24 Sep 2019 - {{hitsCtrl.values.hits}}

(London) AFP: British travel group Thomas Cook yesterday declared bankruptcy after failing to reach a last-ditch rescue deal, triggering the UK’s biggest repatriation since World War II to bring back tens of thousands of stranded passengers.

The 178-year-old operator, which had struggled against fierce online competition for some time and which had blamed Brexit uncertainty for a recent drop in bookings, was desperately seeking £200 million (US $ 250 million, 227 million euros) from private investors to avert collapse.

The news leaves some 600,000 tourists stranded worldwide according to Thomas Cook, including more than 150,000 holidaymakers seeking help from the British government to return from destinations including Bulgaria, Cuba, Turkey

and the United States.

Earlier, in a statement published just after 0100 GMT, Thomas Cook said that “despite considerable efforts”, it was unable to reach an agreement between the company’s stakeholders and proposed new money providers.

“The company’s board has therefore concluded that it had no choice but to take steps to enter into compulsory liquidation with immediate effect,” it added.

The UK government said it had hired planes to fly home British tourists, in an operation starting immediately.

Launching Britain’s “largest repatriation in peacetime history”, Transport Secretary Grant Shapps added that the government and UK Civil Aviation Authority had hired dozens of charter planes to fly home Thomas Cook customers.

“All customers currently abroad with Thomas Cook who are booked to return to the UK over the next two weeks will be brought home as close as possible to their booked return date,” the government said.

Both a tour operator and an airline, the travel giant’s key destinations were in Southern Europe and the Mediterranean but it offered also holidays in Asia, North Africa and the Caribbean.

Thomas Cook Chief Executive Peter Fankhauser called it a “deeply sad day”, with thousands of jobs lost.

“It is a matter of profound regret to me and the rest of the board that we were not successful,” he said.

“This marks a deeply sad day for the company, which pioneered package holidays and made travel possible for millions of people around the world,” he added in the group’s statement.

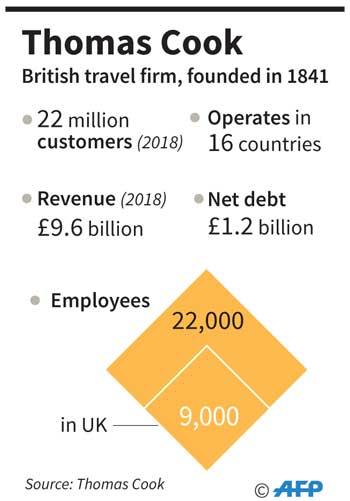

As well as grounding its planes, Thomas Cook has been forced to shut travel agencies, leaving the group’s 22,000 global employees -- 9,000 of whom are in Britain -- out of a job.

Chinese peer Fosun, which was already the biggest shareholder in Thomas Cook, agreed last month to inject £450 million into the business as part of an initial £900 million rescue package.

In return, the Hong Kong-listed conglomerate acquired a 75 percent stake in Thomas Cook’s tour operating division and 25 percent of its airline unit.

“Fosun is disappointed that Thomas Cook Group has not been able to find a viable solution for its proposed recapitalisation with other affiliates, core lending banks, senior noteholders and additional involved parties,” the Chinese group said in a statement to AFP yesterday.

Cabinet maker Thomas Cook created the travel firm in 1841, transporting temperance supporters by train between British cities.

It soon began arranging foreign trips, being the first operator to take British travellers on escorted visits to Europe in 1855, followed soon after by destinations further afield.

Thomas Cook grew into a huge operation but fell into massive debt despite recent annual turnover of £10 billion from transporting about 20 million customers worldwide.

The company’s demise comes just two years after the collapse of Monarch Airlines that prompted the British government to take emergency action and return 110,000 stranded passengers, costing taxpayers some £60 million on hiring planes.“It’s not just been Thomas Cook that has fallen victim to overcapacity in the sector, with the collapse of a host of airlines in the past few years, with the most profile casualty being Monarch,” Michael Hewson, Chief Market Analyst at CMC Markets UK, said yesterday.

14 Nov 2024 51 minute ago

14 Nov 2024 2 hours ago

14 Nov 2024 2 hours ago

14 Nov 2024 2 hours ago

14 Nov 2024 3 hours ago