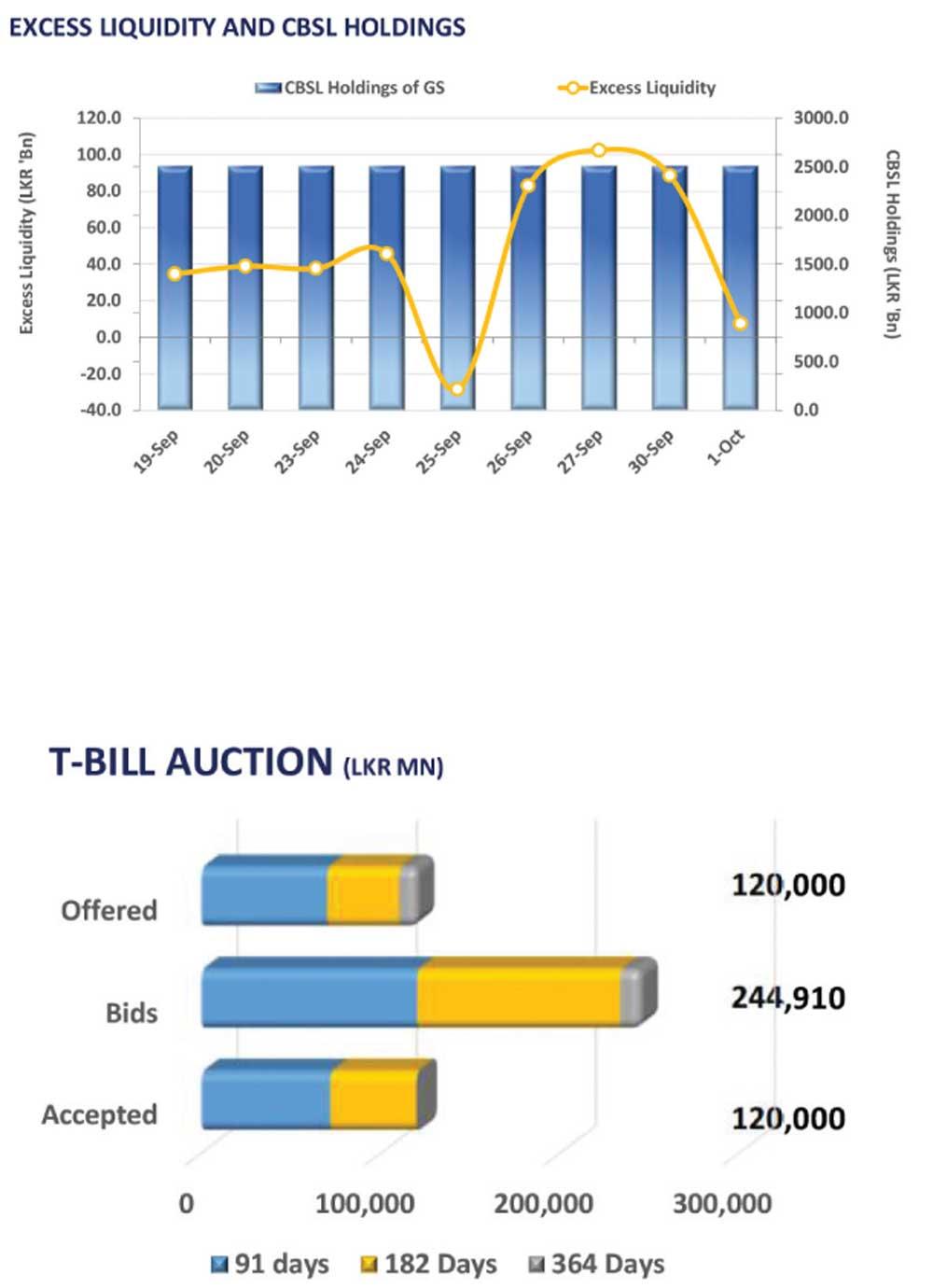

Notably, the overnight liquidity for the day significantly declined to Rs. 7.57bn, whilst CBSL holdings remained stagnant at Rs. 2,515.6bn for the 10th consecutive session.

Furthermore, in the forex market, the LKR continued to appreciate against the USD for the 06th consecutive session, closing at Rs. 297.2 for the day. During the year up to 27th September 2024, the LKR has appreciated by 7.3% against the USD, reflecting a strong overall performance for the year.

09 Jan 2025 3 hours ago

09 Jan 2025 4 hours ago

09 Jan 2025 7 hours ago

09 Jan 2025 7 hours ago

09 Jan 2025 8 hours ago