15 Mar 2021 - {{hitsCtrl.values.hits}}

More than two thirds of the foreign currency exposure of Sri Lanka’s banking sector to the State is on international sovereign bonds (ISBs) and development bonds while the rest composes of loans to the State and the State-owned enterprises (SOEs).

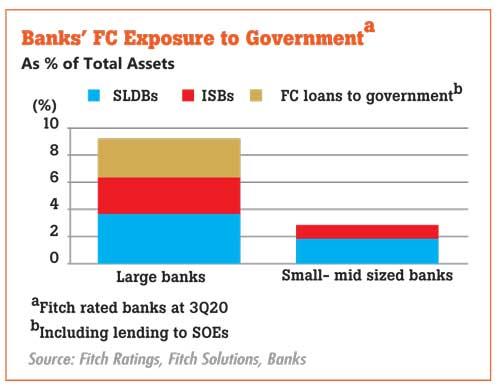

According to Fitch Ratings, total foreign currency assets by Fitch-rated licensed commercial banks in Sri Lanka was at 20 percent of the total cumulative assets by the end of September 2020, of which 8.7 percent was to the State via ISBs, development bonds, State loans and loans to SOEs.

The balance foreign currency assets are in foreign currency loans to private individuals and firms who mostly deal with foreign currency in their day-to-day business dealings, one-off investments, such as offshore investments by a local company and other investments made in foreign currency denominated financial assets— equity and debt instruments.

According to Central Bank data, the licensed commercial banking sector had total assets of Rs.12.3 trillion by the end of September 2020.

According to the data parsed by the rating agency, 68 percent of the banks’ foreign currency exposure to the State composed of ISBs and Sri Lanka Development Bonds issued by the government, making their exposure to the two instruments little over two thirds of their total foreign currency exposure to the State.

“….and the rest being foreign currency loans to State and State-owned entities. The share of investment in foreign currency-denominated government securities is much higher at large banks, at 6 percent -12 percent of their total assets,” the rating agency said.

Fitch rates 13 licensed commercial banks. The two specialised banks, SDB and HDFC did not have foreign currency exposures.

The banks were seen providing substantially higher impairments against sovereign bonds they hold after Fitch Ratings downgraded Sri Lanka’s sovereign credit rating in December 2020.

However, the banks went on a borrowing spree of foreign currency denominated loans,

rebuffing any impacts from the sovereign downgrade.

Meanwhile, Fitch Ratings cautioned of, “reduced buffers against foreign currency exposure,” after the Central Bank reduced capital charge for foreign currency claims on the government to 10 percent of risk-weighted assets in 2021 from 20 percent.

Banks were further permitted to reduce the loss given default rate to 10 percent from 20 percent when computing expected losses for these exposures in 2021.

“We believe that while these measures offer some interim regulatory relief to banks, the resulting capital and provisioning levels may not fully reflect the underlying risk exposure,” the rating agency added.

19 Nov 2024 6 hours ago

19 Nov 2024 7 hours ago

19 Nov 2024 8 hours ago

19 Nov 2024 19 Nov 2024

19 Nov 2024 19 Nov 2024