07 Oct 2020 - {{hitsCtrl.values.hits}}

Adding to the drumbeat of warnings coming out from rating agencies on developing economies and their banking systems from the pandemic-induced economic damage, Moody’s Investors Service said risks will grow in Asia Pacific banks as asset quality deteriorates and profitability weakens from increases in credit costs and contraction of margins, weighing on their capitalisation.

Even though capitalisation will weaken most in Sri Lankan and Indian banks among others, that will have only a little impact on the strength of their credit profiles, as capital is only one out of many matrices watched by the rating agency before it triggers a rating action, Moody’s added.

Last week, Moody’s downgraded the Sri Lankan sovereign by an unusual two notches to Caa1 from B2 while revising the outlook to stable from negative citing concerns from governance to

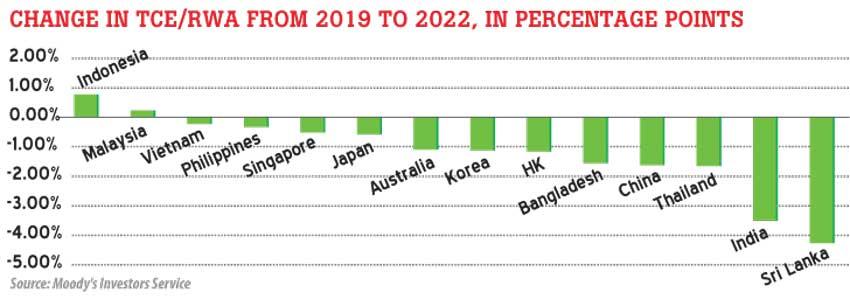

debt re-financing to stretched fiscal deficit. Three days later, Sri Lanka settled a billion dollar sovereign bond successfully. In a fresh report this week, which looked at the impact of the economic downturn on asset quality, capital and profitability of Asia-Pacific (APAC) region banks, the rating agency said capitalisation measured by the Tangible Common Equity (TCE) of majority of rated banks in India, Thailand and Sri Lanka would plunge by more than 200 basis points (bps) by 2022, “while in other economies, the proportion of such weak performers will range from 10 percent to 30 percent of rated banks.” “Among the 14 APAC banking systems, TCE ratios will decline most significantly in Sri Lanka and India due to the severity of economic shocks to the countries, banks’ weaker starting solvency metrics, and historically weak underwriting. By contrast, capitalization will strengthen in Indonesia as a result of banks’ strong profitability,” the rating agency added.

Moody’s is of the view that while measures by the Central Bank such as credit guarantees would provide some buffer against weakening of capital, that will only provide modest relief for banks as most of such guarantees and other support schemes cover only a small section of the total outstanding loans. Sri Lanka’s Central Bank in July announced a credit guarantee scheme to underwrite small business loans up to 80 percent while such loans were spared from the need to risk weight against the capital.

While asset quality and profitability came under pressure during the outbreak of the pandemic, Sri Lankan banks have broadly remained resilient and they are already disbursing loans at levels above pre-pandemic levels.

The outstanding private sector credit rose by a robust Rs.78.3 billion in August after remaining in the negative for three months, reflecting the appetite for growth by the bank and the reinvigorated demand for funds for investments and consumption by borrowers.

While the profits could dent from higher credit costs and narrowing margins, higher loan volumes could partly offset the pressure on profits and thereby reduce the pressure on capital.

Moody’s estimate the problem loans to double on average across the 14 APAC economies by 2022, which includes Sri Lanka. By end-June, Sri Lanka’s banking sector gross NPL ratio was 5.4 percent, up from 4.7 percent in December 2019.

While the rating agency estimates the pre-provision income of the APAC banks to decline between 5 percent and 10 percent in 2020 from 2019 due to fall in interest rates, it estimates the profitability of Sri Lankan banks as measured by the net income as a percentage of tangible assets or return on tangible assets to fall between 0.5 percent and 0.25 percent from 2020 through 2022.

18 Nov 2024 4 hours ago

18 Nov 2024 5 hours ago

18 Nov 2024 5 hours ago

18 Nov 2024 6 hours ago

18 Nov 2024 18 Nov 2024