18 Jul 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary market saw a pre-auction buzz with moderate buying interest in short to mid-term maturities, where 01.06.26 and 15.12.27 traded at 10.65 percent and 11.65 percent, respectively.

Meanwhile, four-year tenures, including 15.12.28 and 15.03.28 hovered within the range of 11.75 percent and 11.70 percent, whilst 01.05.28 and 01.07.28 traded in the range of 11.82 percent and 11.80 percent.

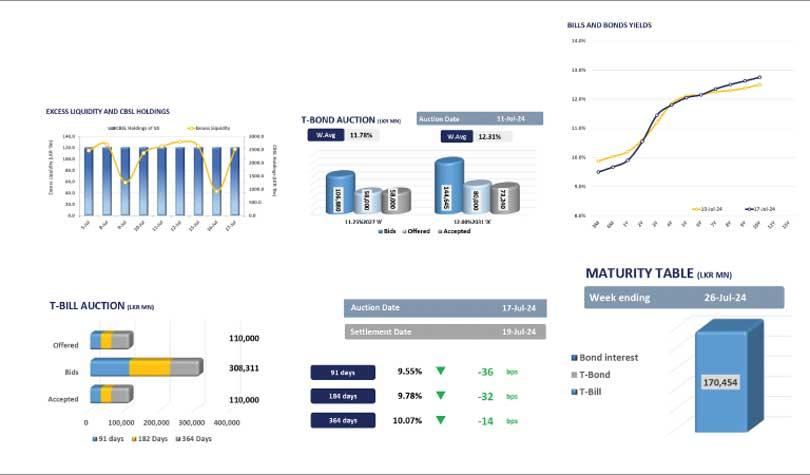

Furthermore, at the weekly T-bill auction held yesterday, the Central Bank fully subscribed to the total offered amount of Rs.110.0 billion, whilst the auction yields experienced a decline across the board for the second consecutive week.

The Central Bank accepted the total offered for the 91-day, 182-day and 364-day maturities, at a WAYRs of 9.55 percent (-36bps), 9.78 percent (-32bps) and 10.07 percent (-14bps), respectively.

Post-auction, the market displayed mixed activity, where at the short-end of the curve, 01.08.26 witnessed buying interest at 10.50 percent, while the mid-term bonds, including 15.09.29 and 01.12.31, traded at 12.05 percent and 12.40 percent, respectively.

Moreover, the overnight liquidity significantly improved to Rs.117.2 billion, from the previous day’s Rs.42.7 billion, whilst the Central Bank holdings remained unchanged at Rs.2,595.6 billion. On the external front, the Sri Lankan rupee depreciated against the US dollar for the first time after six straight sessions of gains, closing at Rs.303.3/USD.

26 Nov 2024 3 hours ago

26 Nov 2024 4 hours ago

26 Nov 2024 5 hours ago

26 Nov 2024 6 hours ago

26 Nov 2024 6 hours ago