14 Jun 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

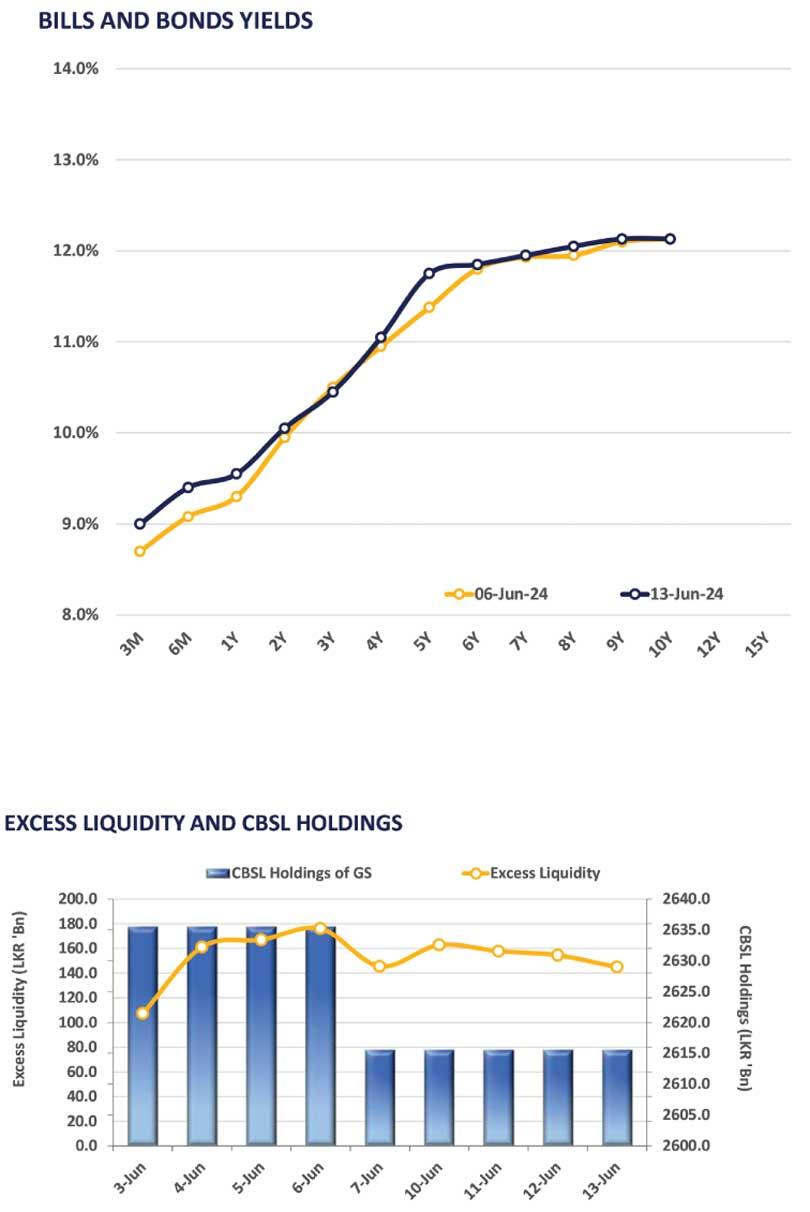

The secondary market witnessed moderate volumes backed by high investor participation post the year’s biggest T-Bond auction which was held yesterday. Influenced by the Bond auction, there was notable buying interest centred on short tenors namely 2027 and 2028.

Furthermore, 01.05.27 traded at 10.50%, 15.09.27 traded at 10.70% whilst 2028 maturities, namely 15.01.28, 15.03.28, 01.05.28, 01.07.28 and 01.09.28 traded between the range of 11.20%-11.00%.

Consequently, 15.09.29 traded between the range of 11.90%-11.80% and 01.12.31 traded at 12.00%.

