24 Oct 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

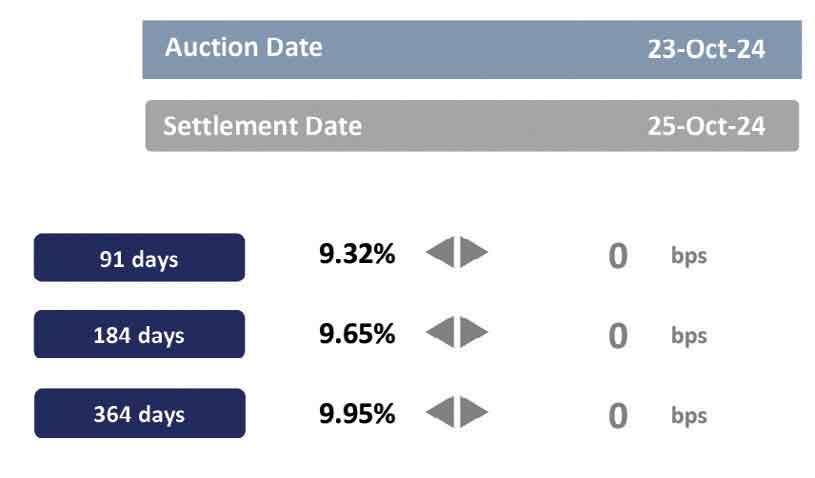

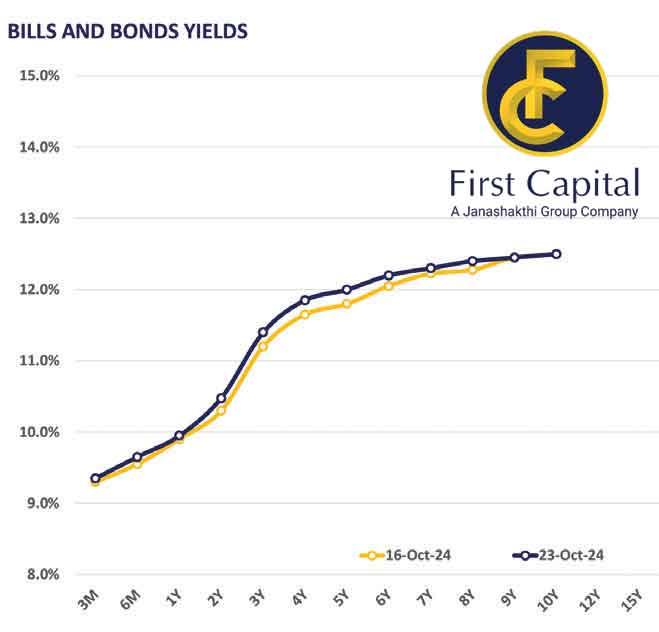

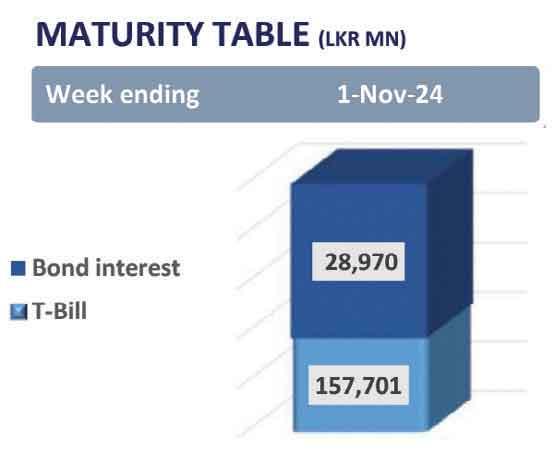

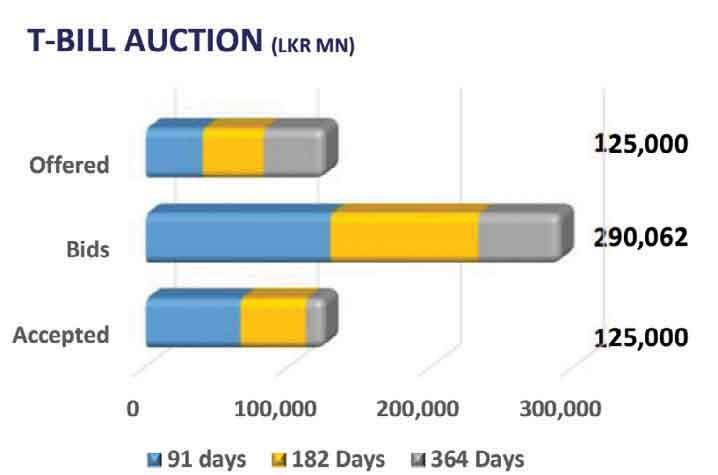

The secondary market yield curve remained broadly unchanged during the day, reflecting a mixed sentiment while generating moderate trading volumes. In the short end of the curve, the 15.09.27 and 15.12.27 maturities were traded in the range of 11.35 percent-11.45 percent. On the mid end, 15.02.28, 15.03.28 and 01.07.28 saw trades between 11.70 percent-11.85 percent. Meanwhile, on the long end, the 15.05.30 maturity was observed trading between 12.15 percent-12.20 percent, respectively. In the primary market, following four consecutive declines in yields, stability was noted across the board during yesterday’s T-bill auction. The total offered T-bill amount of Rs.125.0 billion was fully accepted, with 53 percent being accepted from the three-month T-bill. Moreover, the weighted average yields of the three-month, six-month and one-year T-bills remained stable at 9.32 percent, 9.65 percent and 9.95 percent, respectively. Meanwhile, the Central Bank announced the issuance of Rs.32.5 billion worth of T-bonds through an auction scheduled for October 28, 2024. This issuance includes Rs.20.0 billion and 12.5 billion to be issued under the maturities of 15.10.28 and 01.06.33, respectively. On the external side, the Sri Lankan rupee depreciated against the greenback closing at Rs.293.3. Meanwhile, overnight liquidity recorded at Rs.144.1 billion while the Central Bank holdings remained unchanged at Rs.2,515.6 billion.

28 Dec 2024 1 hours ago

28 Dec 2024 3 hours ago

28 Dec 2024 3 hours ago

28 Dec 2024 4 hours ago