01 May 2024 - {{hitsCtrl.values.hits}}

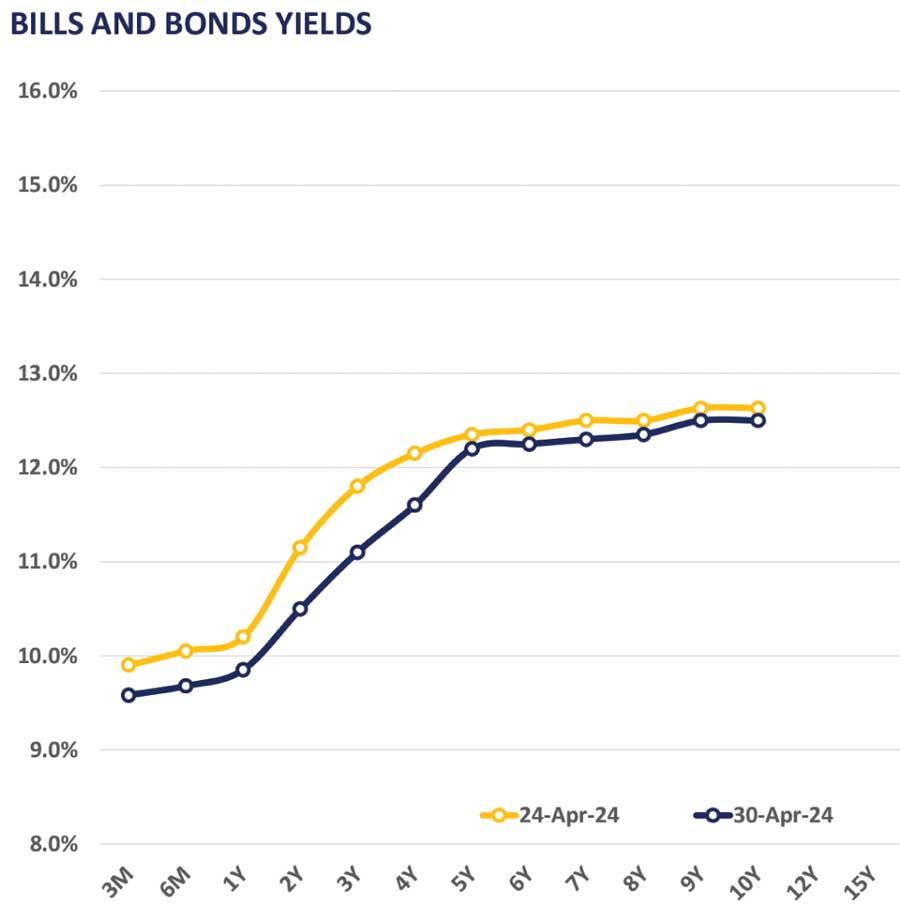

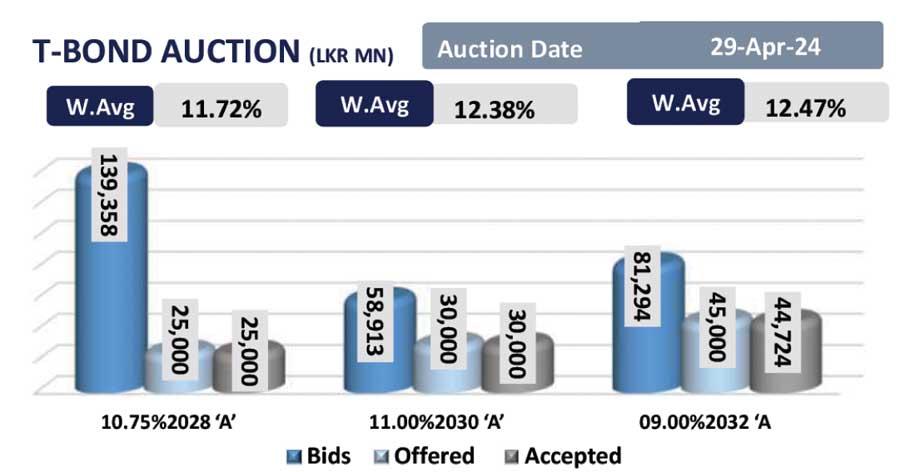

Bullish sentiment persisted in the secondary market for the 4th consecutive day, following the auction yields sharply declining in both T-Bond and T-Bill auctions.

Short to mid tenors witnessed significant buying interest and high volumes.

Liquid tenors of 2026 maturities including 15.05.26, 01.06.26, and 15.12.26 traded in the range of 11.00 -10.80 percent, while 2027 maturities 01.05.27 and 15.09.27 ranged between 11.25-11.05 percent.

