21 Mar 2019 - {{hitsCtrl.values.hits}}

The sluggish economy and deceleration of vehicle sales are hurting Sri Lanka’s non-bank lenders, as the sector is facing risks raging from weaker asset quality, muted growth, underwhelming profitability and need for higher regulatory capital.

According to a status report on the country’s non-bank finance company sector by Fitch Ratings, the sector loans are dominated by vehicle leasing and hire purchases, which accounted for 53 percent at end-2018.

The macro-prudential measures taken by authorities to stem the influx of vehicles have stymied the growth prospects of the sector.

“Loan growth year-on-year had already slowed to 9.0 percent by end-2018, from a high of 31 percent in 2015, due to the imposition of tighter loan-to-value ratios on vehicle financing by the Central Bank,” the rating agency said.

Sri Lanka virtually removed all the incentives for import of vehicles this month by raising the excise duties and slapping a luxury tax on top of it, blurring any prospects available for the

non-bank lenders.

Sri Lanka’s financial services sector has been on a rollercoaster from 2014 through 2018, due to the bad policies of successive governments.

The sector non-performing loan ratio has spiked to 7.7 percent by end-2018, from 5.9 percent end-2017, as its target customer base is suffering from economic slowdown, Fitch’s

estimates showed.

This is despite the non-bank non-performing loans measured much leniently compared to banks, where a loan falls into the non-performing status only after the lapse of 180 days since the instalment due date, whereas it is 90 days and in certain cases 60 days for banks.

Meanwhile, Fitch has also observed some non-banking institutions increasingly diversifying their lending portfolios away from vehicle financing to offset the slowdown in the latter.

But the shift has become extremely risky due to loaning big ticket facilities to non-core sectors, which the companies do not have expertise and with poor collateral.

Hence, the rating agency expects the companies will scale down exposure to these non-core sectors in the future, considering the increased pressure on their asset quality and capitalisation.

Meanwhile, the ongoing capitalisation challenges, which require the non-bank lenders to bring their minimum core capital up to Rs.2.5 billion by January 1, 2021, will further force them to raise fresh capital, adding further pressure on returns to shareholders, which will in turn make it a tall order to raise capital from capital owners.

Funding the profile of the non-bank lenders is dominated by the deposits, which accounted for 62 percent by end-2018, from 55 percent in 2016 but the rating agency said “a highly concentrated and price-sensitive deposit base is susceptible to market events and less reliable in situation of market stress”.

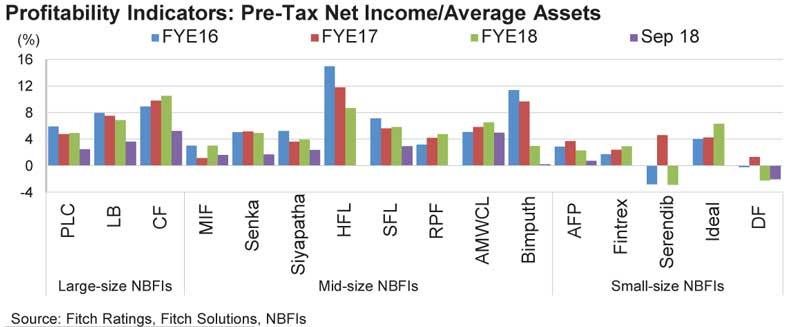

All these will finally weigh on the profitability of the sector, due to the rising credit costs, funding costs and higher taxes, Fitch said.

“Fitch Rated peers’ average return on assets declined – a trend witnessed across the sector – but continued to remain better than that of the sector.

Non-bank lenders’ net interest margins are also affected by the companies’ inability to reprice, due to their predominant fixed rate lending practices,” the rating agency said.

24 Dec 2024 4 minute ago

24 Dec 2024 7 minute ago

24 Dec 2024 21 minute ago

23 Dec 2024 23 Dec 2024