08 Nov 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

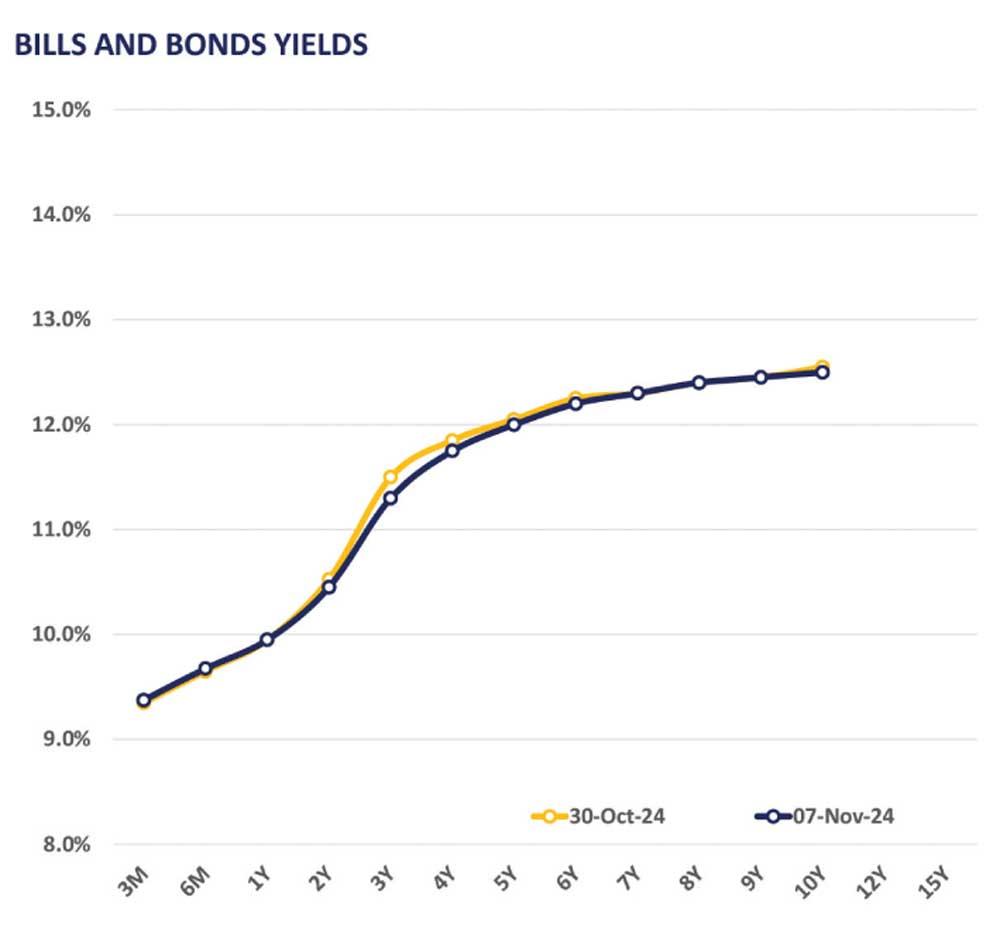

The secondary market yield curve witnessed mild buying interest primarily on the short to mid end of the curve.

The secondary market yield curve witnessed mild buying interest primarily on the short to mid end of the curve.

The market experienced thin trading volumes and limited activity. A slight decrease in the yield curve for bonds maturing between 2027 and 2028 was witnessed.

Amongst the traded maturities, notable trades were seen on the short to mid end of the curve. On the short end of the curve, 01.05.27, and 15.09.27 were seen trading at rates of 11.20%, and 11.30%, respectively.

