06 Aug 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

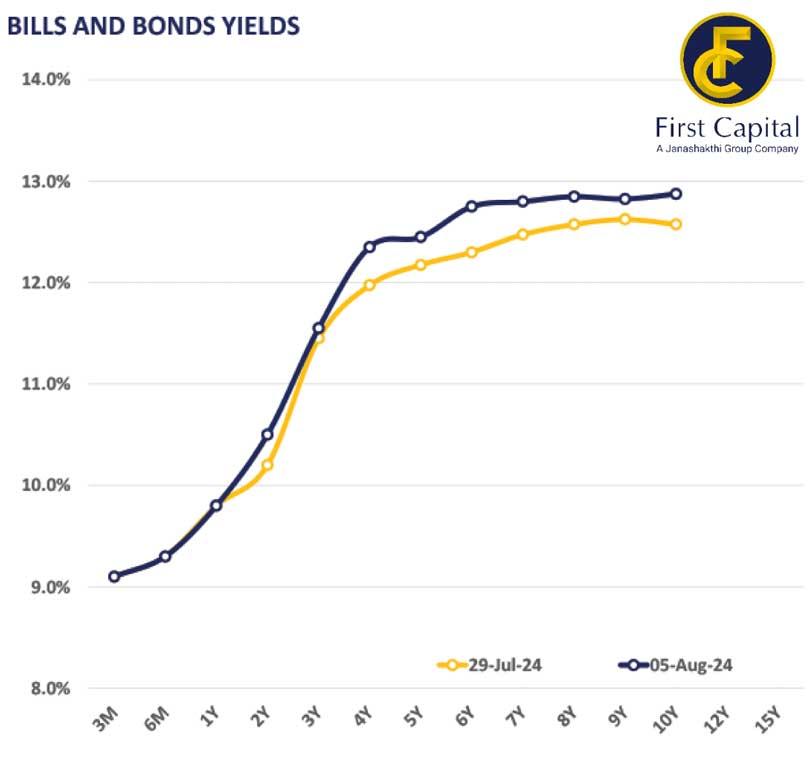

The secondary market yield curve slightly edged up on the belly as selling pressure emerged on the mid tenures amidst moderate volumes. Broadly, investor sentiment remained mixed but selling pressure was observed on the mid tenures such as 2028, 2029 and 2030.

Accordingly, 01.07.2028 closed transactions at 12.40 percent while 15.09.2029 observed trades at 12.45 percent. Meanwhile, 15.10.2030 registered trades at 12.80 percent level during the day. Investors continue to maintain a cautious stance amidst the growing uncertainty evolving in the political landscape given the upcoming elections.

On the external side, the Sri Lankan rupee appreciated against the US dollar closing at Rs.302.1.

However, against other major currencies including GBP, EUR and JPY, the Sri Lankan rupee depreciated during the day. The AWPR for the week ending August 02, 2024, inched up by 23 bps to 9.04 percent compared to the previous week displaying volatility.

Meanwhile, foreign holding of government securities remained broadly unchanged with only a marginal decline of 0.03 percent to Rs.52 billion for the week ending August 01, 2024.

Meanwhile, overnight excess liquidity remained high at Rs.99.5 billon whilst the Central Bank holdings remained stagnant at Rs.2,575.6 billon.

26 Nov 2024 10 minute ago

26 Nov 2024 15 minute ago

26 Nov 2024 40 minute ago

26 Nov 2024 51 minute ago

26 Nov 2024 1 hours ago