19 Jul 2021 - {{hitsCtrl.values.hits}}

COVID-19 upended the balance sheets of many countries in the Asia Pacific (APAC) region with rising public debt relative to the size of their economies, but the situation became more pronounced in Sri Lanka as the country entered the pandemic with an already high debt stock, according to Fitch Ratings.

Governments around the world had to provide unprecedented level of monetary and fiscal support to fight the virus and to mitigate its impact on people and livelihoods by way of stimulus and moratoria.

Sri Lanka also had to increase its spending, and in the process the government debt relatively to the country’s economy’s size rose substantially. Most of such moneys came through liquidity injections or what is commonly known money printing.

According to the latest data available through April 2021, total outstanding government debt stock was at Rs.16.3 trillion compared to Rs.15.1 trillion at the end of 2020. The debt stock denominated in foreign currency was at Rs.6.6 trillion.

By February 2020, the month before the virus found its way into Sri Lanka this debt stock was Rs.13.2 trillion of which Rs.6.4 trillion was denominated in foreign currency.

Given the magnitude of the economic destruction caused by the virus, Sri Lanka has added only Rs.3.0 trillion in fresh debt, and most notably the foreign debt stock remained virtually unchanged.

This is amid substantial fall in State revenues as tax generating businesses and consumer activities were dormant through most of this period while the economic output contracted, making the debt stock appear larger than it otherwise would have been.

Sri Lankan economy contracted by 3.6 percent in 2020 making the debt stock look even larger in relative terms.

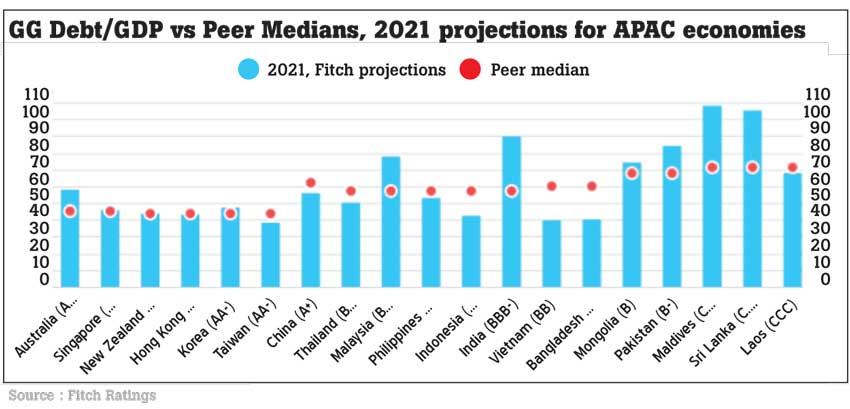

“Among the few APAC sovereigns where GG debt/GDP was already high relative to peers prior to the pandemic, the differential has widened in India and more significantly in Sri Lanka, but narrowed in Malaysia and more substantially in Pakistan,” Fitch Ratings said in a note titled, ‘Pandemic Debt Impact Varies Widely Across APAC Sovereigns’.

According to the rating agency’s projections, Sri Lanka’s General Government Debt (GG Debt) to Gross Domestic Product (GDP) is estimated to rise between 100 percent to 110 percent in 2021 compared to the peer median of around 70 percent and second only to Maldives whose credit rating was lowered to CCC from B+ in 2019.

Domestic debt or liquidity is less of a concern than the foreign liquidity, at least until the economy makes up for the slack because a humming economy would generate enough revenues to bring the domestic liquidity stock down gradually which could alleviate the price pressures which could clip up from excessively high amount of money.

18 Nov 2024 4 hours ago

18 Nov 2024 5 hours ago

18 Nov 2024 5 hours ago

18 Nov 2024 6 hours ago

18 Nov 2024 18 Nov 2024