11 Oct 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

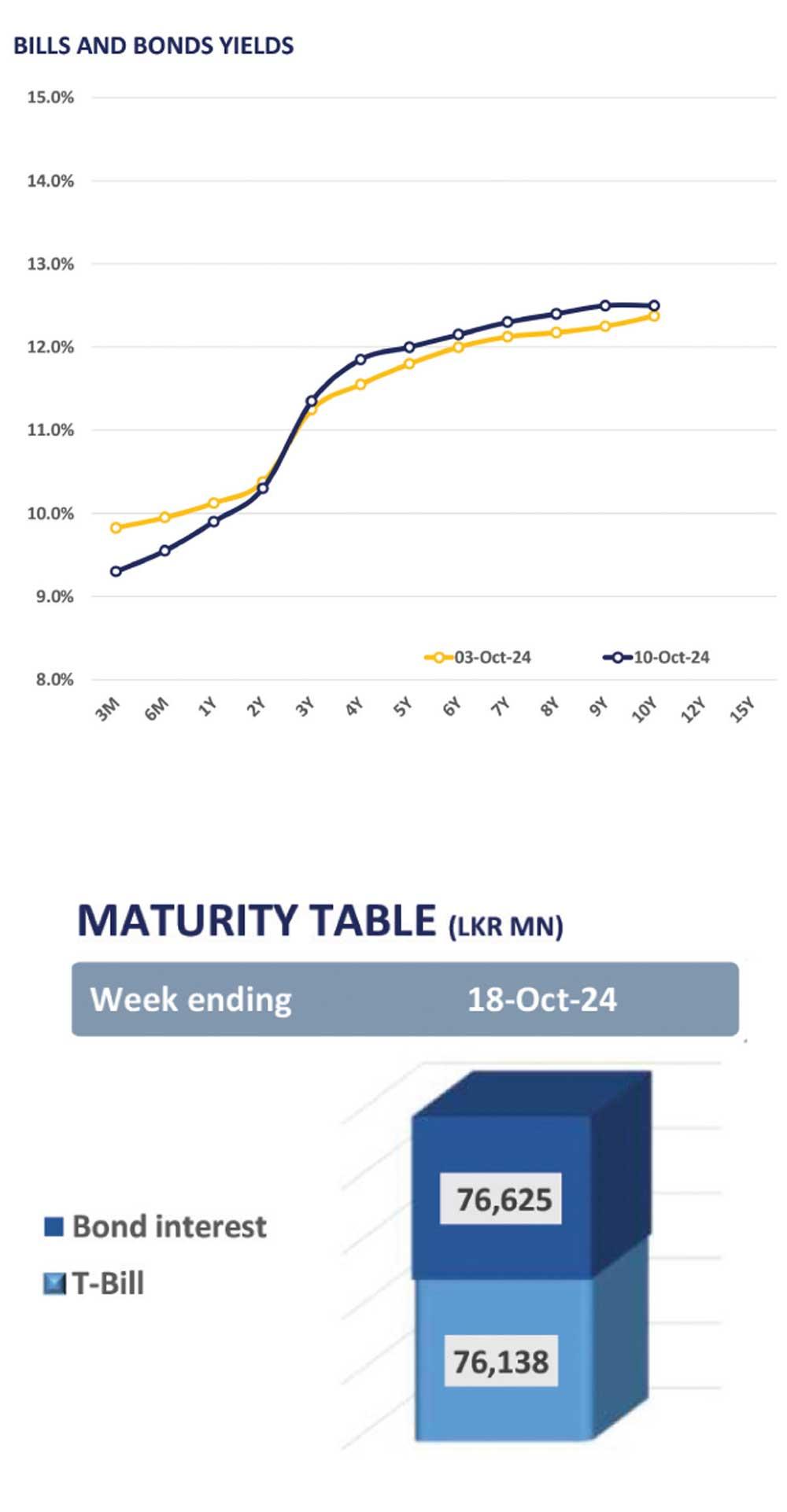

The secondary market yield curve remained broadly unchanged yesterday as the market participants opted to lay low ahead of today’s bond auction.

The overall market delivered low volumes with limited activities. During the day, on the mid end of the curve, 15.02.28, 15.03.28 and 01.05.28 maturities hovered in the range of 11.75%-11.80% while 15.09.29 maturity closed at 12.02%.

