07 Mar 2018 - {{hitsCtrl.values.hits}}

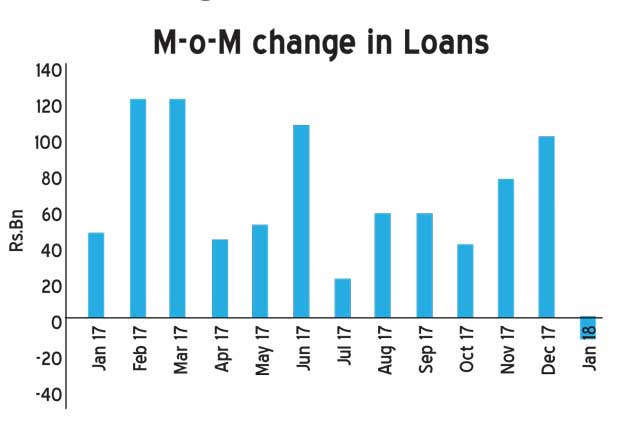

In a rare development, Sri Lanka’s banking sector new loans have turned negative in January as investments and consumption fizzled out amid the widespread uncertainty triggered by the volatile political landscape in the country.

Sri Lanka’s banking sector loans and advances slowed down during the second half of 2017 as the delayed transition effects of monetary policy tightening measures employed since 2016 started taking hold slowly.

In January 2018, banks saw their total loans and advances shrinking by Rs.14 billion with the biggest contraction coming from large banks—banks with assets more than Rs.500 billion.

While a clear reason could not be ascertained as individual bank loan portfolios for January are still not available, one banking sector analyst said this could perhaps be due to a settlement of some large facility or a few given by large bank/s, which off-set the growth in the new loans.

By the end of December 2017, Sri Lanka’s banks in total had Rs.6.318 trillion in gross loans and advances but a month later this portfolio fell to Rs.6.304 trillion, a decline of 0.21 percent.

However, this translated into a 14.8 percent growth on a year-on- year basis.

Sri Lankan banks saw a robust growth in advances during the first half of 2017 but the growth moderated to 14.7 percent by the end of December 2017. Banking sector gross loans and advances growth offers a close proxy for the private sector credit growth in the country as the bulk of the bank credit goes to the private individuals and corporates for consumption and investments.

It was only recently Mirror Business reported that Sri Lanka’s private sector credit growth shows clear signs of easing as the December credit growth registered a 14.7 percent, from almost 22 percent in December 2016, 18.6 percent a six months later and 17.5 percent in September 2017.

Sri Lankan banks in total extended a total of Rs.618 billion in credit to the private individuals and corporates during 2017, a substantial slowdown from a little over Rs.750 billion credit extended during 2016.

Further moderation in growth in new loans by the banks might induce the Monetary Board in considering a rate cut at their next policy meeting in April but the odds are weighing against such a decision.

Sri Lanka in January saw car imports doubling from two years as the credit induced vehicle purchases have rebounded strongly as the Central Bank raised the loan-to-value ratios on loans and leases on vehicles and the interest rates also started easing since lately.

19 Nov 2024 38 minute ago

19 Nov 2024 38 minute ago

19 Nov 2024 50 minute ago

19 Nov 2024 1 hours ago

19 Nov 2024 2 hours ago