02 May 2022 - {{hitsCtrl.values.hits}}

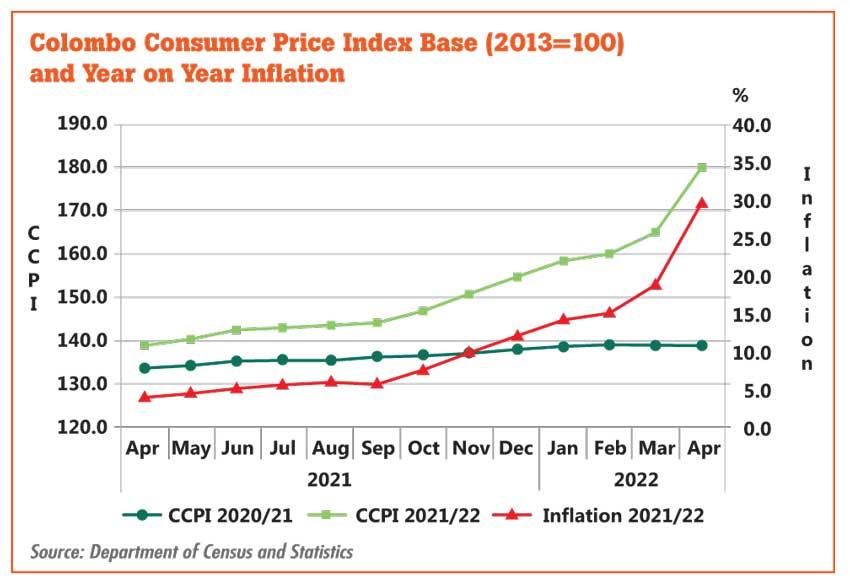

The consumer prices in the Colombo district rose 29.8 percent in April over the same month in 2021, logging the highest ever inflation recorded as prices received a jolt from the botched currency float, which caused multifold increases in prices of all commodities and services in a matter of days and weeks.

This was a sharp acceleration from the 18.7 percent inflation recorded for March.

The previous highest inflation rate was 28.2 percent in June 2008, just about a year before the nearly 30-year war came to a close.

But today’s all-time high inflation is a reflection of how hotter the prices of everyday essentials are and thereby the severe hardships the public across social strata are

going through.

The absence of previous precedence in inflation numbers also reflects the absence of historical parallels to the current economic crisis in Sri Lanka, which is now causing havoc in people’s lives, as they are now confronted with the harsh reality of living for decades, spending more than they earned and consuming more than they produced thanks to a wide range of subsidies.

According to some economic analysts, current prices reflect the true cost of goods, as the government cannot afford to give subsidies anymore and hold the value of the currency artificially.

The data for April showed that monthly prices measured by the Colombo Consumer Price Index(CCPI) had climbed 9.3 percent, more than thrice the 3.0 percent increment seen in March as producers and suppliers delivered multiple price increases in their products and services as the rupee went into a free fall.

The rupee had shed nearly 70 percent of its value against the United States dollar after the currency was floated on March 7 revising sticker prices of all commodities multiple times in line with the weakening rupee.

But, Central Bank Governor Dr. Nandalal Weerasinghe said the rupee is now overvalued and sees scope for easing although he doesn’t provide timelines or a range of values where the rupee could be in the next couple of months.

The food inflation was the hottest in April as such prices climbed 46.6 percent annually and 12.5 percent monthly. The non-food inflation surged 22.0 percent from a year ago, while the monthly prices also logged a step increase of 7.6 percent from 3.6 percent in the earlier month, largely due to back-to-back price increases in petroleum products and resultant higher transport costs.

Meanwhile, the so-called core-prices measured barring often-volatile items such as food, energy and transport, rose by 22 percent from a year ago, accelerating from 13 percent in March, while the monthly prices climbed nearly four times to 8.2 percent from 2.4 percent a month earlier.

Sri Lanka has effectively entered into a hyper inflationary environment where the prices nearly double every month but things could start cooling down when the demand in the economy slows down.

But, a debate is raging among sections of economists as to whether the demand destruction is the right way to tame inflation at a time when most price pressures come from the supply side.

15 Nov 2024 12 minute ago

15 Nov 2024 39 minute ago

15 Nov 2024 1 hours ago

15 Nov 2024 1 hours ago

15 Nov 2024 2 hours ago