16 Feb 2024 - {{hitsCtrl.values.hits}}

In a sign of sustained momentum, activities in both manufacturing and services sectors have advanced as orders picked up once again for textiles and apparel sector while the record tourist arrivals and easing interest rates are adding further fuel to the services sector of the economy.

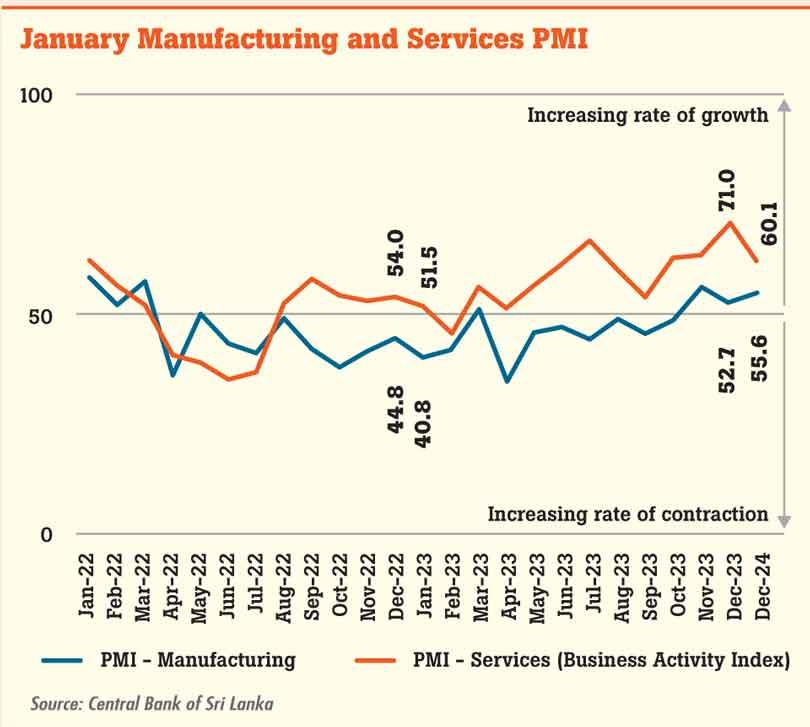

According to the Purchasing Managers’ Index (PMI) data for January released by the Central Bank, the manufacturing sector recorded 55.6 index points from an index value of 52.7 in December 2023 while the services sector registered an index value of 60.1 from 71.0 in December.

In services, officials made a change in how the index should be interpreted from January in line with the international best practices where its variable, ‘The Services Business Activity Index’, is now referred to as the PMI – Services.

This is comparable to the ‘The Manufacturing Production Index’, under PMI – Manufacturing, the Central Bank said in a technical note to the release yesterday.

PMI is a closely watched economic barometer to gauge the health and the direction of the overall economy.

Under PMI, a value above 50.0 is interpreted as an expansion while a value below that level is considered as a contraction. If the value is 50.0, then that activity is interpreted to have remained neutral.

According to data, the new orders and production for textiles and apparel in January have bolstered the manufacturing PMI in a bellwether for positive momentum for the country’s largest industrial export commodity after over a yearlong decline due to softness in demand conditions in the West.

Meanwhile the back-to-back months of tourist arrivals exceeding 200,000 have driven up business activities for personal services, accommodation and food and beverage sub-sectors in January, propelling the services PMI.

Besides, financial services also received a tailwind from the continuous decline in interest rates as people tend to borrow more for both consumption and business activities, helping to accelerate economic growth. This was also seen from the surge in credit granted to the private sector

by the banks.

Meanwhile the back-to-back months of tourist arrivals exceeding 200,000 have driven up business activities for personal services, accommodation and food and beverage sub-sectors in January, propelling the services PMI.

Besides, financial services also received a tailwind from the continuous decline in interest rates as people tend to borrow more for both consumption and business activities, helping to accelerate economic growth. This was also seen from the surge in credit granted to the private sector by the banks.

However, the recent increase in value added tax has tempered some positive expectations for the services sector activities for the next three months as there have been concerns for possible decline in sales with the further erosion in the purchasing power of the people.

27 Oct 2024 30 minute ago

27 Oct 2024 1 hours ago

27 Oct 2024 3 hours ago

27 Oct 2024 3 hours ago

27 Oct 2024 4 hours ago