10 Sep 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

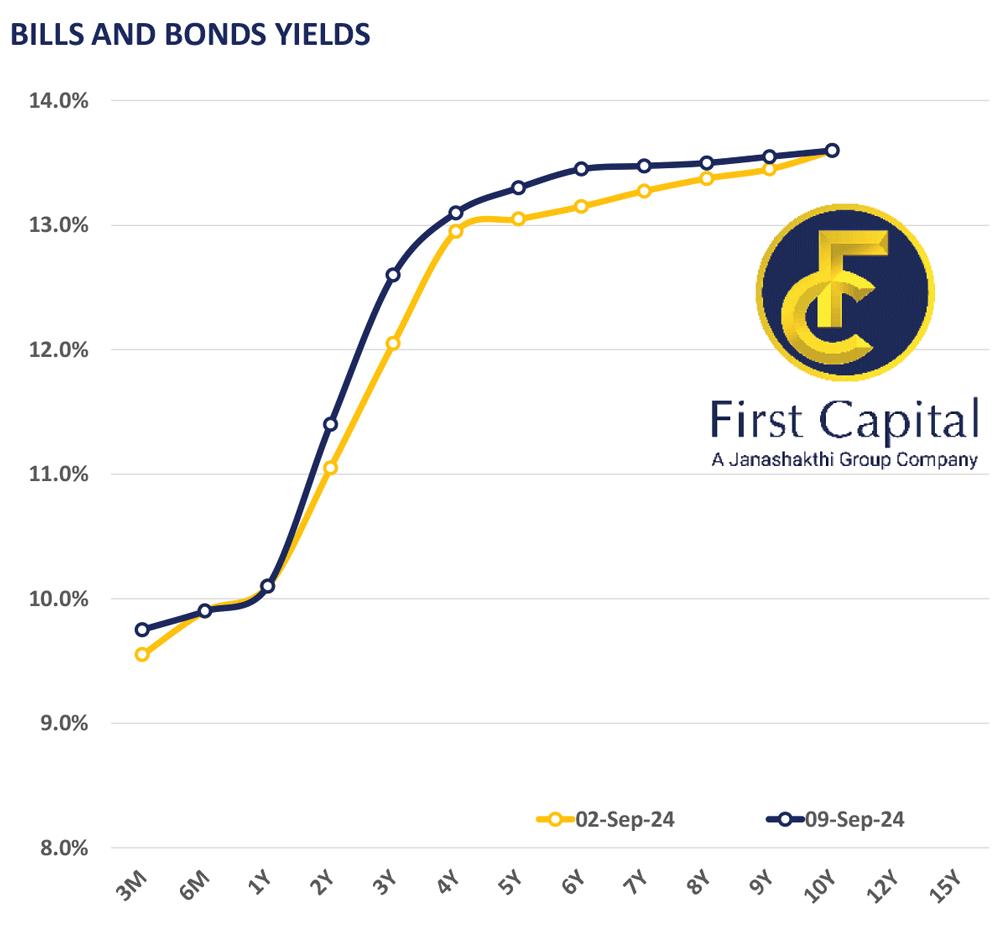

The secondary market yield curve edged higher, broadly across the board, as selling pressure continued to dominate the market amidst lingering uncertainty.

Accordingly, on the short end, 01.08.2026 closed trades at 11.30 percent. The 2028 maturities, 15.02.2028 and 15.03.2028, changed hands between 12.85 percent to 13.00 percent during the day. Moreover, on the mid-end, 15.05.2030 and 15.10.2030 registered trades at 13.40 percent while volumes saw a slight improvement during the day.

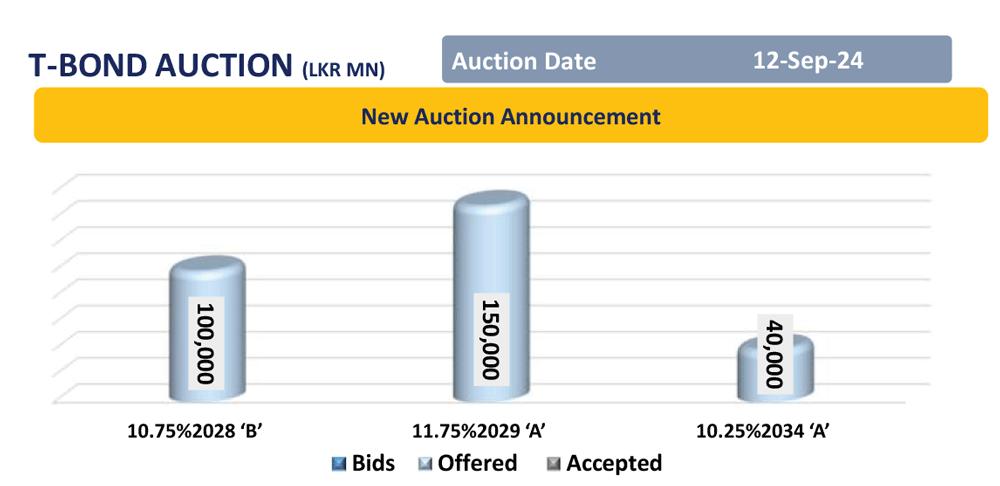

Meanwhile, the Central Bank announced a Rs.290.0 billion worth auction, scheduled to take place on September 12. Rs.150.0 billion is expected to be raised from the 15.02.2028 maturity while Rs.150.0 billion and Rs.40.0 billion are expected to be raised from the 15.06.2029 and 15.09.2034 maturities, respectively.

On the external side, the Sri Lankan rupee continued to appreciate against the US dollar for the third consecutive day, closing at Rs.298.7/US dollar. Similarly, the Sri Lankan rupee appreciated against the other major currencies, including GBP, EUR and AUD. Weekly AWPLR inched up by 19 basis points to 9.32 percent, compared to the previous week’s closing of 9.13 percent.

On the other hand, the AWLR (Average Weighted Lending Rate) hovers at 12.25 percent, as at July 2024, indicating there is room for the gap between the AWLR and AWPLR to further narrow down.

25 Nov 2024 1 hours ago

25 Nov 2024 1 hours ago

25 Nov 2024 3 hours ago

25 Nov 2024 4 hours ago

25 Nov 2024 4 hours ago