31 Aug 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

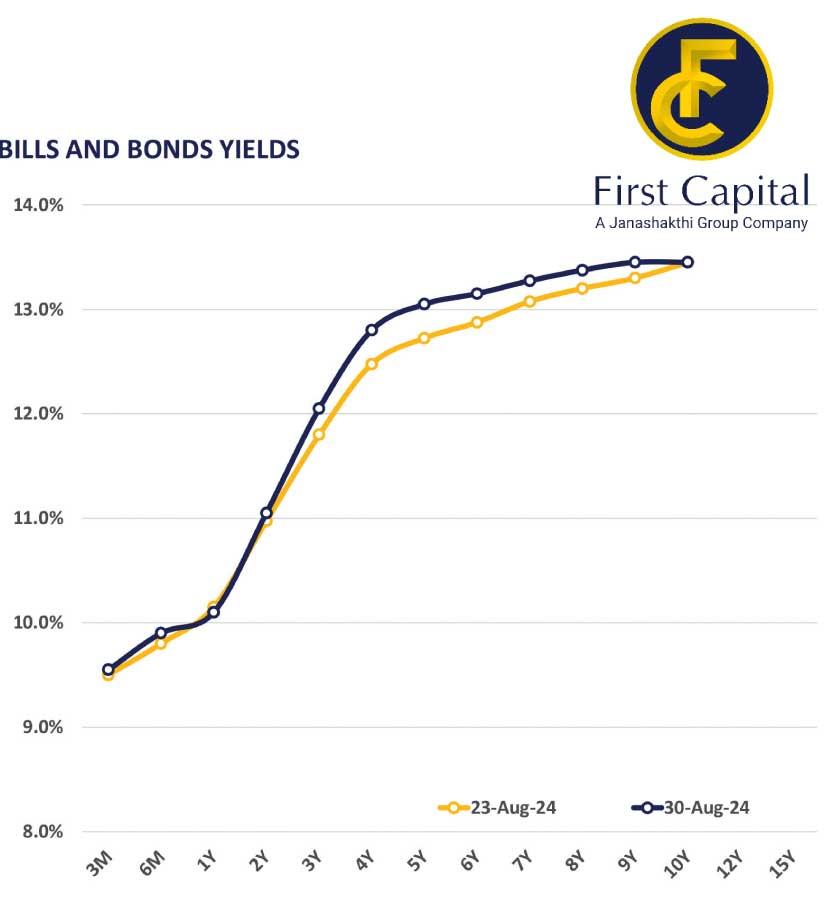

The secondary market yield curve experienced limited activities and thin trading volumes during the day. The market experienced a slight uptick in yields amidst selling pressure across the mid-end of the yield curve.

However, trading volumes remained low in the presence of political uncertainty as investors adopted a cautious approach. Notable trades were on the belly end of the yield curve, primarily amongst the 2028 maturities. On the short end of the curve, 15.12.27 traded at a rate of 12.10 percent. On the belly end of the curve, 15.02.28, 15.03.28 and 15.12.28 traded at rates of 12.60 percent, 12.65 percent and 12.95 percent, respectively. Similarly, 15.09.29 traded at a rate of 13.10 percent. Meanwhile, on the long end of the curve, 01.10.32 traded at a rate of 13.30 percent. On the external front, the Colombo Consumer Price Index (CCPI) fell to 0.50 percent in August, from 2.40 percent year-on-year in the previous month.

The Sri Lankan rupee appreciated slightly against the US dollar, closing at 300.33/US dollar, compared to 300.68/US dollar recorded the previous day.

Similarly, the Sri Lankan rupee also appreciated against the GB pound, closing at 395.34/GB pound, compared to 396.98/GB pound recorded the previous day. Meanwhile, the Central Bank holdings of government securities remained unchanged at Rs.2,555.62 billion yesterday. Overnight liquidity in the banking system expanded to Rs.111.04 billion, from Rs.102.69 billion recorded the previous day.

25 Nov 2024 8 minute ago

25 Nov 2024 2 hours ago

25 Nov 2024 3 hours ago

25 Nov 2024 3 hours ago

25 Nov 2024 3 hours ago