12 Jun 2021 - {{hitsCtrl.values.hits}}

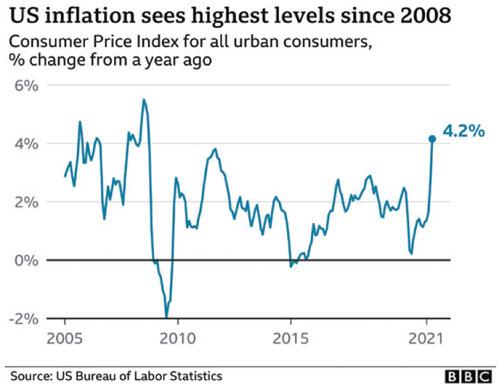

BBC: US inflation surged in April from a year earlier as the economic recovery picked up.

Consumer prices jumped 4.2 percent in the 12 months through to April, up from 2.6 percent in March and marking the biggest increase since September 2008.

Consumer prices jumped 4.2 percent in the 12 months through to April, up from 2.6 percent in March and marking the biggest increase since September 2008.

The report from the US Labour Department comes amid fears that rising consumer prices could push up interest rates.

Some analysts said that the figures could be rising because of temporary factors like supply bottlenecks.

Inflation, which measures the rate at which the prices for goods and services increase, was pushed up by higher prices for cars and food in April.

Prices of second-hand cars increased by 10 percent in comparison with March - the biggest monthly increase since records began. The Labour Department said that accounted for more than one-third of the overall jump. The “core price index”, which strips out food and energy costs that can be more volatile, increased 3 percent in April from the year before.

Off the back of the report, US stocks slid. Losses seen around the world on Tuesday extended into Wednesday amid investor concerns that higher inflation could lead the US central bank to raise interest rates more quickly than had been expected.

At the closing bell, the Dow stood at 33,587 after falling 2.0 percent. The S&P 500 fell 2.14 percent to 4,063, while the tech-focussed Nasdaq index fell 2.7 percent to 13,031.

In March, US President Joe Biden signed a US $ 1.9 trillion (£1.4 trillion) economic relief bill that saw the government send US $ 1,400 cheques to most Americans and last month he set out plans for more government spending on jobs, education and social care.

It has led to a build-up of savings, which is now being spent as the economy reopens, driving prices higher.

Inflation is breaching the Federal Reserve’s target of 2 percent and this has raised fears it might need to raise interest rates to cool things down.

Seema Shah, Chief Strategist at the investment firm Principal Global Investors, says the figures marked a “big miss”.

“US CPI inflation has come in meaningfully higher than expected and will further stoke concerns that the Fed has misread the inflation story,” she said.

“Markets were already expecting a rise in inflation - the big question is how sticky that inflation is. That has not been answered today, nor will it be answered for several months.”

Other central banks have also played down fears of inflation.

The Fed, for example, has insisted that increases would be temporary before levelling out as the economy reopens following COVID-19 restrictions.

Prices for airline fares, for example, were up 9.6 percent from April 2020 as rules around travel ease in the US.

Fed’s Vice Chair Richard Clarida said on Wednesday that he was “surprised” by the jump during a National Association for Business Economics conference.

But he added, “We’ve been saying for some time that reopening the economy would put some upward pressure on the price level.

“We have pent-up demand in the economy. It may take some time for supply to rise to the level of demand,” he said.

Kathy Bostjancic of Oxford Economics shared a similar view: “In the coming months, ongoing base effects, price increases stemming from the reopening of the economy and some pass-through of higher prices from supply chain bottlenecks should prompt higher inflation.”

“However, we believe part of the acceleration in inflation will be transitory and we share the Fed’s view that this isn’t the start of an upward inflationary spiral,” she said, predicting the price increases would cool down next year.

19 Nov 2024 21 minute ago

19 Nov 2024 2 hours ago

19 Nov 2024 4 hours ago

18 Nov 2024 18 Nov 2024

18 Nov 2024 18 Nov 2024