01 Sep 2023 - {{hitsCtrl.values.hits}}

While Sri Lanka’s construction sector experienced a contraction in activities during July, the industry maintains a positive outlook for the future.

This optimism stems from the anticipated revival of the country’s overall economic activity, driven by lower interest rates and reduced material costs.

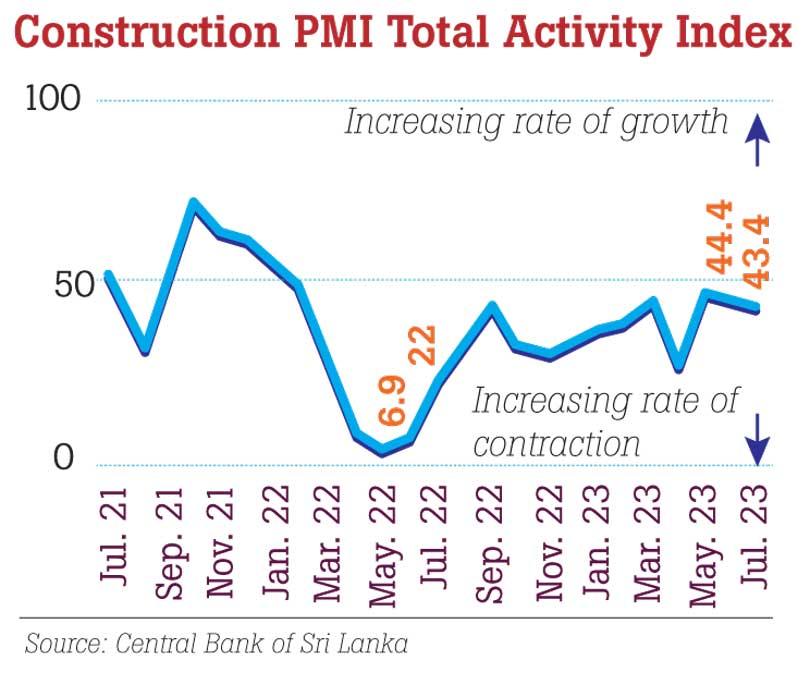

The Purchasing Managers’ Index (PMI) for the Construction Industry compiled by the Central Bank continued to perform at a subdued level in July, recording an index value of 43.2.

“The sentiment amongst the firms towards the next three months broadly remained positive, mainly due to the expected recovery in the economy, the decrease in interest rates and material costs, and current negotiations on the recommencement of suspended government- funded projects,” a Central Bank statement said.

As per the respondents of the survey, most firms remained hibernated amid the challenging industry environment.

However, they had said that the gradual decline in material costs had provided a conducive environment for the limited ongoing projects.

Further, some temporarily suspended government- funded projects resumed at a modest scale during the month.

Meanwhile, the New Orders contracted, yet at a slower rate in July. Many respondents highlighted that tendering opportunities are mostly limited to foreign-funded projects, while private clients are still waiting for further cost reductions.

Sub-contract openings are also scarce as firms with projects in hand possess extra capacities.

Employment in the sector decreased further during the month since firms tend to retain only the key staff.

Further, Quantity of Purchases continued to decline during the month as most of the firms are in a wait-and-see stance, only fulfilling the short-term requirements.

In the meantime, Suppliers’ Delivery Time broadly remained stable during the month, and some respondents mentioned that supplier credit facilities are also becoming available.

30 Oct 2024 1 hours ago

30 Oct 2024 2 hours ago

30 Oct 2024 3 hours ago

30 Oct 2024 3 hours ago

30 Oct 2024 4 hours ago