03 Jul 2018 - {{hitsCtrl.values.hits}}

The asset quality of the non-bank finance sector is not something which often comes to the fore or commented on. But with the economic conditions getting tougher, it is slowly coming into the spotlight.

As the economy wobbles and adverse weather affecting hundreds of thousands in the main agricultural regions, curtailing their repayment capacity, Sri Lanka’s finance companies have begun to feel the brunt with their sour loans climbing up fast.

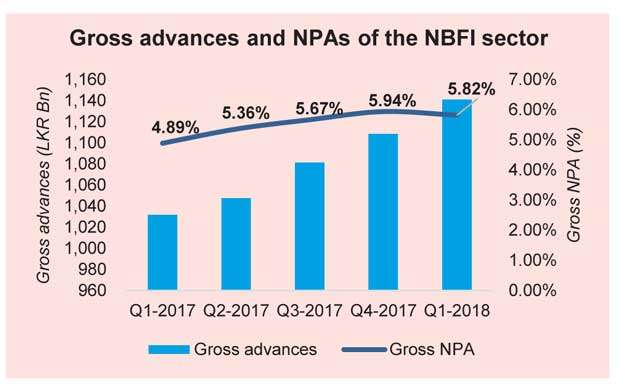

The credit rating firm, ICRA Lanka, recently measured Sri Lanka’s non-bank finance sector’s gross non-performing loans rising by 100 basis points during the 12 months to March 2018, to 5.82 percent. ICRA Lanka, a unit of Moody’s Investors Service, pointed out that during the last couple of years, the finance companies increased their exposure to the small and medium enterprise (SME) segment due to the relatively better yields and challenging market dynamics on the traditional vehicle

leasing segment.

The finance companies granted loans to SMEs in the form of post-dated cheque discounting and

short-term loans.

“However, we observe increasing slippages in these product segments of the SME portfolios as the macro conditions were challenging,” ICRA Lanka said in a special note on the asset quality of the country’s finance company sector.

As a result, the rating agency has observed a significant moderation in the portfolio growth as the companies have raised their efforts on recovering the stressed loans.

Meanwhile, ICRA Lanka also opined that finance companies may have moderated their lending growth in the SME sector in view of the higher capital adequacy requirements coming into effect soon.

The new capital adequacy requirements, in the style of BASEL III on banks, require the finance companies to have 125 percent weight in capital on unsecured lending.

Post-dated cheque discounting and short-term loans are generally unsecured.

Meanwhile, ICRA Lanka also observed stressed assets in the micro-lending portfolio of the finance company sector, although they are in a better position compared to the SME sector NPAs.

The micro-lending portfolio of the non-bank finance companies has grown by 28 percent every year since 2015 and the total sector portfolio is estimated to be between Rs.90-100 billion by March 2017, ICRA Lanka noted.

“A number of factors, including the recent weather conditions affecting rural areas, as well as multiple lending done by unregulated microfinance lenders, has affected the credit quality dynamics of the segment,” the rating agency added.

18 Nov 2024 48 minute ago

18 Nov 2024 1 hours ago

18 Nov 2024 1 hours ago

17 Nov 2024 17 Nov 2024

17 Nov 2024 17 Nov 2024