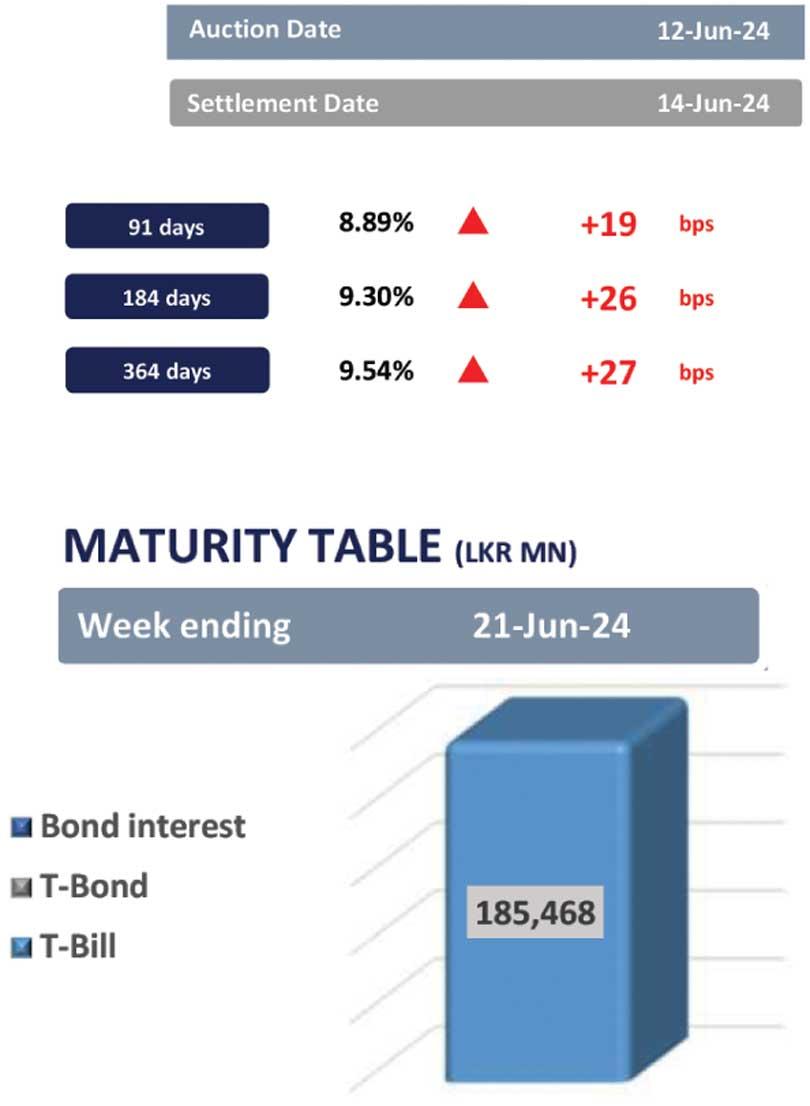

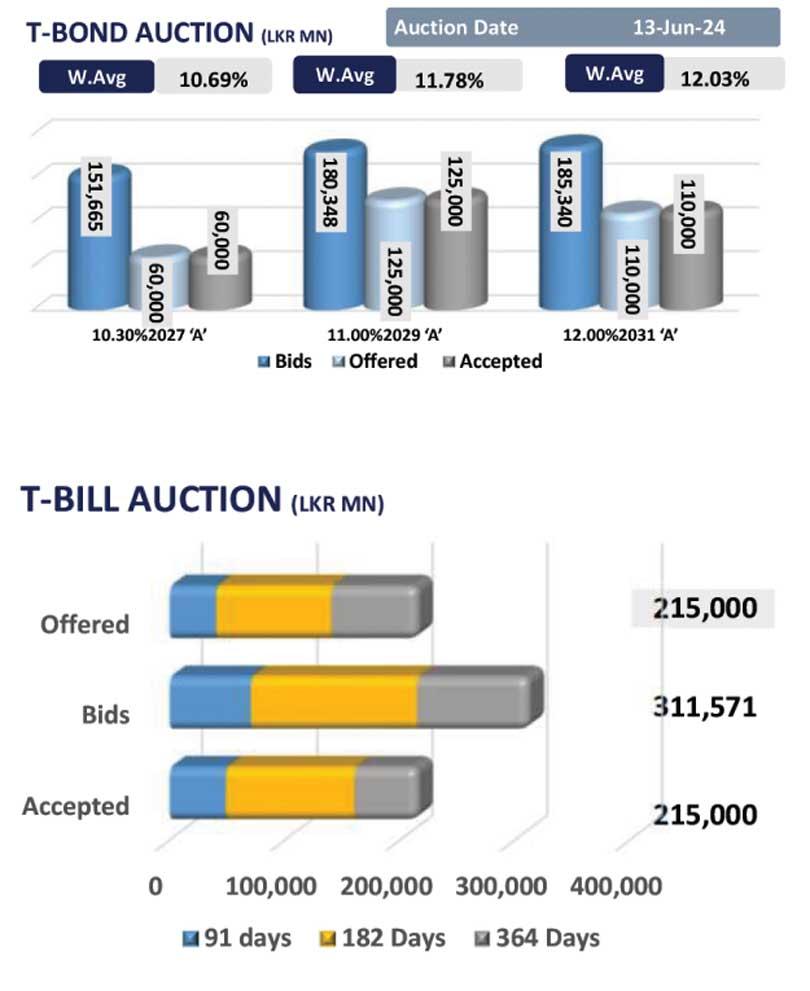

CBSL conducted its biggest auction of the year, offering Rs. 295.0 bn from 15.10.27, 15.09.29 and 01.12.31 tenors, where the total amount offered was fully accepted. Furthermore,15.10.27 was accepted at a weighted average yield of 10.69%, 15.09.29 was accepted at a WAYR of 11.78% alongside 01.12.31 at a WAYR of 12.03%.

There was higher reception across the board where 15.10.27 displayed 2.5 times higher reception than the Rs. 60.0bn offered, whilst 15.09.29 also gained higher reception of 1.4 times (compared to the Rs. 125.0 bn offered) followed by 01.12.31 gaining 1.7 times higher reception compared to the Rs. 110.0 bn offered.

27 Nov 2024 2 hours ago

27 Nov 2024 3 hours ago

27 Nov 2024 4 hours ago

27 Nov 2024 4 hours ago

27 Nov 2024 4 hours ago