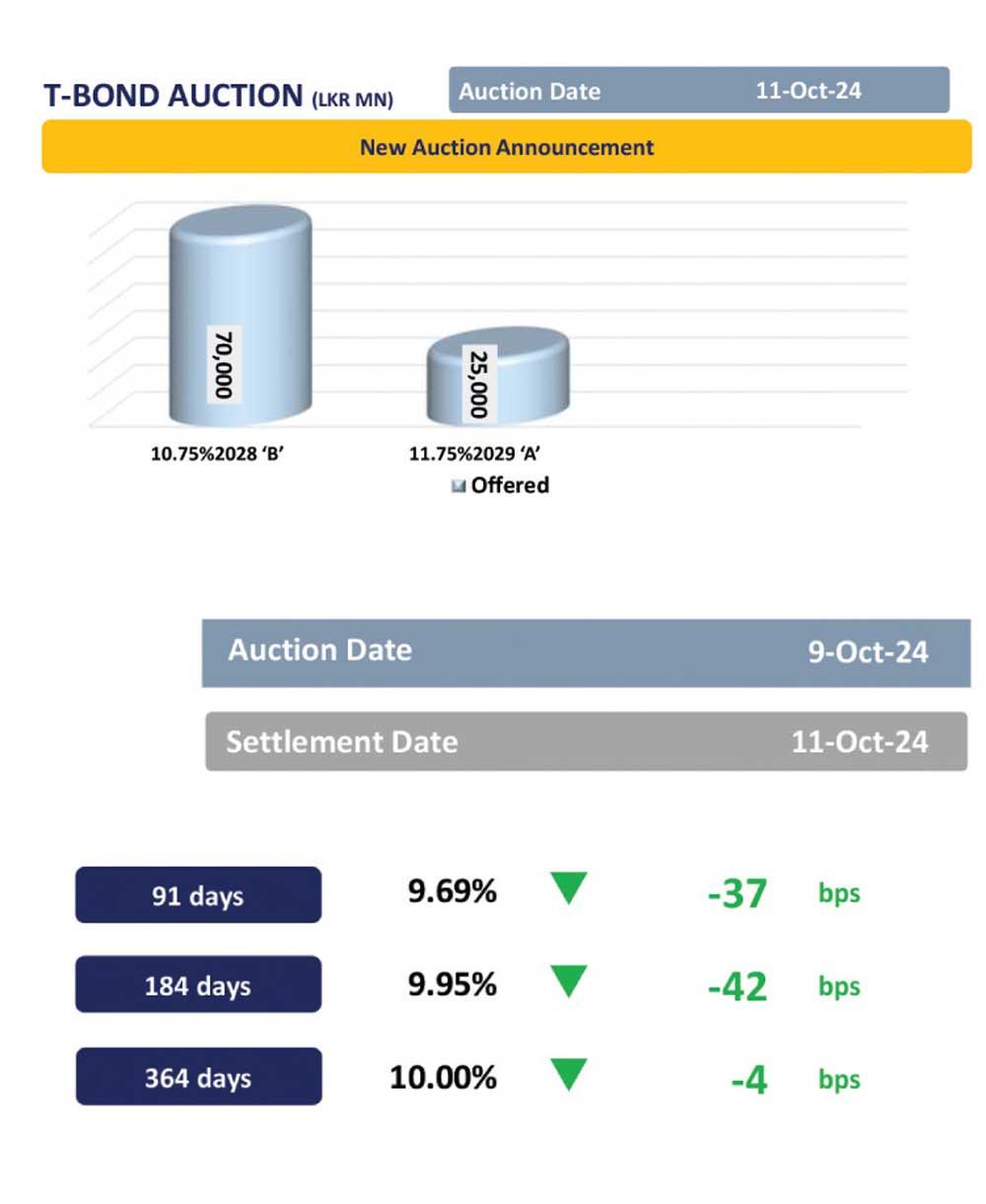

CBSL announced the issuance of Rs. 95.0bn worth of T-Bonds through an auction scheduled for today. This issuance includes Rs. 70.0bn and Rs. 25.0Bn to be issued under the maturities of 15.03.28 and 01.10.32 respectively.

Moreover, in the forex market, the LKR further appreciated against the USD settling at Rs. 292.9. Similarly, LKR marginally appreciated against other major currencies such as the AUD, GBP, and EUR.

