14 Sep 2020 - {{hitsCtrl.values.hits}}

The Colombo stock market has recorded a noteworthy turnaround in recent months, driven by a progress in the indices and improved investor interest.

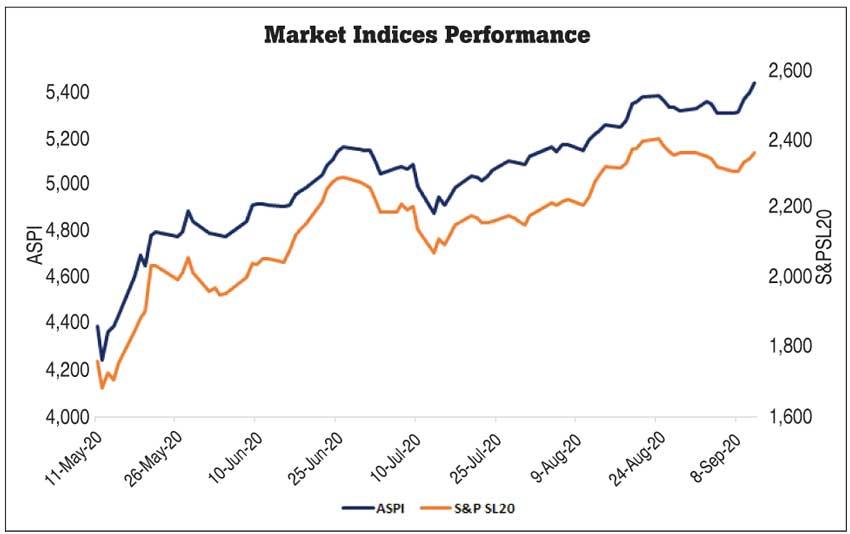

Since reopening the market on 11 May 2020 following an extended closure as a result of the COVID-19 pandemic, the benchmark All Share Price Index (ASPI) has recorded an 18.97 percent gain since reopen, and as of 11th September stands at 5,438.91.

The S&P SL20 index, which features CSE’s 20 largest and most liquid stocks has also gained, making a 21.15 percent gain since the market reopen, closing at 2,359.24 points as of 11th September.

The ASPI and the S&P SL20 Index have made consistent gains tracking back points losses with the indices now at higher levels than before the 11th of March 2020, the day COVID-19 was declared a pandemic by the World Health Organisation.

The overall value of the stock market, which is represented by market capitalisation, has also improved adding Rs.235.5 billion since May 11th.The year-to-date daily average turnover, which is an indication of investor participation in the market, currently stands at Rs.1.35 billion – the highest figure recorded since 2014.

Overall market activity in terms of the average number of trades carried out during a trading day has increased significantly by 73 percent when compared to the average figure recorded in 2019 and is 133 percent higher than 2018.

The post-COVID market presented a unique opportunity for investors to benefit from historically attractive valuations at the time, with the market reaching 4,300 levels.

The low-price points demonstrated by majority of the stocks were the ideal entry phase for new investors and an opportune moment for them to experience the market and grow

their wealth.

Local retail investors were quick to identify this opportunity and accumulate stocks at low prices, which resulted in high participation levels in the market.

A significant increase in account openings was noted since market reopen with 5801 new investors entering the market, which is 98 percent higher than the number of new investors recorded during the same time period (May to August) in 2019 and 56 percent higher

than 2018.

Local investors have contributed to approximately 75 percent of the total market turnover since the market reopened for trading on the 11th, which is significantly higher when compared to approximately 36 percent recorded pre-closure.

The year 2020 has also seen a greater interest among younger investors in the retail segment, with 47 percent of the total accounts opened being attributed to the 18-30 age group. This marks an interesting development considering the fact that a large portion of retail stock market investors has traditionally been above 50 years of age.

On the foreign investment front, 2020 has recorded a net foreign outflow of Rs.34.9 billion, largely in line with the foreign fund outflow trend recorded in emerging and frontier markets around the world. However, the market has continued to attract foreign purchases too with investors continuing to acknowledge attractive valuations compared to 2019, with foreign purchases YTD of Rs.45 billion in 2020.

18 Nov 2024 8 minute ago

18 Nov 2024 4 hours ago

18 Nov 2024 5 hours ago

18 Nov 2024 5 hours ago

18 Nov 2024 5 hours ago