13 Nov 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

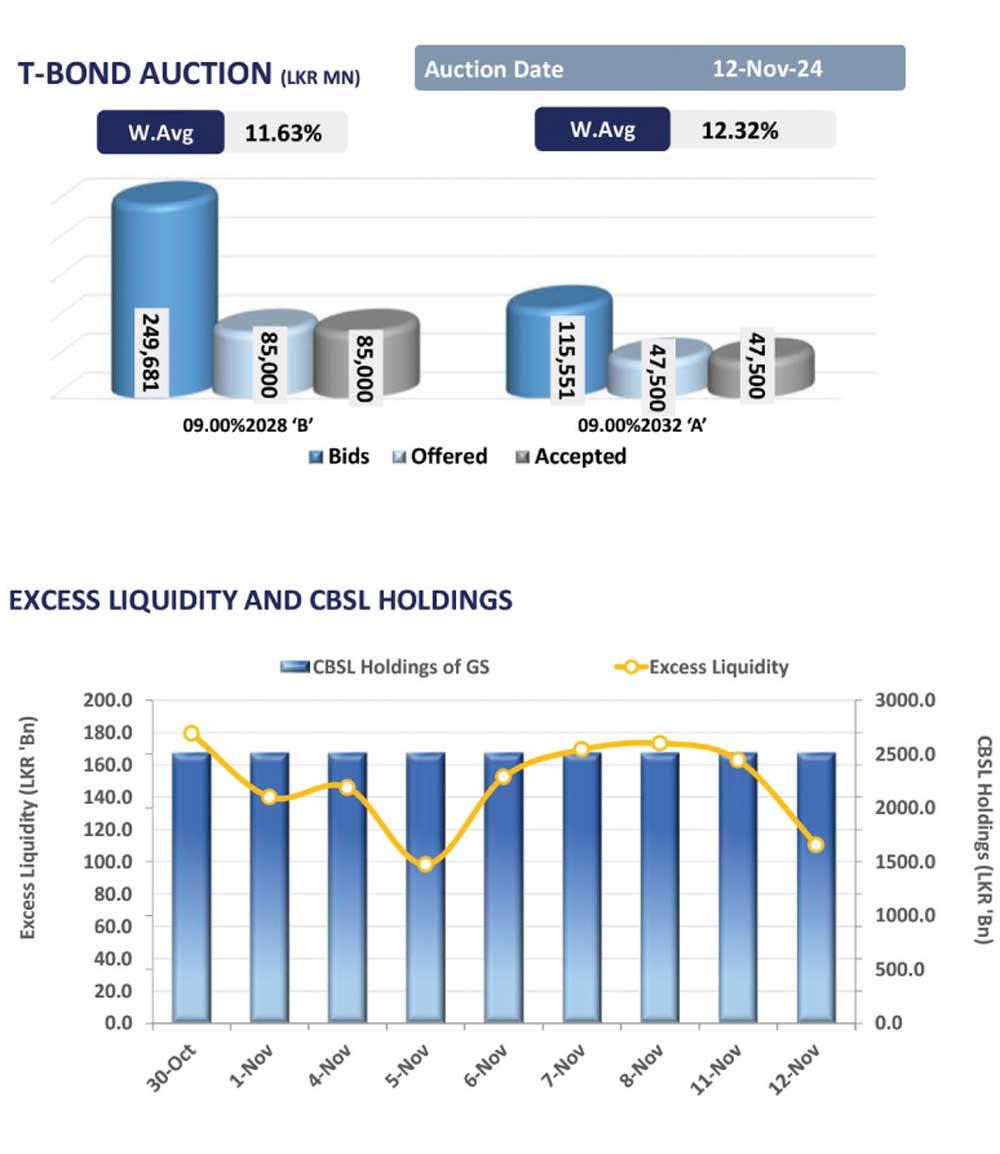

Yesterday’s T-Bond auction raised Rs. 132.5bn, yielding full acceptance across both maturities offered. The 01.05.2028 bond closed at a weighted average yield rate of 11.63%, whilst the 01.10.2032 bond closed at a yield rate of 12.32%. Meanwhile, CBSL aims to raise Rs. 147.5bn in today’s weekly T-Bill auction.

Yesterday’s T-Bond auction raised Rs. 132.5bn, yielding full acceptance across both maturities offered. The 01.05.2028 bond closed at a weighted average yield rate of 11.63%, whilst the 01.10.2032 bond closed at a yield rate of 12.32%. Meanwhile, CBSL aims to raise Rs. 147.5bn in today’s weekly T-Bill auction.

