15 May 2024 - {{hitsCtrl.values.hits}}

The secondary market yield curve further declined as bullish sentiment continued to drive heavy buying momentum in the secondary market.

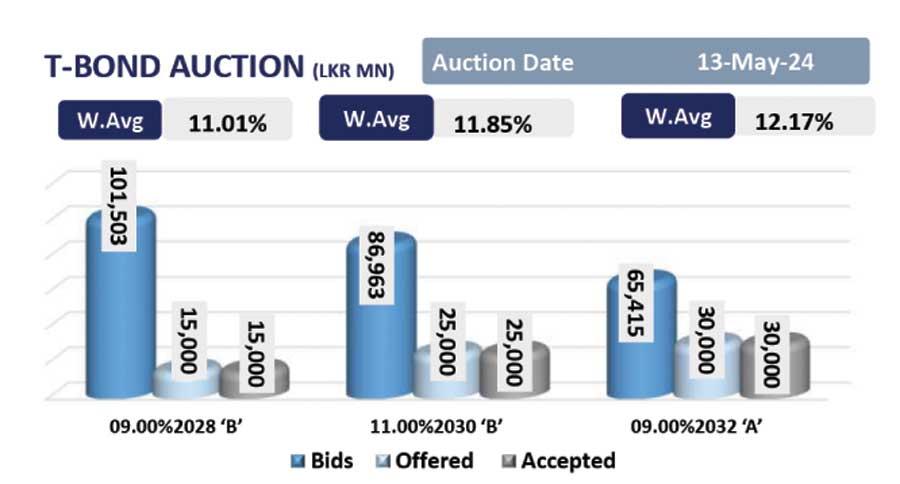

Investor interest enticed across the board, with 2026 tenors trading within the range of 10.15% to 10.00%.

Meanwhile, yields of 01.05.27, 15.09.27, 15.03.28, 01.05.28, and 01.07.28 traded at the lowest at 10.20%, 10.25%, 10.60%, 10.65%, and 10.66% respectively.

Meanwhile, on the long end of the curve, yields further decreased to 11.50% and 11.80% for the 15.05.30 and 01.10.32 maturities.

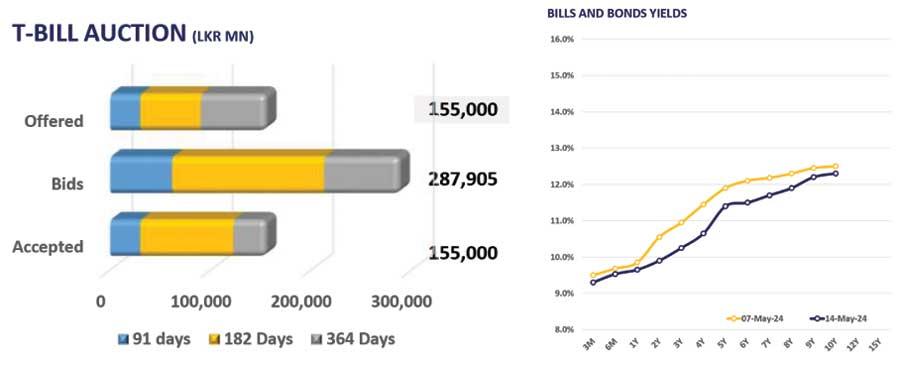

Moreover, CBSL announced an issue of Rs. 177.5bn T-Bills through an auction to be held on 15th May 2024, out of which Rs. 45.0bn is to be raised from 91-day maturity, Rs. 77.5bn is expected to be raised from 182-day maturity while Rs. 55.0bn is to be raised from 364-day maturity.

On the external side, LKR slightly depreciated against the greenback and recorded at Rs. 299.90/USD.

28 Nov 2024 20 minute ago

28 Nov 2024 1 hours ago

28 Nov 2024 2 hours ago

28 Nov 2024 3 hours ago

28 Nov 2024 3 hours ago