20 Jun 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

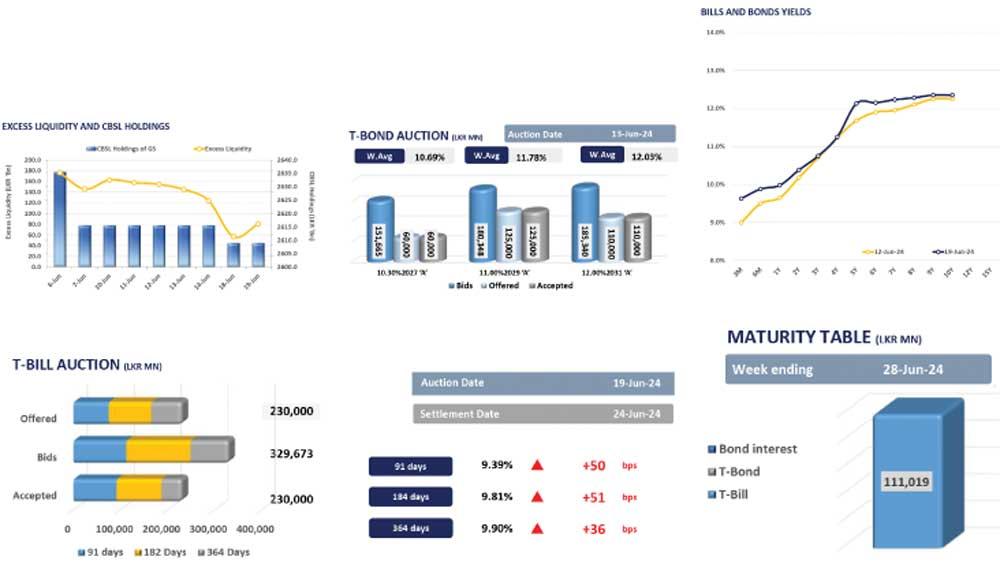

The Central Bank conducted the weekly T-bill auction yesterday, raising Rs.230.0 billion and accepted the total offered while the weighted average yield rates saw a rise across the board for the third straight week.

Accordingly, the three-month and six-month bills edged higher by 50 basis points (bps) and 51bps to close at 9.39 percent and 9.81 percent, respectively while the one-year bill nudged up by 36bps to 9.90 percent.

Moreover, the three-month and six-month bills enticed an oversubscription amidst higher reception whilst the one-year bill was undersubscribed at yesterday’s auction.

Following the outcome of the bill auction, the secondary market participants displayed a complete standstill.

However, during the day, slight selling interest emerged on the short end of the curve, predominantly on 2026 maturity. Accordingly, 01.06.2026, 01.08.2026 and 15.12.2026 hovered between 10.25 percent and 10.45 percent. Moreover, the 15.09.2029 maturity observed trades between 11.90 percent and 12.03 percent during the day.

Meanwhile, overnight liquidity improved slightly to Rs.80.8 billion today, after falling below Rs.60.0 billion levels yesterday, recoding nearly three months low. Furthermore, on the external front, the rupee continued to depreciate against the greenback, closing at Rs.304.5.

27 Nov 2024 1 hours ago

27 Nov 2024 3 hours ago

27 Nov 2024 4 hours ago

27 Nov 2024 4 hours ago

27 Nov 2024 4 hours ago