28 Feb 2024 - {{hitsCtrl.values.hits}}

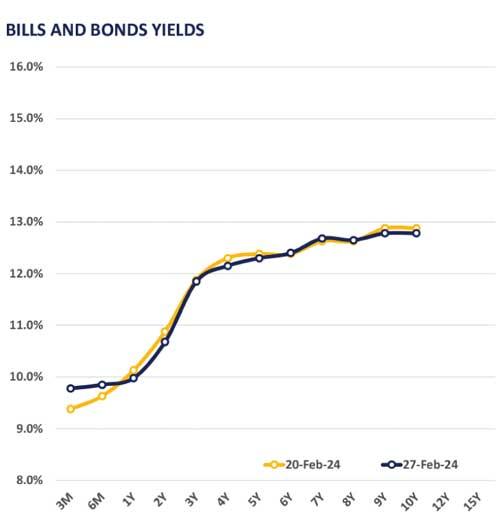

Secondary market yield curve slightly adjusted downwards following yesterday’s session despite activities being subdued while volumes were thin. Displaying a mixed sentiment, liquid tenors such 2026, 2027 and 2028 enticed trades during the day.

Accordingly, 2026 maturities, 01.02.2026, 15.05.2026, 01.08.2026 and 15.12.2026 observed trades in the range 10.65 percent-11.00 percent.

Moreover, 15.09.2027 registered trades at the 11.90 percent levels while 2028 maturities, 15.01.2028, 01.05.2028 and 01.07.2028 hovered between 12.10 percent- 12.20 percent.

However, clear buying appetite was perceptible on the 15.05.2030 maturity which changed hands at 12.30 percent. Meanwhile, CBSL expects to raise Rs. 122.5 bn from the weekly T-Bill auction scheduled for tomorrow, offering Rs. 35.0 bn from 91-days maturity, Rs. 47.5 bn from 182-days maturity and Rs. 40.0 bn from the 364-daysmaturity.

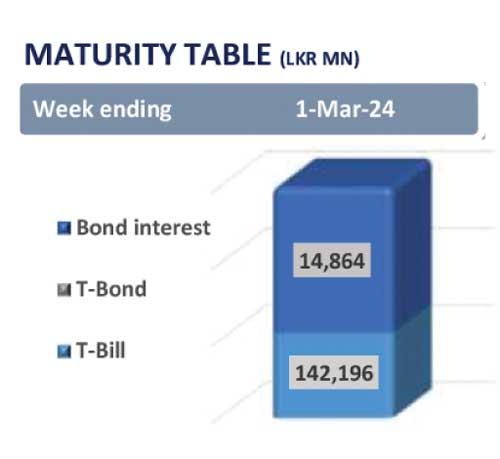

Meanwhile, CBSL expects to raise Rs. 122.5 bn from the weekly T-Bill auction scheduled for tomorrow, offering Rs. 35.0 bn from 91-days maturity, Rs. 47.5 bn from 182-days maturity and Rs. 40.0 bn from the 364-daysmaturity.

On the external side, LKR continued to appreciate against the greenback for the 8th straight day closing at 310.8. Meanwhile, overnight liquidity for the day closed at Rs. -37.3 bn while CBSL holdings remained steady at Rs. 2,715.6 bn.

30 Nov 2024 10 minute ago

30 Nov 2024 3 hours ago

30 Nov 2024 5 hours ago

30 Nov 2024 6 hours ago

29 Nov 2024 29 Nov 2024