17 May 2021 - {{hitsCtrl.values.hits}}

BLOOMBERG: Sri Lankan government debt is leading gains in Asian dollar bonds this year as investors bet that the nation will avoid defaulting on its short-term notes, with the help of a Chinese funding facility.

Italian investment manager AcomeA SGR S.p.A., which added to its holdings of the nation’s debt securities last quarter, sees the bonds as continuing to offer attractive yields, even if most of the gains have already been made.

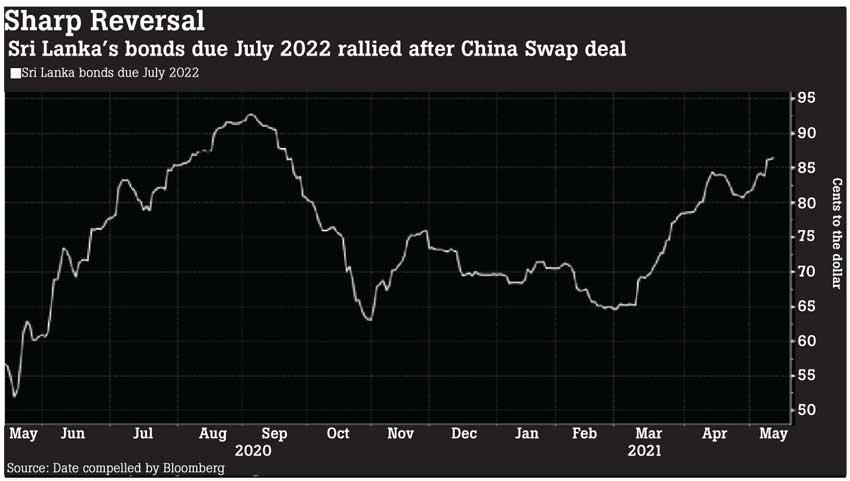

The Sri Lankan notes have returned 15 percent this quarter, extending year-to-date gains to 25 percent, the best performance for any Asian nation’s U.S. currency debt in 2021, a Bloomberg Barclays index shows. They lost 31 percent last year, the worst showing in the region.

Sri Lanka received US$ 1.5 billion currency swap line from China in March that eased fears over the government’s ability to pay its debt after having been cut deeper into junk in 2020 by S&P Global Ratings and Moody’s Investors Service. The nation, which is struggling with a resurgence in Covid-19 cases that threatens its tourism industry, has at least US$ 2.5 billion of dollar notes maturing before the end of July 2022, including US$1 billion bond due in a little over two months.

The yield on that debt security is indicated around 16 percent, while a July 2022 note offers 20 percent, according to data compiled by Bloomberg.

“Given the latest improvement in the short-term liquidity conditions, we prefer to hold the shorter-end tenors,” said PieroCingari, fixed-income strategist in Milan, who helps manage 2.9 billion euros (US$ 3.5 billion) of assets at AcomeA.

19 Nov 2024 54 minute ago

19 Nov 2024 1 hours ago

19 Nov 2024 2 hours ago

19 Nov 2024 2 hours ago

19 Nov 2024 3 hours ago