25 Mar 2019 - {{hitsCtrl.values.hits}}

Sri Lanka’s banks managed to overcome in what could become a thorny issue on their capital coming from the first time impact of the new accounting standard on loan loss expenses as the companies built up buffers in the run up to the full implementation of BASEL III rules, satisfactory profitability buffers and four-year phasing in period, Fitch Rating said.

In a note issued after analysing the final results of the banks for financial year ended in December 2018, Fitch Ratings said this was in line with their expectations.

Fitch Ratings rate 16 of the local banks and 12 of them have disclosed their day-one impact of the new accounting standard which significantly increases the banks’ loan loss provisions. International Financial Reporting Standards (IFRS 9) or its Sri Lankan equivalent of SLFRS 9 required banks to change their provisioning models from incurred credit loss method to the expected credit loss method.

The expected credit loss method or the ECL is a forward looking approach to measure the possible bad loans and use judgments in broader areas from the macro-economic fundamentals and their possible impact on the bank’s asset quality and the people’s ability to service their loans.The standard which came in to effect on financial periods starting on or after January 1, 2018 gave two options for the first time reporting of the impact from the standard.

Hence the companies could opt for retrospective method which required them to restate prior periods if and only if the restate is possible without the use of hindsight.

Instead the banks could opt for the modified retrospective method which requires the disclosure of the impact of adopting IFRS 9 on the balance sheet and retained earnings showing the restated opening balances as at January 1, 2018. All banks followed the latter which recognised the day -one impact on the retained earnings. From those who have disclosed their day-one impact, Fitch measured their aggregate opening loan loss allowance increasing by Rs.32 billion or 27 percent from 2017 end position.

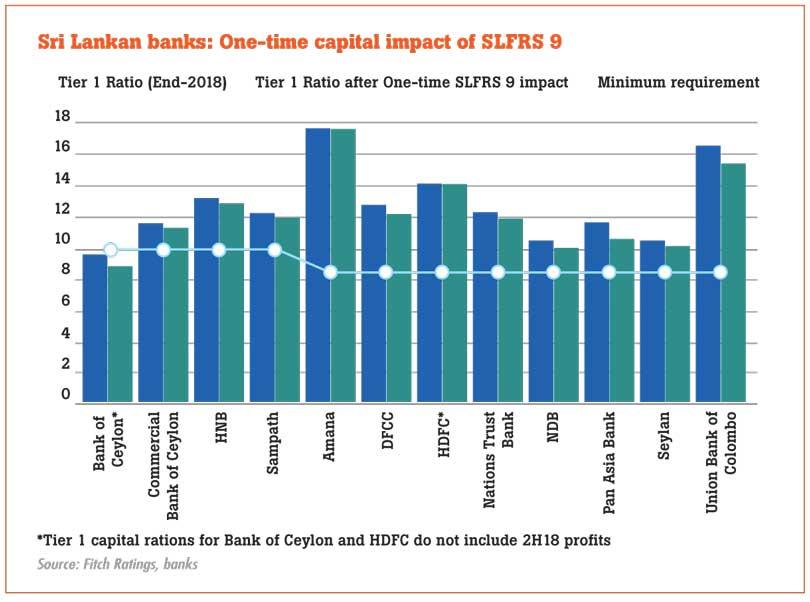

“This translates to a reduction in their regulatory capital ratio of about 50bp-60bp on average. Eleven of the 12 banks could have met the Basel III capital ratio requirements in full at 1 January 2019, even without the permitted capital benefit from deferring the SLFRS 9 impact”, the note from the rating agency stated.

Due to the sheer significance of the day-one impact has on the capital (as retained earnings makes part of equity capital), the Central Bank last year gave the banks a four year time horizon to recognise its impact on the capital on a piecemeal basis.Given the urgency to stay in line or above the BASEL III minimum capital regulations which also came in to full effect from January 1, 2019, the banks were also racing to raise as much as possible capital, both by way of equity and tier II capital. According to Fitch Ratings, the banks raised a mammoth Rs.50 billion in 2017 and Rs.24 billion in 2018 in fresh capital. This has put pressure on the banks’ return on equities and became a damper on the banking sector shares as the investor appetite on the sector waned amid declining shareholder returns and profits lacking vigour.

Meanwhile Fitch Ratings cited Bank of Ceylon as having the highest one time impact from SLFRS 9 among domestic systematically important banks or banks with assets above Rs.500 billion. “The impact of 0.9 percent of risk-weighted assets would have reduced its Tier 1 capital ratio below the 10 percent minimum requirement for D-SIBs, if applied in full to its Fitch-estimated end-2018 capital ratio.

People’s Bank has not yet released its end-2018 financial statement and is therefore not included in the chart. We estimate that the day-one impact of SLFRS 9 may also reduce its Tier 1 ratio to just under 10 percent, based on our analysis of its end-3Q18 disclosures. However, the four-year phase-in should help to keep both BOC and People’s Bank just above the minimum regulatory ratio”, the rating agency added. The rating agency also said the banks would continue its capital raising through 2019 but would face execution risks from the macro-economic instability. The market is scrambling for liquidity and the getting investor support for any new capital could be met with resistance due to poor investor returns.Meanwhile, Fitch Ratings also said the asset quality risks facing the sector had not completely abated.

15 Nov 2024 52 minute ago

15 Nov 2024 2 hours ago

15 Nov 2024 3 hours ago

15 Nov 2024 3 hours ago

15 Nov 2024 3 hours ago