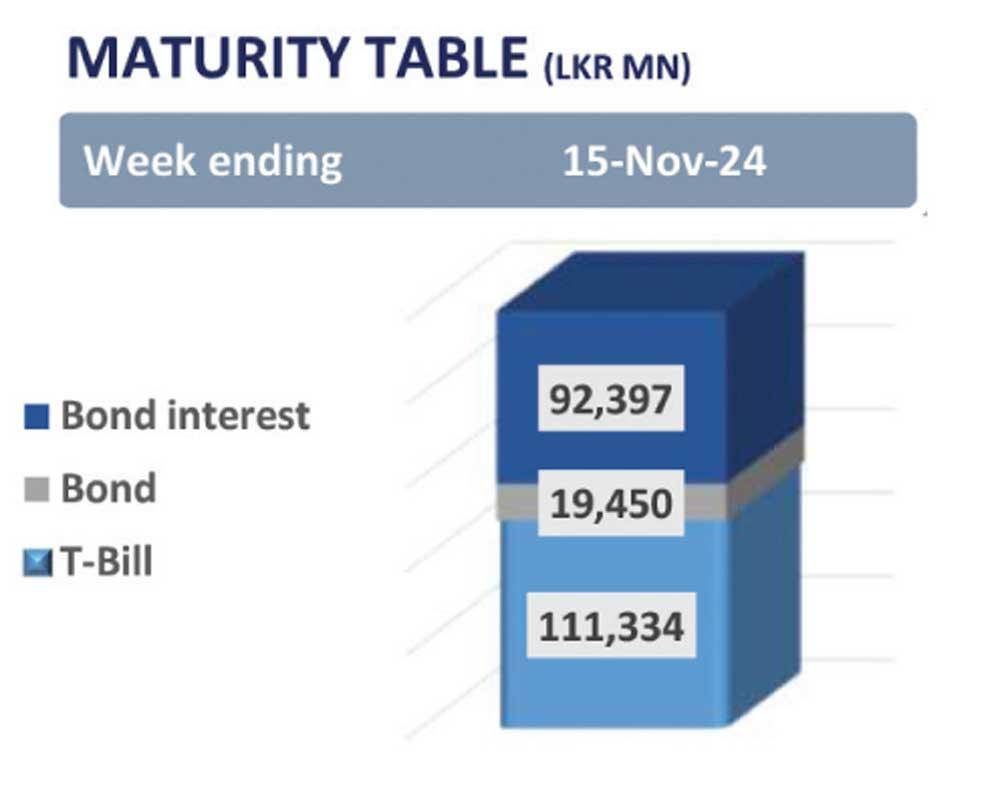

On the belly end of the curve, 15.03.28, 01.05.28, 01.07.28, and 15.12.28 traded at rates of 11.67%, 11.70%, 11.75%, and 11.80%, respectively. Additionally, the CBSL announced the issuance of LKR 132.5Bn in treasury bonds at the upcoming bond auction to be held on the 12th of Nov-24.

Meanwhile, on the external front, the LKR appreciated against the USD, closing at Rs. 292.94/USD, compared to Rs. 293.11/USD recorded the previous day.

Similarly, the LKR also appreciated against other major currencies including the GBP, EUR, CNY, and JPY.

Additionally, Sri Lanka’s Official Reserve Assets increased significantly by 7.9% to USD 6.46bn in Oct-24 from USD 5.99bn in Sep-24.

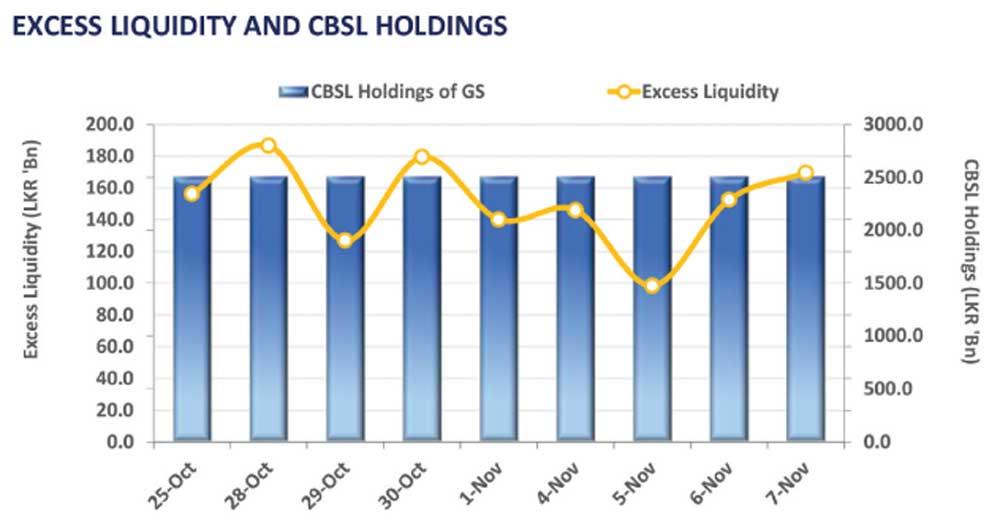

CBSL holdings of government securities remained unchanged, closing at Rs. 2,515.62bn yesterday. Overnight liquidity in the banking system expanded to Rs. 169.51bn from Rs. 152.57bn recorded the previous day.

25 Dec 2024 25 Dec 2024

25 Dec 2024 25 Dec 2024

25 Dec 2024 25 Dec 2024