12 Dec 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

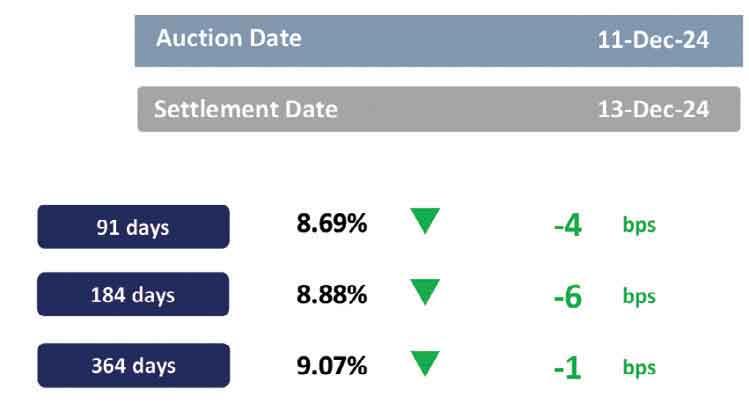

The Central Bank conducted the weekly T-bill auction yesterday, raising Rs.206.0 billion and fully accepting the total offered amount. All three maturities experienced oversubscriptions at yesterday’s T-bill auction, with total bids exceeding the total offered amount by 2.3 times. Meanwhile, the weighted average yield rates saw a slight downturn across the board, where three-month T-bill, six-month T-bill and one-year T-bill, experienced declines of 4bps, 6bps and 1bps, respectively.

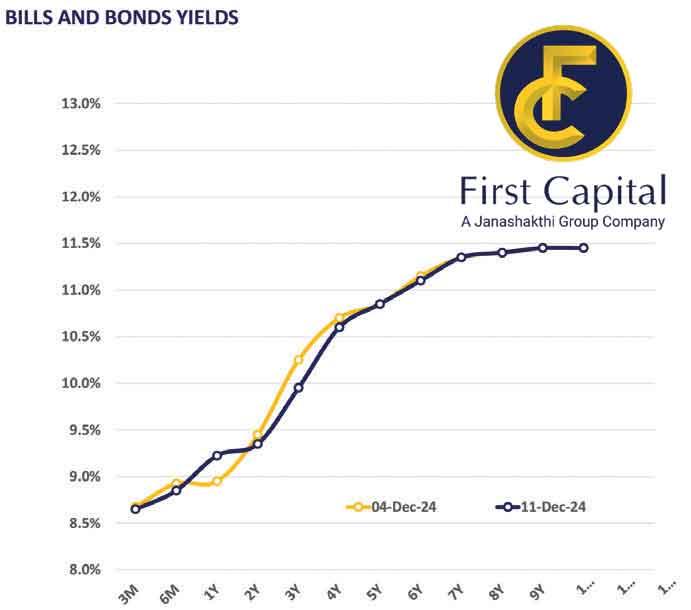

In the secondary market, market participants maintained bullish momentum prior to the T-bond auction due today. As a result, the secondary market saw continued buying interest throughout the trading day, generating moderate volumes. Amongst the traded maturities, notable trades occurred in the 2027, 2028, 2029, 2030 and 2031 maturities. On the short end of the curve, 01.05.27, 01.09.27 and 15.12.27 maturities traded between 9.85 percent to 10.00 percent. On the mid-end of the curve, 15.02.28 and 15.03.28 traded at 10.30 percent whilst 01.05.28, 01.07.28, 15.10.28 maturities traded at 10.36 percent, 10.45 percent and 10.55 percent, respectively. The 15.09.29 maturity traded at 10.85 percent. Meanwhile, the 15.05.30, 15.10.30 and 15.03.31 traded at the rates of 11.05 percent, 11.10 percent and 11.30 percent, respectively.

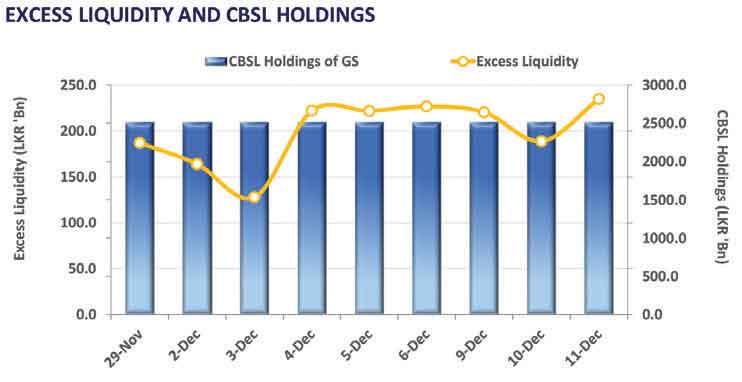

On the external front, the Sri Lankan rupee appreciated against the US dollar, closing at Rs.290.31/US dollar, compared to Rs.290.36/US dollar recorded the previous day. The Central Bank holdings of government securities remained unchanged, closing at Rs.2,515.62 billion yesterday. Overnight liquidity in the banking system increased to Rs.234.79 billion, from Rs.188.91 billion recorded the previous day.

22 Dec 2024 2 hours ago

22 Dec 2024 3 hours ago

22 Dec 2024 5 hours ago

22 Dec 2024 5 hours ago

22 Dec 2024 5 hours ago