14 Feb 2024 - {{hitsCtrl.values.hits}}

The Treasury bond auction held yesterday yielded a bullish outcome, with the entire offered amount of Rs. 55.0 billion on the 2026 and 2028 maturities fully accepted, indicating strong investor appetite.

on the 2026 and 2028 maturities fully accepted, indicating strong investor appetite.

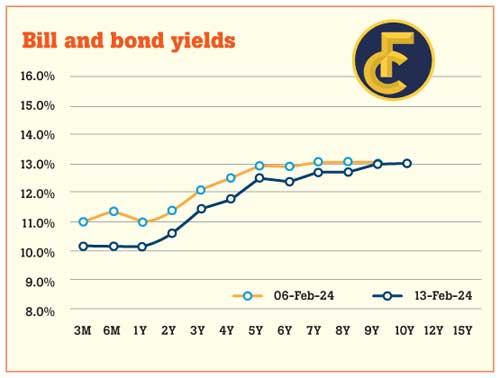

The total bids received exceeded the total offered amount by a substantial margin of 2.75 times. Accordingly, the 15.12.2026 maturity recorded a weighted average rate of 10.81 percent, while the 15.12.2028 recorded a weighted average rate of 11.90 percent.

The bullish market sentiment extended to the secondary market, resulting in a further reduction in yields across the board. Notably, robust investor demand was observed in liquid maturities including 2026, 2027, and 2028 which traded at the lowest rates of 10.60 percent, 11.45 percent, and 11.80 percent, respectively, during the day.

On the external side LKR marginally depreciated against the US$, closing at Rs. 313.3 during the day.

Moreover, market liquidity significantly improved during the day and recorded a net liquidity surplus of Rs. 128.0 billion as an amount of Rs. 165.4 billion been deposited at the Central Bank Standing Deposit Facility Rate of 9.0 percent . Meanwhile, CBSL holdings remained stagnant at Rs. 2,735.6 billion.

27 Oct 2024 2 hours ago

27 Oct 2024 3 hours ago

27 Oct 2024 5 hours ago

27 Oct 2024 5 hours ago

27 Oct 2024 5 hours ago