31 Jul 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

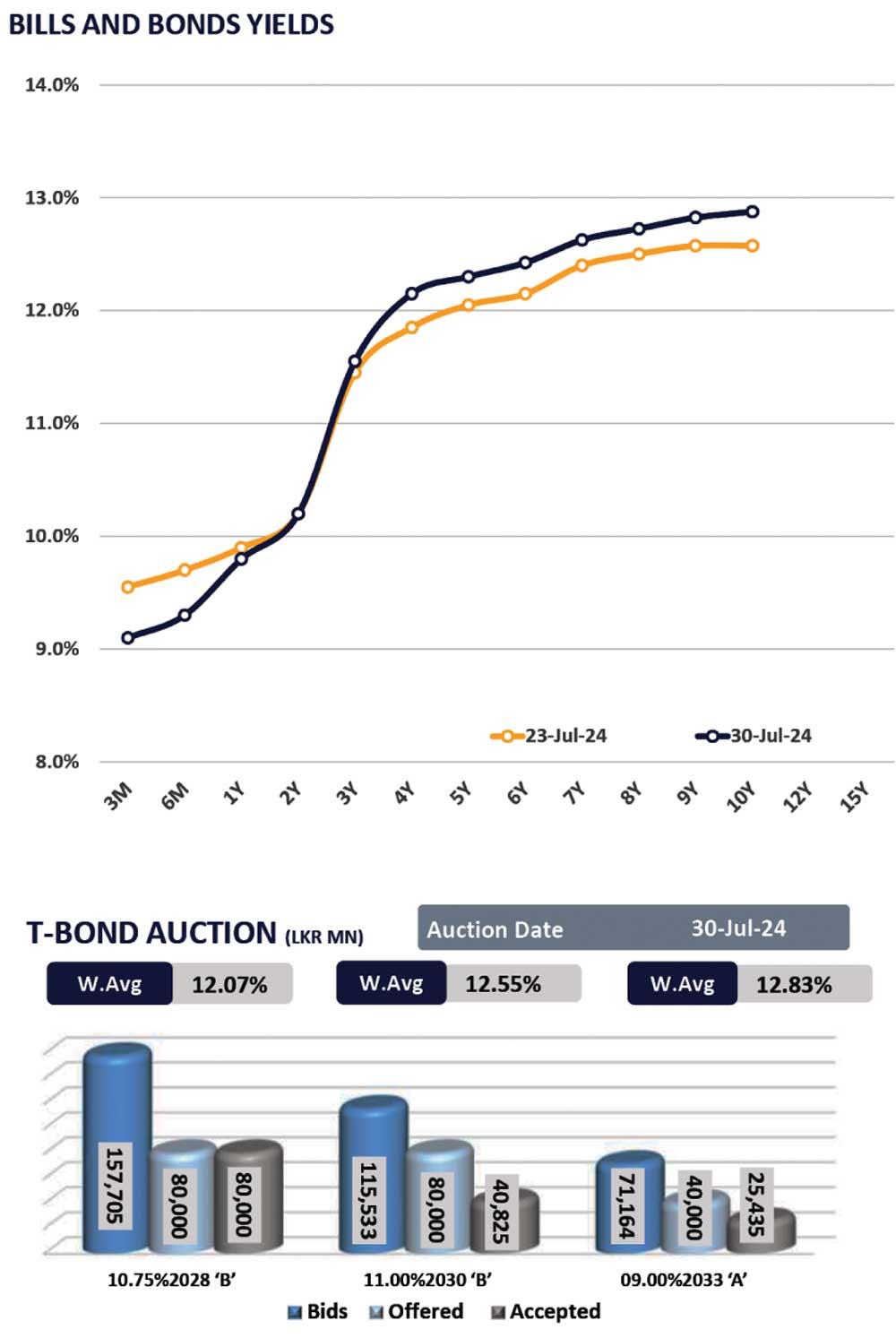

The secondary market witnessed a complete standstill during yesterday as the investors remained on the sidelines longing for the outcome post the Rs. 200.0bn T-Bond auction held yesterday, where auction yields witnessed an incline.

Meanwhile, CBSL held its Rs. 200.0bn T-Bond auction yesterday where only Rs. 146.3bn was accepted. 15.02.28 was accepted at a weighted average yield rate of 12.07% whilst the total offered amount was fully accepted.

However, both 15.10.30 and 01.06.33 maturities were accepted below the amounts offered during the auction as they were accepted at a weighted average yield rate of 12.55% and 12.83%, respectively.

On the external side, LKR appreciated against the USD for the 3rd consecutive day registering Rs. 302.9 during the day. The local currency recorded multiple appreciations against most of the major currencies namely the GBP and EUR, recording at Rs. 389.2 and Rs. 327.6 respectively.

CBSL holdings remained stagnant at Rs. 2,575.6bn whilst overnight liquidity in the banking system declined to Rs. 40.6bn from Rs. 107.2bn recorded during the previous day.

26 Nov 2024 26 minute ago

26 Nov 2024 53 minute ago

26 Nov 2024 59 minute ago

26 Nov 2024 2 hours ago

26 Nov 2024 2 hours ago