21 Jan 2020 - {{hitsCtrl.values.hits}}

The one-year debt moratorium announced by the government for the small and medium-sized enterprises (SMEs) is credit negative for the Sri Lankan banks and sovereign as it would undermine the banks’ asset quality and may not support the country’s overall economic growth, according to Moody’s Investors Service.

Moody’s, which maintains a B2/stable rating on Sri Lanka, believes that the moratorium could increase SMEs’ risk appetite and relax their attitude towards debt repayments.

SME activity across various sectors accounts for half of Sri Lanka’s gross domestic product (GDP) and employment.

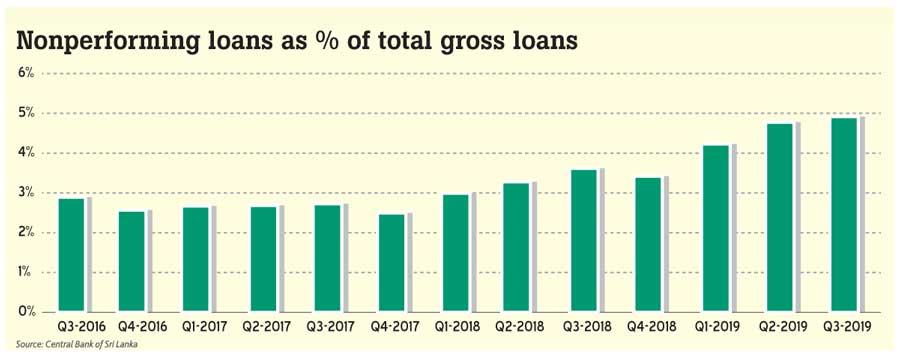

The asset quality of Sri Lankan banks has deteriorated in recent years as a result of a weak domestic economy and excessive loan growth prior to 2017.

“The debt moratorium will help slow the banks’ non-performing loan formation this year but we anticipate an increase in bad debts when the grace period ends, especially if the domestic economic conditions remain weak,” Moody’s said.

The rating agency also said the debt relief is unlikely to lead to sustained acceleration in economic activity similar to the sweeping tax cuts announced by the new government in November, last year.

“We do not expect the SME debt relief package or the broad-based tax cuts to significantly boost demand.

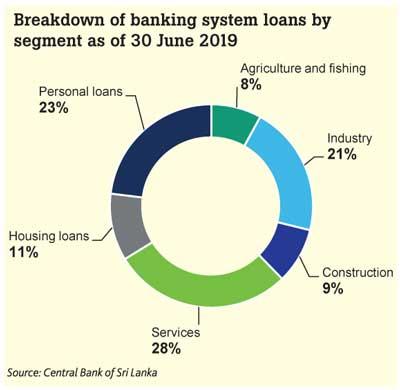

Any short-term boost to economic activity will depend jointly on SMEs’ uptake for working capital support and banks’ additional lending because of the aggregate measures.” SMEs in the manufacturing, services, agriculture and construction sectors (see Exhibit 1) with an annual turnover of Rs.16 million to Rs.750 million and outstanding loans of up to Rs.300 million are eligible to apply for a moratorium on their principal repayments, with a grace period up to a year. The moratorium also applies to SMEs with poor credit bureau records and non-performing loans.

Import credit facilities for items other than machinery and equipment are not included in this moratorium.

Moody’s noted that the scope of this debt moratorium is much wider than last year’s moratorium for the tourism sector, given that the SME loans constitute a significant part of the banking system’s gross loans.

Moody’s said among the Sri Lankan banks it rates, Hatton National Bank and Sampath Bank would be the most affected, given that SME banking is one of their core businesses. Bank of Ceylon (BOC) will be the least affected because its loan book is largely exposed to state-owned enterprises and large local corporates, the rating agency pointed out.

According to the Central Bank’s guidance, the moratorium will not apply to import credit facilities, with the exception of those for machinery and equipment.

As such, Moody’s doesn’t expect most export-oriented SMEs to receive a significant benefit from the relief package because of the weak external environment.

Through the first 11 months of 2019, Sri Lanka’s exports grew just 0.8 percent year-on-year in US dollar terms, a significant deceleration from 5.0 percent in the corresponding period in 2018. Moody’s expects the Sri Lankan economy to recover in 2020 with the gradual strengthening of the tourism sector. The rating agency forecasts Sri Lanka’s real GDP growth to pick up to 3.4 percent this year, from 2.6 percent in 2019.

16 Nov 2024 5 minute ago

16 Nov 2024 37 minute ago

15 Nov 2024 15 Nov 2024

15 Nov 2024 15 Nov 2024

15 Nov 2024 15 Nov 2024