22 Nov 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

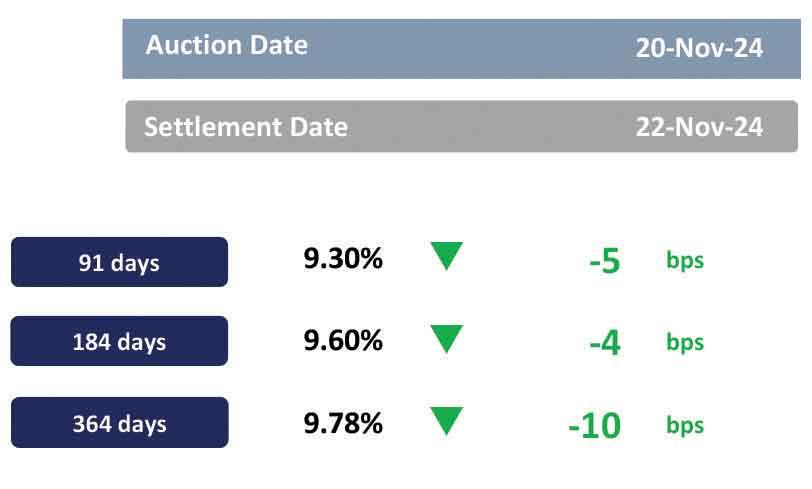

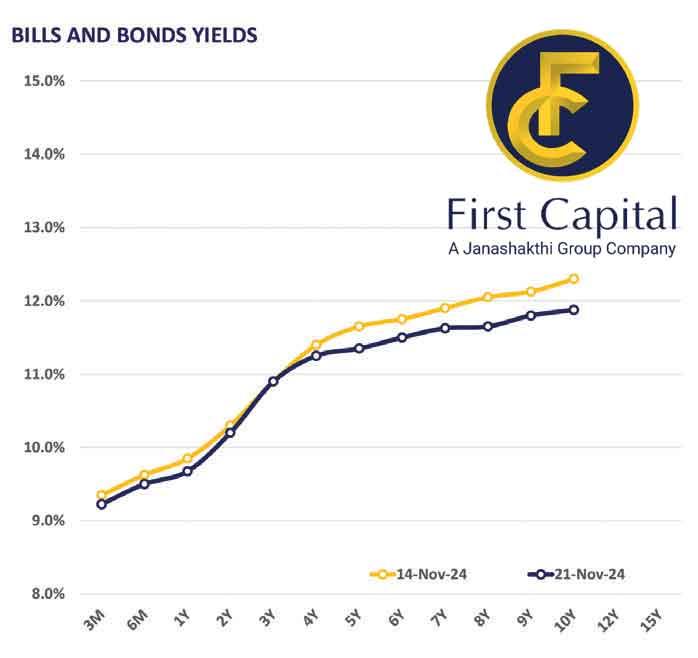

Investor sentiment in the secondary market remained relatively stable yesterday following Wednesday’s Rs. 145.0bn worth T-bill auction, with slight buying interest concentrated on the 3-year and 4-year tenors, keeping the yield curve broadly unchanged.

Amongst the traded maturities notable trades were recorded in 2026,2027, 2028, and 2031 maturities respectively. At the short end of the curve, 01.06.26, 01.08.26 and 15.12.26 maturities traded between 10.25% to 10.00% whilst 01.05.27 and 01.05.27 maturities traded between 10.90% to 10.80%.

Meanwhile, towards the belly end of the curve, 15.03.28 and 15.05.28 maturities traded at 11.15% and 15.12.28 traded at 11.25%. At the tail end of the curve, 01.12.31 traded at 11.70% to 11.65%. On the external side, the LKR slightly depreciated against the greenback closing at Rs. 290.98 compared to yesterday’s closing at 290.92. However, LKR has appreciated against the USD by 0.9% month-to-date.

Furthermore, LKR also appreciated against other major currencies such as the AUD, GBP, JPY and EUR yesterday compared to Wednesday.

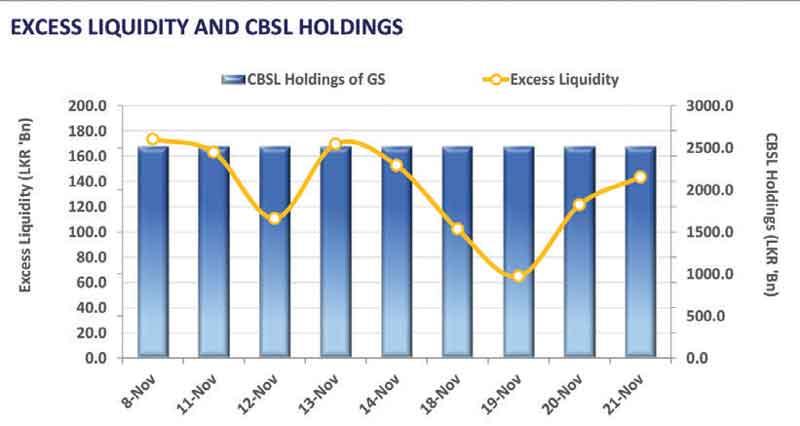

Furthermore, CBSL holdings of government securities remained unchanged, closing at Rs. 2,515.62bn yesterday.

24 Dec 2024 54 minute ago

24 Dec 2024 2 hours ago

24 Dec 2024 2 hours ago

24 Dec 2024 4 hours ago

24 Dec 2024 4 hours ago