12 Mar 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary market remained stagnant, as market activity came to a standstill with no trade occurring during the day.

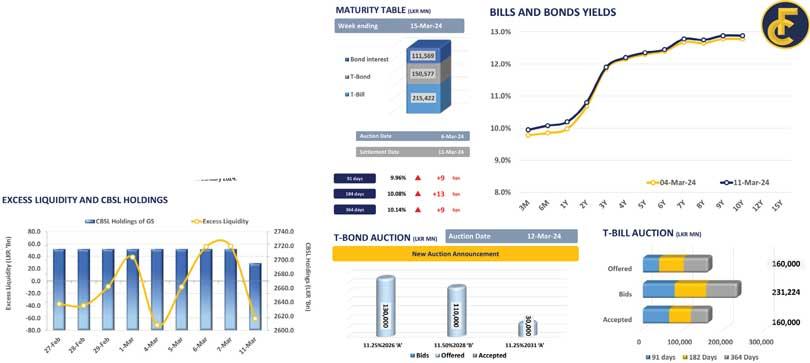

The investors adopted a cautious ‘wait and see’ approach, ahead of the Rs.270.0 billion T-bond auction scheduled for March 12, 2024.

The Central Bank announced the largest value issue of T-bonds through an auction, where Rs.130.0 billion, Rs.110.0 billion and Rs.30.0 billion are to be issued under 15.12.26, 15.12.28 and 15.03.31 maturities, respectively.

Moreover, the Central Bank announced an issue of Rs.180.0 billion T-bills through an auction to be held on March 13, 2024, out of which Rs.50.0 billion is to be raised from the 91-day maturity, Rs.75.0 billion is expected to be raised from the 182-day maturity while Rs.55.0 billion is to be raised from the 364-day maturity. Meanwhile, in the forex market, the Sri Lankan rupee continued to appreciate against the US dollar and stood at Rs.307.6 during the day.

Meanwhile, the AWPR continued its downtrend, as it shed seven basis points, closing at 11.35 percent for the week ending on March 7, 2024. Moreover, foreign holdings in government securities increased by 2.6 percent week-on-week and registered at Rs.96.0 billion as of March 7, 2024.

Furthermore, foreign reserves inched up by US $ 21.0 million to US $ 4,517.0 million in February 2024, from US $ 4,496.0 million in January 2024.

29 Nov 2024 8 hours ago

29 Nov 2024 9 hours ago

29 Nov 2024 29 Nov 2024

29 Nov 2024 29 Nov 2024

29 Nov 2024 29 Nov 2024