17 May 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

With the persistent selling interest enticed during the past two trading weeks eased off during yesterday’s session, as selling interest resurfaced on the secondary market.

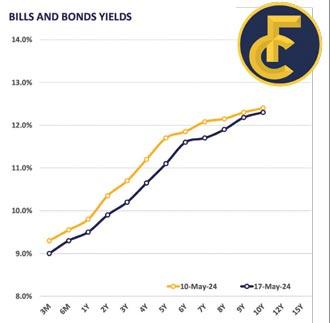

Therefore, selling interest was visible on the more liquid 2028 maturity, as 15.03.28, 01.05.28 and 01.07.28 maturities traded in the range of 10.60% to 10.80%.

Given the steep decline in yields during the past 2 weeks, thin volumes were observed during today’s trading session. Meanwhile, on the external front, LKR kept volatile as LKR slightly appreciated against greenback as CBSL published mid-rate recorded at Rs. 301.31/dollar whilst the LKR recorded an YTD appreciation of 7.0%.

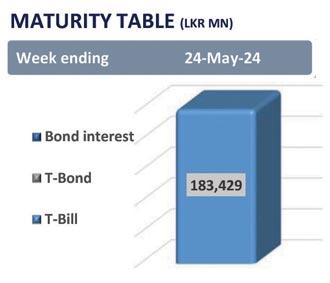

Meanwhile, liquidity in the banking sector continued to improve and recorded at Rs. 151.6bn cf.

Rs. 88.0bn was recorded at Dec-23 end, whilst CBSL Holdings remained stagnant at Rs. 2.7tn.

28 Nov 2024 1 hours ago

28 Nov 2024 2 hours ago

28 Nov 2024 3 hours ago

28 Nov 2024 4 hours ago

28 Nov 2024 4 hours ago