08 Oct 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary market adopted a mixed sentiment during the day despite the finalisation of the EDR process as the country completed the OCC and IMF consultation proceedings.

The secondary market adopted a mixed sentiment during the day despite the finalisation of the EDR process as the country completed the OCC and IMF consultation proceedings.

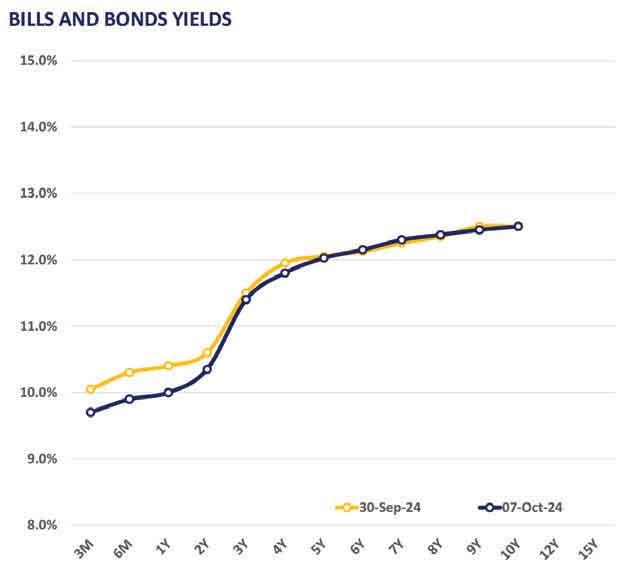

The mid and long tenures displayed selling interest whilst the short tenures mostly witnessed buying interest.

Among the traded maturities, on the short end of the curve, the 01.06.26, 01.08.26 and 15.12.26 maturities traded between 10.37 percent - 10.45 percent. 15.12.27 tenure traded at 11.50 percent whilst the 2028 maturities namely, 15.02.28, 15.03.28, 01.07.28 and 15.12.28 traded between the range of 11.60 percent - 11.80 percent. Towards the belly end of the curve, the 15.09.29 and 15.10.30 maturities traded at 12.00 percent and 12.20 percent, respectively. On the external side the Sri Lankan rupee appreciated against the US dollar, recording at Rs.293.78 compared to the previous day which was recorded at Rs.295.47.

Meanwhile, the Sri Lankan rupee appreciated against most of the major currencies such as GBP, EUR, JPY, etc.

The AWPR declined by 19bps compared to the previous week as it was recorded at 9.13 percent for the week ending October 04, 2024 whilst the AWLR for August 2024 was recorded at 12.12 percent.

08 Jan 2025 30 minute ago

08 Jan 2025 1 hours ago

08 Jan 2025 3 hours ago

08 Jan 2025 4 hours ago