24 Dec 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

Market participants in the secondary market exhibited mixed sentiment, pivoting from the dull sentiment yesterday observing thin trading volumes and limited market activity.

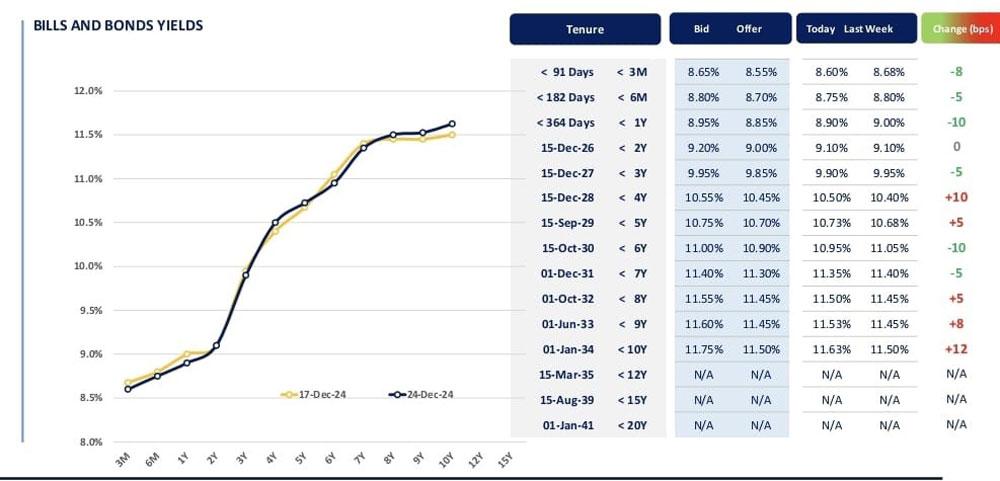

The secondary market yield curve edged down slightly by 5bps across 3M, 6M and 1Yr maturities, following the weekly T-Bill auction results.

The CBSL conducted its weekly T-Bill auction today, successfully raising Rs. 120.0 billion, with the total offered amount being fully accepted across all maturities. The 1Yr bill attracted the most interest, while weighted average yield rates declined across the board for the third consecutive week.

The 03M bill closed at 8.62% (-04bps), the 06M bill at 8.77% (-04bps), and the 1Yr bill at 8.96% (-06bps). Amongst the traded maturities, 15.09.27 traded at a range of 9.85% to 9.80% whilst 15.02.28 and 15.03.28 traded in the range of 10.15% to 10.10% and both the maturities 01.05.28 and 01.07.28 traded between 10.05% to 10.03%.

Meanwhile, on the external front, the LKR depreciated against the USD, closing at LKR 295.61/USD compared to LKR 293.17/USD recorded the previous day. Similarly, the LKR depreciated against other major currencies such as the GBP, EUR, AUD, CNY, and JPY.

CBSL holdings of government securities remained unchanged, closing at Rs. 2,515.62 billion today. Overnight liquidity in the banking system contracted to Rs. 159.37 billion from Rs. 197.51 billion recorded the previous day.

26 Dec 2024 2 hours ago

26 Dec 2024 3 hours ago

26 Dec 2024 4 hours ago

26 Dec 2024 6 hours ago

26 Dec 2024 7 hours ago