01 Feb 2018 - {{hitsCtrl.values.hits}}

Sri Lanka continued to do well in merchandise exports as the country recorded gains in exports for the fifth consecutive month in November but the trade gap widened to a record high due to higher oil imports.

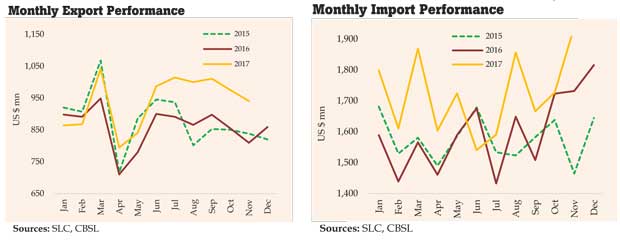

The latest trade data released by the Central Bank for November showed exports gaining by 16.2 percent year-on-year (YoY) to US $ 941 million, partly driven by the low base in 2016.

At the same time, imports rose by 12 percent YoY to US $ 1.94 billion, a figure which is more than double the export earnings, stretching out the trade deficit to almost a billion dollars for the month from US $ 922 million a year earlier.

The November 2017 import figure is the highest recorded since November 2011, the Central Bank said.

The cumulative trade deficit for the 11 months rose to US $ 8.6 billion from US $ 7.9 billion YoY as the import expenditure of US $ 18.9 billion surpassed the export earnings of US $ 10.3 billion.

Sri Lanka last week signed a free trade agreement with Southeast Asian economic power house, Singapore—third such agreement and the first with an East Asian country— which will eliminate custom duties on 50 percent of tariff lines immediately.

The agreement sends a message to the world that Sri Lanka remains committed to opening up its markets and thus could bode well for balancing future trade.

Sri Lanka’s positive export performance in recent months is often attributed to the restoration of GSP Plus by the European Union (EU) and higher tea prices remained throughout the year.

“The export earnings from garments increased for the fifth consecutive month in November 2017 with increased demand from the EU and USA and non-traditional markets such as Australia, Hong Kong and the UAE.

Following the restoration of the GSP Plus facility, earnings from garment exports to the EU continued to expand and in November 2017, it grew by 13.8 percent YoY, while garment exports to the USA increased by 11.9 percent,” the Central Bank said.

The total textile and garment exports in November rose by 11 percent YoY to US $ 424 million while the cumulative earnings for the 11 months rose by 1.6 percent YoY to US $ 4.6 billion. The earnings from tea exports rose by 25.4 percent YoY to US $ 127 million in November and 21 percent YoY to US $ 1.4 billion for the 11 months.

Meanwhile, the rising global fuel prices and the higher import volumes during the period weighed on the country’s import bill.

November’s fuel bill, which includes crude oil, refined petroleum and coal, rose by a sharp 38 percent YoY to US $ 306.4 million, while the oil bill for the 11 months rose by 39.1 percent YoY to US $ 3.0 billion.

The consumer goods imports rose by a modest 2.6 percent YoY during the 11 months to US $ 4.1 billion reflecting the moderation in consumption levels in response to higher interest rates and higher taxes prevailed during the year. The non-food consumer goods fell by 2.8 percent YoY to US $ 2.4 billion due to the same reasons.

Continuing the declining trend, in November, worker remittances— the single largest foreign exchange earner for Sri Lanka—fell 0.9 percent YoY to US $ 562 million, while for the 11 months’ remittances declined by 7.3 percent YoY to US $ 6.1 billion.

Worker remittances help Sri Lanka to offset much of the deficit in the trade account.

It is estimated that close to two million Sri Lankans work in blue-collar jobs in the Gulf region.

As Gulf countries have embarked on diversifying their economies, ending their decades-long oil dependency and recent crackdown on corruption, the Sri Lankan policymakers will have to look for alternatives for remittances from the region.

The Central Bank governor last year said the slowing remittance income could be a blessing in disguise as certain sectors in the economy, which are expanding aggressively, require additional labour.

Sri Lanka’s balance of payment (BoP) turned a positive US $ 2.0 billion for the 11 months due to the net inflows into the government securities market, the Colombo Stock Exchange and funds raised via a sovereign bond issue.

The other long-term loans, foreign currency term financing facilities and the third tranche received as part of the International Monetary Fund’s extended fund facility also helped the country’s BoP to record positive gains.

The stronger than last year’s foreign direct investment (FDI) receipts too buttressed the BoP during the period. The Board of Investment said Sri Lanka received little over US $ 1.6 billion in FDI in 2017.

20 Nov 2024 53 minute ago

20 Nov 2024 1 hours ago

20 Nov 2024 2 hours ago

20 Nov 2024 3 hours ago

20 Nov 2024 3 hours ago