Notable transactions occurred on 2028 tenors such as 15.03.28 and 01.05.28 traded lowest at 11.60 percent and 11.65 percent, respectively, while 15.12.28 traded between 11.75-11.70 percent.

Moreover, bond auction maturities, 15.05.30 and 01.10.32 saw yields dip, trading at 12.25 -12.20 percent and 12.40-12.35 percent, respectively.

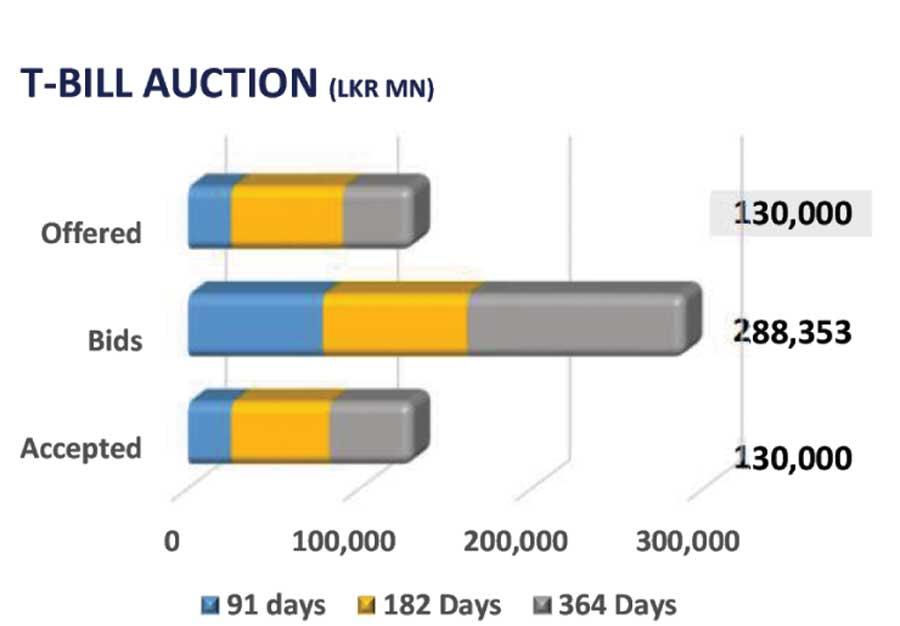

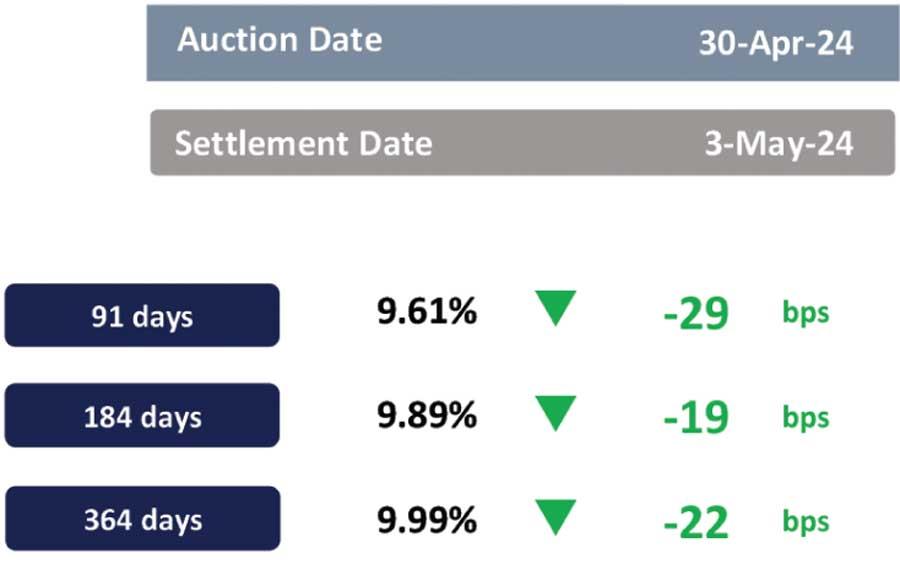

Meanwhile, at the T-Bill auction, the Weighted Average Yield Rate (WAYR) across all tenors dropped below the 10.0 percent mark, with the total offered amount of Rs. 130.0 billion fully accepted.

3M bill got fully accepted at a WAYR of 9.61 percent (-29bps), while Rs. 47.9 billion was accepted for the 1-year bill compared to the offered Rs.40.0 billion at a WAYR of 9.99 percent (-22bps).

Notably, 6M bill was undersubscribed at the auction at a WAYR of 9.89 percent (-19bps). In the forex market, LKR depreciated against the greenback after 4-days and closed at Rs. 296.9.

28 Nov 2024 4 hours ago

28 Nov 2024 5 hours ago

28 Nov 2024 6 hours ago

28 Nov 2024 7 hours ago

28 Nov 2024 9 hours ago