09 Aug 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

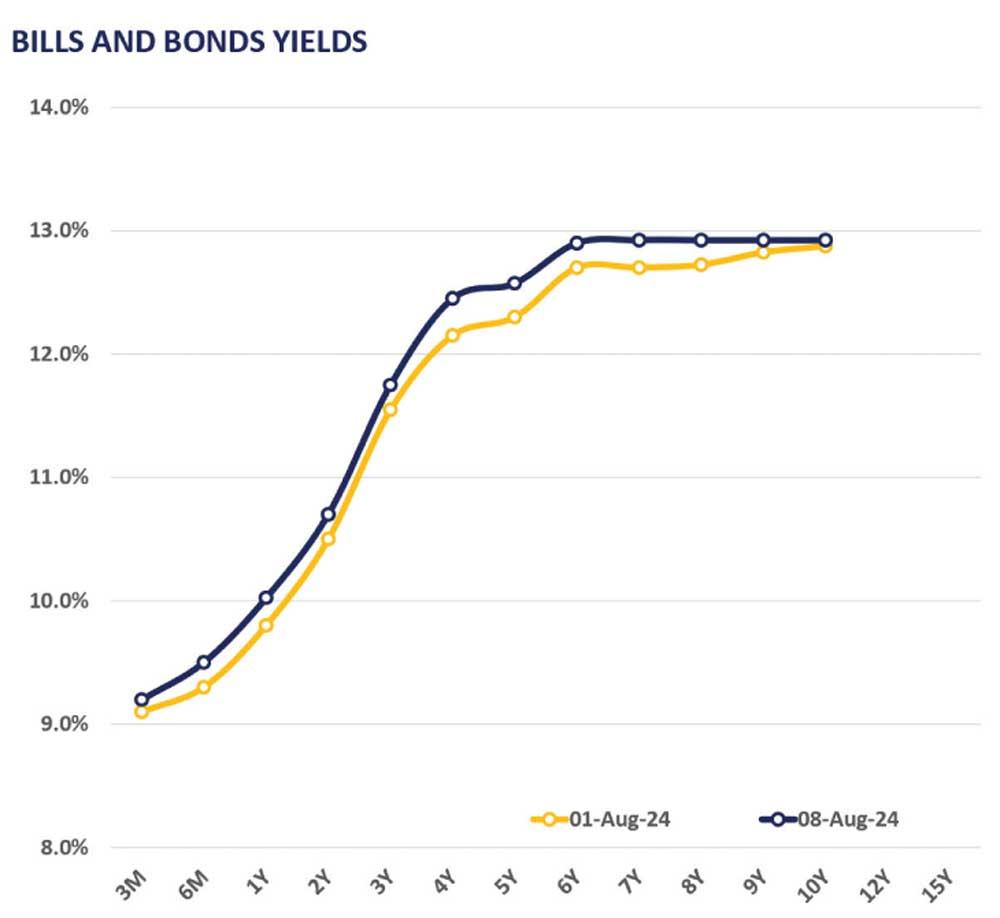

The secondary market experienced limited activities and thin trading volumes across the market, as a result of political uncertainty.

The short end of the curve experienced increased interest and an uptick in activity amongst the 2026 and 2027 tenors, contrasting the trends of the past few sessions which displayed increased activity on the belly end of the curve primarily amongst mid tenors such as the 2028 maturities.

Among the traded maturities, notable trades were amongst the short tenors, where 08.01.26, 15.01.27, 05.01.27, and 15.12.27 traded at rates of 10.80%, 11.12%, 11.80%, and 12.30%, respectively.

Meanwhile, on the belly end of the curve, mid tenors such as 01.07.28, and 15.09.29 traded at rates of 12.50% and 12.66% respectively. The secondary market reflected the trends of the previous sessions in displaying continuous rate increases amidst uncertainty.

On the external front, LKR appreciated against USD, closing at 301.9/USD compared to 302.3/USD recorded the previous day. Meanwhile, CBSL Holdings of government securities remained unchanged at Rs. 2,575.6bn yesterday. Overnight liquidity in the banking system contracted to Rs. 80.20bn from Rs. 88.93bn recorded the previous day.

26 Nov 2024 15 minute ago

26 Nov 2024 53 minute ago

26 Nov 2024 1 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 3 hours ago