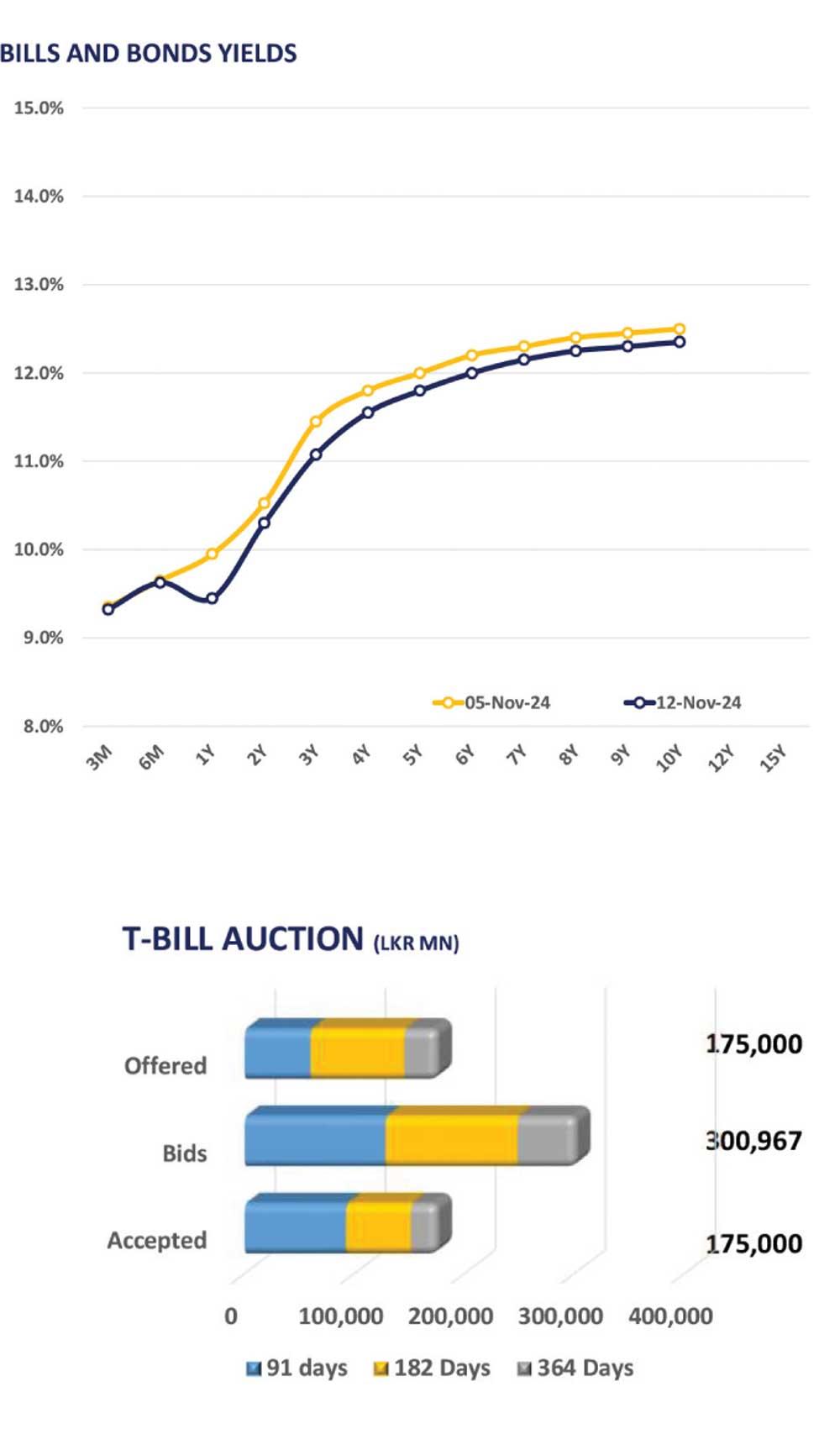

Following the T-bond auction, the secondary market witnessed heavy buying interest driven by both foreign and local demand, leading to higher trading volumes and increased activities, particularly across the mid-long end of the curve. On the mid-end of the curve, 2027 maturities including 01.05.27, 15.09.27, and 15.12.27 traded in the range of 11.30%-11.00%. Meanwhile, 2028 maturities including 15.01.28, 15.02.28, and 15.03.28 traded between 11.50%-11.25%, whilst 01.05.28, 15.10.28, 15.12.28 hovered in the range of 11.60%-11.45%. Moreover, 2029 maturities including 15.06.29 and 15.09.29 saw trades within the 11.95%-11.75% range.

Additionally, towards the long-end of the curve, 15.05.30 traded at 12.10%, whilst the auction bond for01.10.32 traded between 12.35%-12.20%, and 01.06.33 traded within 12.30%-12.25%.

Furthermore, CBSL holdings remained stagnant at Rs. 2,515.6bn, and in the forex market, the LKR continued to appreciate against the USD for the 4th consecutive session, closing at Rs. 292.6 for the day.

25 Dec 2024 3 hours ago

25 Dec 2024 3 hours ago

25 Dec 2024 4 hours ago

25 Dec 2024 5 hours ago

25 Dec 2024 6 hours ago