10 Aug 2021 - {{hitsCtrl.values.hits}}

Sri Lanka’s insurance industry emerged stronger in 2020, receiving a tailwind from the pandemic-induced conditions, as life insurance premiums rose the most in recent years while the general insurers ended up recording higher profits supported by the lower claims from motor insurance.

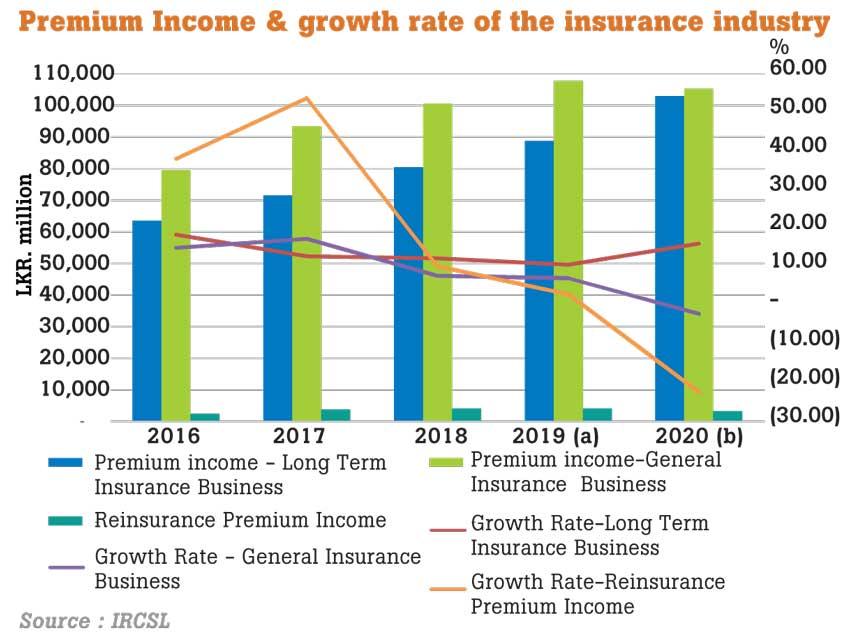

According to a biannual analysis undertaken by the sector regulator, the Insurance Regulatory Commission of Sri Lanka (IRCSL), to assess how the industry had fared, the life insurance gross written premiums (GWP) had risen by a robust 16 percent to Rs.102.9 billion, the highest growth since 2016, which sent the total premium incomes, including the general insurance to Rs.208.3 billion, up 6 percent.

According to a biannual analysis undertaken by the sector regulator, the Insurance Regulatory Commission of Sri Lanka (IRCSL), to assess how the industry had fared, the life insurance gross written premiums (GWP) had risen by a robust 16 percent to Rs.102.9 billion, the highest growth since 2016, which sent the total premium incomes, including the general insurance to Rs.208.3 billion, up 6 percent.

The growth in life insurance premiums also had corresponded with the growing confidence of the insurance by the public over the last few years, which the regulator cited as caused by the increased public awareness and the improved services and product development by the insurers.

However, the most recent boost in life insurance uptake was prompted by the pandemic as people grew more risk conscious to seek more life protection against ailments and social protection upon their retirement.

“The public awareness on life protection is believed to be increased due to the circumstances evolved by the pandemic,” the IRCSL said in a statement.

This was reflected in the 739,784 new life insurance policies issued during 2020, up slightly from 2019 levels, bringing the total life policies in force to 3.6 million, up 6.21 percent from 2019.

This makes out to 16.39 percent of the total population and 42.6 percent of the total labour force, up from 15.52 percent and 39.48 percent, respectively in 2019.

This faster uptake in life insurance policies sent the total insurance sector assets to Rs.796.8 billion, up by 14.33 percent, accelerating from 10.55 percent in 2019 and the highest pace of growth recorded in a year in recent times.

Albeit the higher premium incomes pushed the total insurance penetration measured as a percentage of the gross domestic product to 1.39 percent in 2020, from 1.31 percent in 2019, this remains still below the other countries in the Asian region. The insurance penetration is the insurance premium cited in relation to the GDP of the country.

Meanwhile, the general insurance sector saw its GWP slipped by 2.24 percent to Rs.105.3 billion in 2020, mainly caused by the sharp decline in the vehicle imports, which accounts for the largest share of the general insurance business. However, the profits before tax of this segment rose the most in recent years to Rs.23 billion, surpassing the long-term insurance’s contribution to the overall profit of the insurance business. This was due to the 27 percent decline in general insurance claims, the lowest during the last five years, which became possible due to reduced motor claims and the decline in travel and tourism industries, due to the pandemic. The overall profit before tax of the insurance industry has risen by a robust 29 percent to Rs.41.8 billion.

18 Nov 2024 13 minute ago

18 Nov 2024 4 hours ago

18 Nov 2024 5 hours ago

18 Nov 2024 5 hours ago

18 Nov 2024 5 hours ago