29 Jun 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

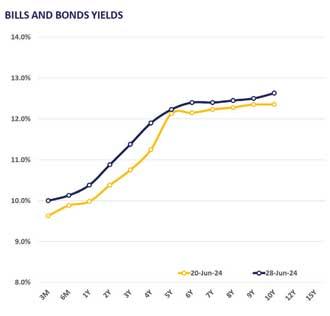

The secondary market yield curve edged up after yesterday’s session as selling pressure continued to dominate the market. Foreign selling has been perceptible during the day as uncertainty mounts amidst the absence of clear direction following the surge in auction yields.

Accordingly, activities were centered mostly on the mid tenors where 15.02.2028 witnessed trades at 11.95% while 15.09.2029 closed trades at 12.20%.

Moreover, 15.05.2030 enticed trades at 12.40% and 01.12.2031 hovered between 12.35%-12.41%. Despite an auction-full week, volumes remained at moderate levels amidst considerable activity.

Moreover, on the external side LKR continued to depreciate against the greenback, closing at Rs. 305.7 for the month ending 28th July.

Meanwhile, overnight liquidity closed at Rs. 120.4bn despite volatilities during the week while CBSL Holdings declined to Rs. 2,595.6bn after remaining stable for the last 7 days at Rs. 2,609.1bn.

As per inflation data released for June, CCPI Inflation for the month of June was recorded at 1.7%, rising from 0.9% in May, owing to the increase in both Food and Non-Food inflation by 1.4% and 1.8% respectively, compared to 0.0% and 1.3%, recorded in May.

27 Nov 2024 55 minute ago

27 Nov 2024 58 minute ago

27 Nov 2024 1 hours ago

27 Nov 2024 2 hours ago

27 Nov 2024 2 hours ago