08 Jun 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary market experienced a day of mixed sentiment characterised by limited activity and thin trading volumes.

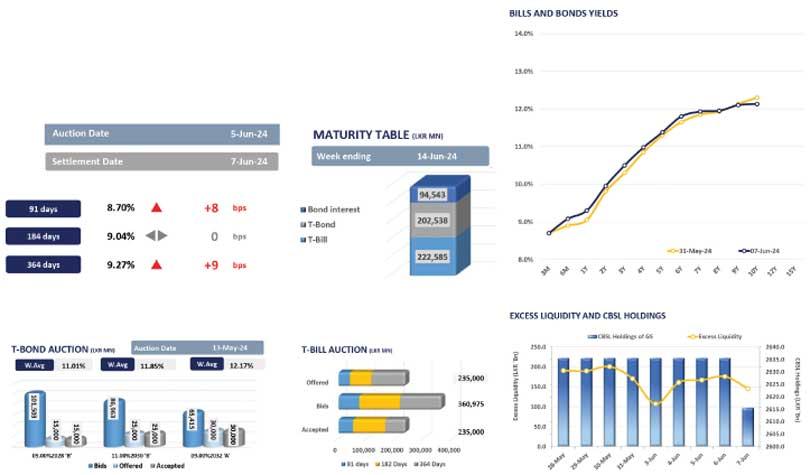

Selling interest was evident in the short to mid-tenure bonds, particularly those maturing in 2026, such as the 01.02.26, 15.05.26 and 15.12.26 maturities, which traded within the range of 9.65 percent and 10.10 percent.

Similarly, the bonds maturing in 2028, including 15.01.28, 15.03.28, 01.05.28, 01.07.28, 01.09.28 and 15.12.28, saw trading within the range of 10.90 percent and 11.10 percent. In contrast, there was a slight uptick in buying interest at the tail end of the curve, with the 01.10.32 maturity, trading at 11.95 percent.

Moreover, the Central Bank announced an issue of Rs.215.0 billion in T-bills through an auction scheduled on June 12, 2024, out of which Rs.40.0 billion is to be raised from the 91-day maturity, Rs.100.0 billion is expected to be raised from the 182-day maturity, whilst another Rs.75.0 billion is to be raised from the 364-day maturity.

Furthermore, the overnight liquidity was recorded at Rs.145.6 billion, whilst the Central Bank holdings decreased to Rs.2,615.6 billion after remaining stagnant at Rs.2,635.6 billion for nearly two weeks.

On the external side, the Sri Lankan rupee continued to depreciate against the US dollar for the second consecutive week, closing at Rs.302.7 during the day.

27 Nov 2024 6 hours ago

27 Nov 2024 7 hours ago

27 Nov 2024 7 hours ago

27 Nov 2024 8 hours ago

27 Nov 2024 8 hours ago