14 Aug 2020 - {{hitsCtrl.values.hits}}

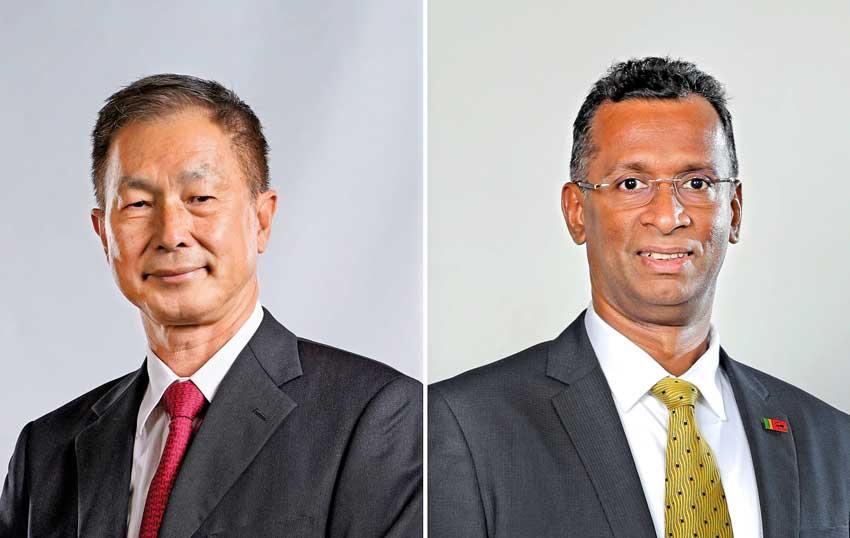

Chairman Bill Lam (left) and CEO Pubudu De Silva

Teejay Lanka PLC has reported operating profit of Rs. 15.2 million and profit before tax of Rs. 13.9 million for the first quarter of 2020-21, but posted a net loss of Rs.31.5 million – its first since being listed on the Colombo Stock Exchange (CSE) – directly as a result of the loss of production and orders due to COVID-19 pandemic.

In a filing with the CSE, Teeja Lanka, which has manufacturing operations in Sri Lanka and India said, revenue for the three months ending June 30, 2020 at Rs. 4.7 billion reflected a reduction of 42 percent year-on-year. Group gross profit reduced by 73 percent YoY to Rs. 256 million but administrative expenses, although 31 percent lower than in the corresponding period of last year, totalled Rs.262.8 million for the quarter, resulting in profit before tax falling by 98 percent YoY.

Consequently, the group posted a net loss of Rs 31.5 million for the three months under review, as against a net profit of Rs. 453.6 million in the first quarter of 2019-20.

The Teejay group posted net profit of Rs. 2.4 billion for the full year of 2019-20, but revenue and net profit for final quarter of the year declined by 21 percent and 30 percent due to the suspension of both production and sales in March 2020.

Teejay Lanka Chairman Bill Lam disclosed that in addition to the under-utilisation of capacity Teejay had received updates from customers of order pushbacks as well as credit extensions in the period under review. “To meet these trying times, the team negotiated with suppliers to extend the credit period applicable to customers and went on a cost-cutting drive. This included a number of situational cost reduction projects such as salary reductions and freezing of new capital expenditure. These were some of the stringent measures to stabilise the ship in one of the biggest storms this company has had to face in its 20-year history,” he said.

Teejay Lanka CEO Pubudu De Silva said the group was agile enough to introduce new fabrics for the manufacture of personal protection equipment (PPE). “In addition, Teejay is working on new business opportunities including new customers and new product lines of defensive fabrics to meet customer demands relating to post COVID-19 requirements,” he said. “As a result of the team’s speed in setting up COVID-19 prevention processes, our operations in Sri Lanka got underway by mid-May, and our highly mechanised plants in Sri Lanka were capable of producing the same capacity as pre-COVID-19 levels by the end of May 2020,” he added.

De Silva also revealed that reduction of reliance on a single destination for fabric has become high on the agenda of many customers who are now looking for diverse locations to source their fabric requirements. As a result, the last month of the quarter under review saw a significantly better performance than the first two months and this trend is expected to continue into the second quarter, generating a stronger order book compared to that of the first quarter.

Brandix Lanka Limited owns 33.08 percent of the issued shares of Teejay Lanka while Pacific Textured Jersey Holdings Limited has 27.91 stake being the second largest shareholder of the firm.

18 Nov 2024 24 minute ago

18 Nov 2024 29 minute ago

18 Nov 2024 35 minute ago

18 Nov 2024 1 hours ago

18 Nov 2024 1 hours ago