07 May 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

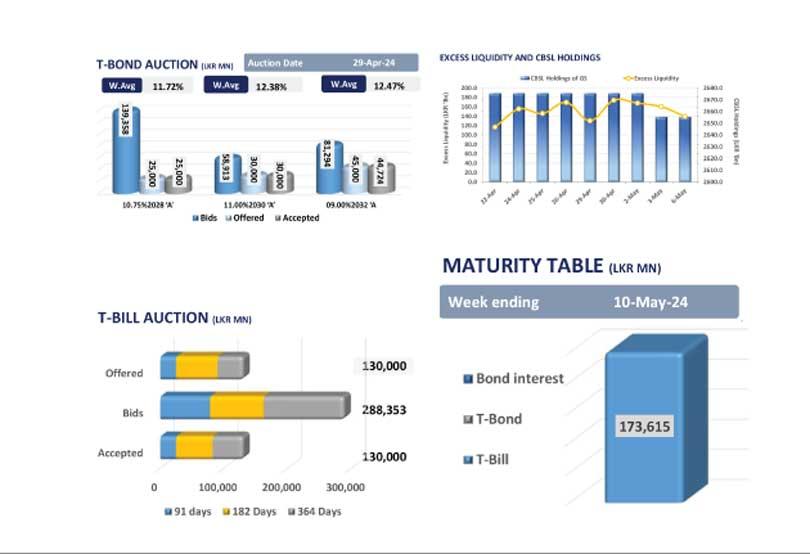

The secondary market continues to observe buying interest amidst moderate volumes, pushing down the rates across the yield curve.

Thus, the buying interest was enticed on 15.05.26, 01.06.26 and 15.12.26 between 10.70 percent and 10.50 percent, whilst the 01.05.27 and 15.09.27 maturities traded between 11.07 percent and 10.95 percent.

Moreover, mixed activities were seen on the 15.03.28 and 01.07.28 maturities between 11.45 percent and 11.58 percent whilst the buying interest re-emerged on the tail-end of the curve on the 01.10.32 maturity, which traded between 12.31 percent and 12.25 percent during the day.

Meanwhile, on the external front, the Sri Lankan rupee depreciated against the greenback, as the Central Bank mid-rate recorded at Rs.297.13 whilst the Central Bank US dollar purchases for March 2024 were recorded at US $ 715.1 million cf. US $ 248.5 million in February 2024 and US $ 451.5 million in March 2023.

Moreover, the Central Bank-published weekly AWPR slightly inclined to 10.15 percent, from previous week’s 10.13 percent whilst the overnight liquidity in the banking system continues to improve and remain less volatile at Rs.139.3 billion.

28 Nov 2024 2 hours ago

28 Nov 2024 3 hours ago

28 Nov 2024 4 hours ago

28 Nov 2024 5 hours ago

28 Nov 2024 7 hours ago