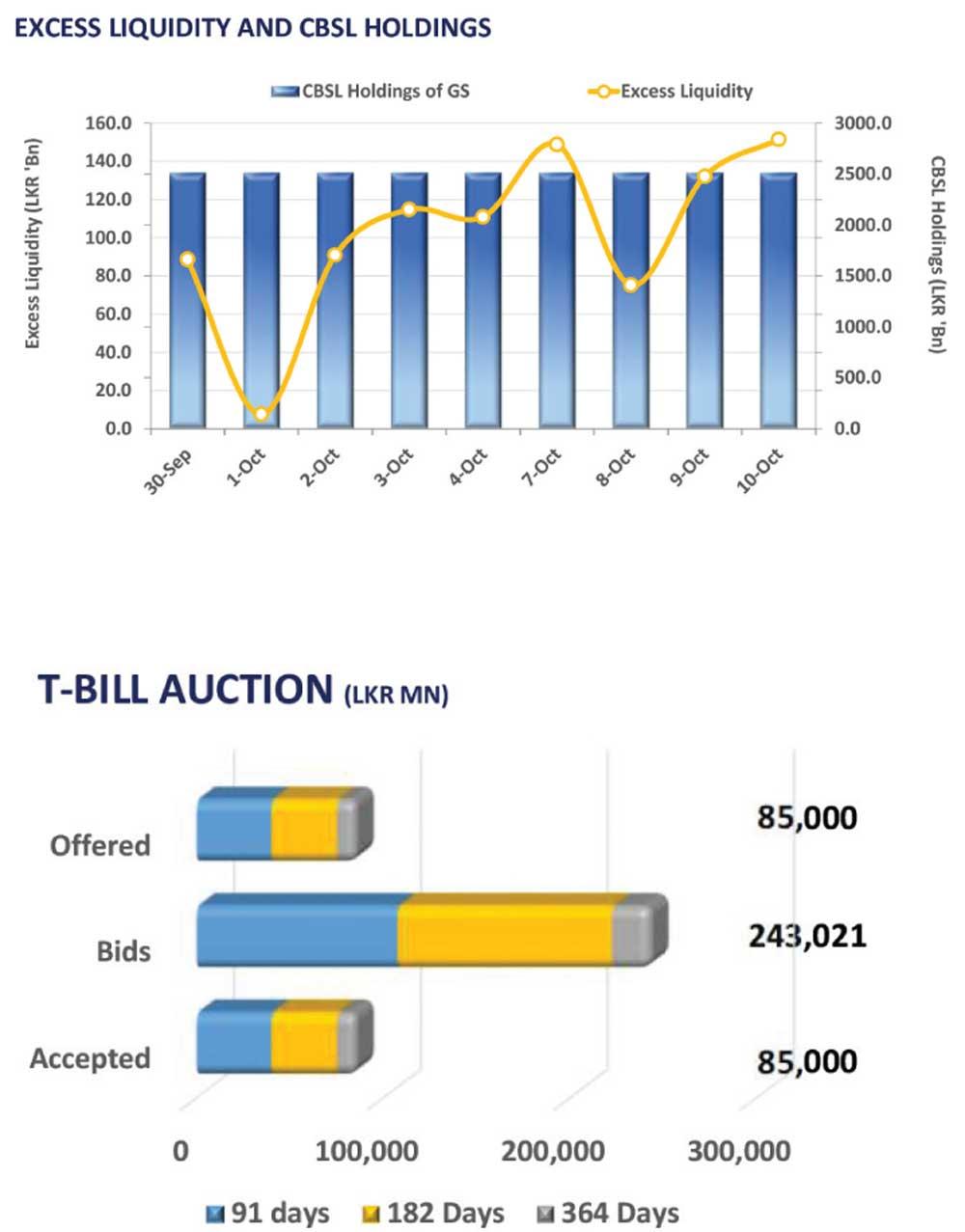

Meanwhile, overnight liquidity for the day was recorded at Rs. 151.6bn while CBSL holdings remained steady at Rs. 2,515.6bn.

08 Jan 2025 5 minute ago

07 Jan 2025 7 hours ago

07 Jan 2025 7 hours ago

07 Jan 2025 8 hours ago

07 Jan 2025 07 Jan 2025