21 Jan 2022 - {{hitsCtrl.values.hits}}

The growth in the money supply in the economy has eased in recent months in a sign that the August pivot to monetary tightening has caused some pullback on the fast pace at which the money supply grew since the onset of the pandemic.

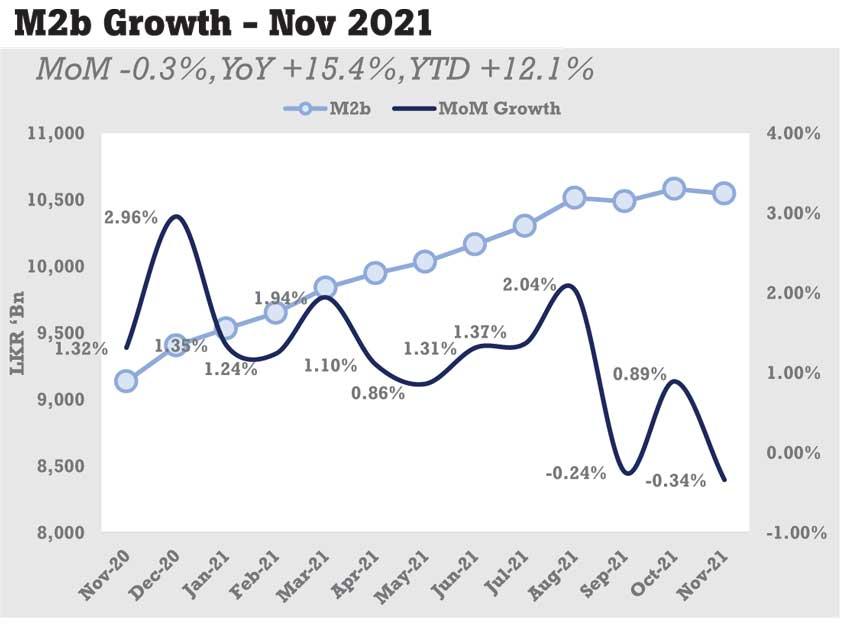

According to an analysis by First Capital Research (FCR) into the monthly change in the money supply in the economy, in the three months since August policy rate hike, the monthly growth has in fact fallen into the negative territory in September and November while the annual growth rate has also ebbed quite notably.

However, it remains to be seen whether the current pace is enough or more needs to be done to contain the hotter prices, which have engulfed the entire economy, as there is a substantial element of inflation coming from the supply side constraints than the demand side pressures.

There is also no guarantee that the pace of growth in money supply will continue on the current decelerating path given the massive fiscal handouts offered by the government without careful thought or analysis.

According to data, the money supply measured by Broad Money (M2b), which has currency in circulation, demand deposits in the commercial banks and the domestic and offshore banking assets with the commercial banks, has risen by 15.4 percent in the year though November 2021, decelerating from 17.3 percent in the year through October.

In November 2020, the broad money was growing at a high of 22.3 percent as the Central Bank slashed rates to record lows and unleashed liquidity at an unprecedented level since the beginning of the pandemic to resuscitate the economy beset by the virus related restrictions.

But as the excesses emerged in areas of foreign exchange and prices towards mid last year, the Central Bank raised its key policy rates by 50 basis points on August 19 to signal the markets that it was ending the pandemic era policy support.

This substantially decelerated the pace of private sector credit growth and created a massive liquidity shortage in the overnight money market, which as of last week stood at Rs.460 billion.

The Central Bank funds the shortage through its Standing Lending Facility at 6.00 percent and such overnight liquidity injections amounted to a massive Rs.514 billion on January 13. Economists point out that the rising liquidity injections are a sign of money going out of the country by way of forex payments.

At the first monetary policy announcement for the year, yesterday, the Central Bank further increased the policy rates by 50 basis points.

16 Nov 2024 48 minute ago

16 Nov 2024 1 hours ago

16 Nov 2024 1 hours ago

16 Nov 2024 1 hours ago

16 Nov 2024 2 hours ago